Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

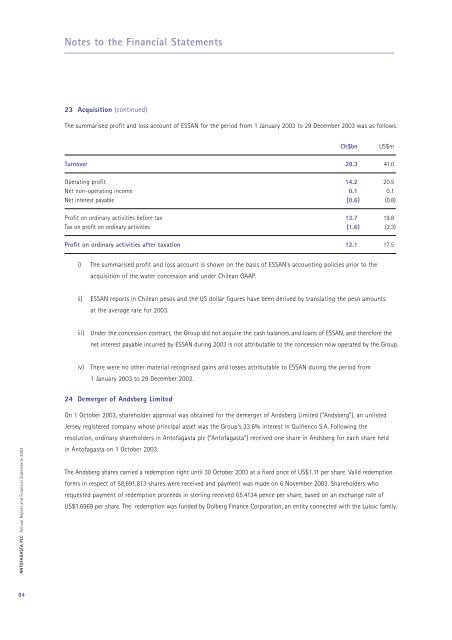

Notes to the Financial Statements23 Acquisition (continued)The summarised profit and loss account of ESSAN for the period from 1 January <strong>2003</strong> to 29 December <strong>2003</strong> was as follows:Ch$bnUS$mTurnover 28.3 41.0Operating profit 14.2 20.5Net non-operating income 0.1 0.1Net interest payable (0.6) (0.8)Profit on ordinary activities before tax 13.7 19.8Tax on profit on ordinary activities (1.6) (2.3)Profit on ordinary activities after taxation 12.1 17.5i) The summarised profit and loss account is shown on the basis of ESSAN’s accounting policies prior to theacquisition of the water concession and under Chilean GAAP.ii)ESSAN reports in Chilean pesos and the US dollar figures have been derived by translating the peso amountsat the average rate for <strong>2003</strong>.iii)Under the concession contract, the Group did not acquire the cash balances and loans of ESSAN, and therefore thenet interest payable incurred by ESSAN during <strong>2003</strong> is not attributable to the concession now operated by the Group.iv)There were no other material recognised gains and losses attributable to ESSAN during the period from1 January <strong>2003</strong> to 29 December <strong>2003</strong>.24 Demerger of Andsberg LimitedANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>On 1 October <strong>2003</strong>, shareholder approval was obtained for the demerger of Andsberg Limited (“Andsberg”), an unlistedJersey registered company whose principal asset was the Group’s 33.6% interest in Quiñenco S.A. Following theresolution, ordinary shareholders in <strong>Antofagasta</strong> <strong>plc</strong> (“<strong>Antofagasta</strong>”) received one share in Andsberg for each share heldin <strong>Antofagasta</strong> on 1 October <strong>2003</strong>.The Andsberg shares carried a redemption right until 30 October <strong>2003</strong> at a fixed price of US$1.11 per share. Valid redemptionforms in respect of 58,691,813 shares were received and payment was made on 6 November <strong>2003</strong>. Shareholders whorequested payment of redemption proceeds in sterling received 65.4134 pence per share, based on an exchange rate ofUS$1.6969 per share. The redemption was funded by Dolberg Finance Corporation, an entity connected with the Luksic family.84