Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

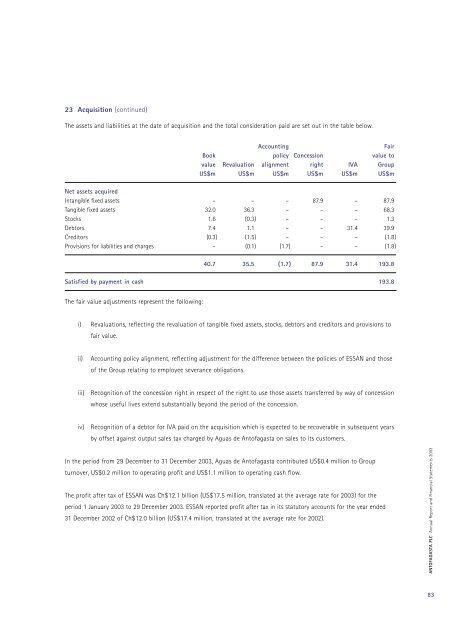

23 Acquisition (continued)The assets and liabilities at the date of acquisition and the total consideration paid are set out in the table below.AccountingFairBook policy Concession value tovalue Revaluation alignment right IVA GroupUS$m US$m US$m US$m US$m US$mNet assets acquiredIntangible fixed assets – – – 87.9 – 87.9Tangible fixed assets 32.0 36.3 – – – 68.3Stocks 1.6 (0.3) – – – 1.3Debtors 7.4 1.1 – – 31.4 39.9Creditors (0.3) (1.5) – – – (1.8)Provisions for liabilities and charges – (0.1) (1.7) – – (1.8)40.7 35.5 (1.7) 87.9 31.4 193.8Satisfied by payment in cash 193.8The fair value adjustments represent the following:i) Revaluations, reflecting the revaluation of tangible fixed assets, stocks, debtors and creditors and provisions tofair value.ii)Accounting policy alignment, reflecting adjustment for the difference between the policies of ESSAN and thoseof the Group relating to employee severance obligations.iii)Recognition of the concession right in respect of the right to use those assets transferred by way of concessionwhose useful lives extend substantially beyond the period of the concession.iv)Recognition of a debtor for IVA paid on the acquisition which is expected to be recoverable in subsequent yearsby offset against output sales tax charged by Aguas de <strong>Antofagasta</strong> on sales to its customers.In the period from 29 December to 31 December <strong>2003</strong>, Aguas de <strong>Antofagasta</strong> contributed US$0.4 million to Groupturnover, US$0.2 million to operating profit and US$1.1 million to operating cash flow.The profit after tax of ESSAN was Ch$12.1 billion (US$17.5 million, translated at the average rate for <strong>2003</strong>) for theperiod 1 January <strong>2003</strong> to 29 December <strong>2003</strong>. ESSAN reported profit after tax in its statutory accounts for the year ended31 December 2002 of Ch$12.0 billion (US$17.4 million, translated at the average rate for 2002).ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>83