Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

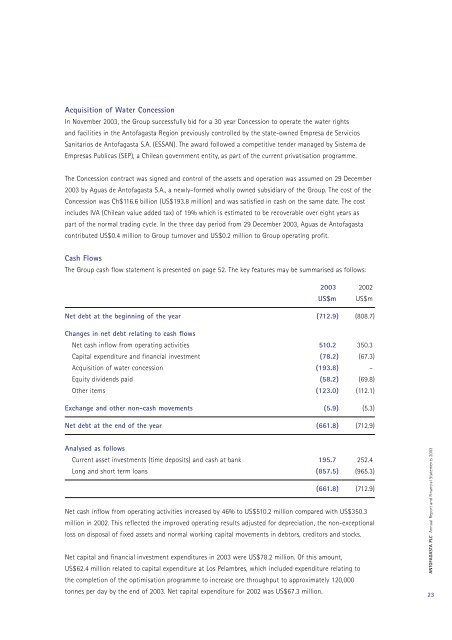

Acquisition of Water ConcessionIn November <strong>2003</strong>, the Group successfully bid for a 30 year Concession to operate the water rightsand facilities in the <strong>Antofagasta</strong> Region previously controlled by the state-owned Empresa de ServiciosSanitarios de <strong>Antofagasta</strong> S.A. (ESSAN). The award followed a competitive tender managed by Sistema deEmpresas Publicas (SEP), a Chilean government entity, as part of the current privatisation programme.The Concession contract was signed and control of the assets and operation was assumed on 29 December<strong>2003</strong> by Aguas de <strong>Antofagasta</strong> S.A., a newly-formed wholly owned subsidiary of the Group. The cost of theConcession was Ch$116.6 billion (US$193.8 million) and was satisfied in cash on the same date. The costincludes IVA (Chilean value added tax) of 19% which is estimated to be recoverable over eight years aspart of the normal trading cycle. In the three day period from 29 December <strong>2003</strong>, Aguas de <strong>Antofagasta</strong>contributed US$0.4 million to Group turnover and US$0.2 million to Group operating profit.Cash FlowsThe Group cash flow statement is presented on page 52. The key features may be summarised as follows:<strong>2003</strong> 2002US$m US$mNet debt at the beginning of the year (712.9) (808.7)Changes in net debt relating to cash flowsNet cash inflow from operating activities 510.2 350.3Capital expenditure and financial investment (78.2) (67.3)Acquisition of water concession (193.8) –Equity dividends paid (58.2) (69.8)Other items (123.0) (112.1)Exchange and other non-cash movements (5.9) (5.3)Net debt at the end of the year (661.8) (712.9)Analysed as followsCurrent asset investments (time deposits) and cash at bank 195.7 252.4Long and short term loans (857.5) (965.3)(661.8) (712.9)Net cash inflow from operating activities increased by 46% to US$510.2 million compared with US$350.3million in 2002. This reflected the improved operating results adjusted for depreciation, the non-exceptionalloss on disposal of fixed assets and normal working capital movements in debtors, creditors and stocks.Net capital and financial investment expenditures in <strong>2003</strong> were US$78.2 million. Of this amount,US$62.4 million related to capital expenditure at Los Pelambres, which included expenditure relating tothe completion of the optimisation programme to increase ore throughput to approximately 120,000tonnes per day by the end of <strong>2003</strong>. Net capital expenditure for 2002 was US$67.3 million.ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>23