Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

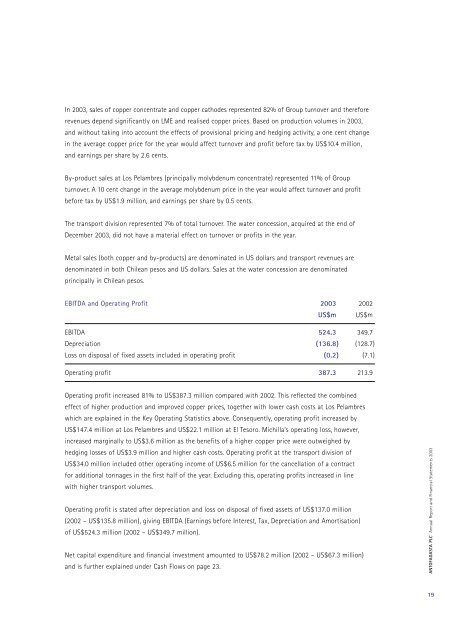

In <strong>2003</strong>, sales of copper concentrate and copper cathodes represented 82% of Group turnover and thereforerevenues depend significantly on LME and realised copper prices. Based on production volumes in <strong>2003</strong>,and without taking into account the effects of provisional pricing and hedging activity, a one cent changein the average copper price for the year would affect turnover and profit before tax by US$10.4 million,and earnings per share by 2.6 cents.By-product sales at Los Pelambres (principally molybdenum concentrate) represented 11% of Groupturnover. A 10 cent change in the average molybdenum price in the year would affect turnover and profitbefore tax by US$1.9 million, and earnings per share by 0.5 cents.The transport division represented 7% of total turnover. The water concession, acquired at the end ofDecember <strong>2003</strong>, did not have a material effect on turnover or profits in the year.Metal sales (both copper and by-products) are denominated in US dollars and transport revenues aredenominated in both Chilean pesos and US dollars. Sales at the water concession are denominatedprincipally in Chilean pesos.EBITDA and Operating Profit <strong>2003</strong> 2002US$m US$mEBITDA 524.3 349.7Depreciation (136.8) (128.7)Loss on disposal of fixed assets included in operating profit (0.2) (7.1)Operating profit 387.3 213.9Operating profit increased 81% to US$387.3 million compared with 2002. This reflected the combinedeffect of higher production and improved copper prices, together with lower cash costs at Los Pelambreswhich are explained in the Key Operating Statistics above. Consequently, operating profit increased byUS$147.4 million at Los Pelambres and US$22.1 million at El Tesoro. Michilla’s operating loss, however,increased marginally to US$3.6 million as the benefits of a higher copper price were outweighed byhedging losses of US$3.9 million and higher cash costs. Operating profit at the transport division ofUS$34.0 million included other operating income of US$6.5 million for the cancellation of a contractfor additional tonnages in the first half of the year. Excluding this, operating profits increased in linewith higher transport volumes.Operating profit is stated after depreciation and loss on disposal of fixed assets of US$137.0 million(2002 – US$135.8 million), giving EBITDA (Earnings before Interest, Tax, Depreciation and Amortisation)of US$524.3 million (2002 – US$349.7 million).Net capital expenditure and financial investment amounted to US$78.2 million (2002 – US$67.3 million)and is further explained under Cash Flows on page 23.ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>19