Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

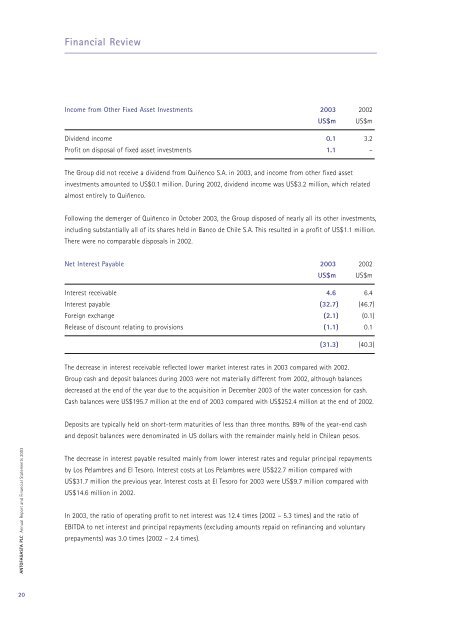

Financial ReviewIncome from Other Fixed Asset Investments <strong>2003</strong> 2002US$m US$mDividend income 0.1 3.2Profit on disposal of fixed asset investments 1.1 –The Group did not receive a dividend from Quiñenco S.A. in <strong>2003</strong>, and income from other fixed assetinvestments amounted to US$0.1 million. During 2002, dividend income was US$3.2 million, which relatedalmost entirely to Quiñenco.Following the demerger of Quiñenco in October <strong>2003</strong>, the Group disposed of nearly all its other investments,including substantially all of its shares held in Banco de Chile S.A. This resulted in a profit of US$1.1 million.There were no comparable disposals in 2002.Net Interest Payable <strong>2003</strong> 2002US$m US$mInterest receivable 4.6 6.4Interest payable (32.7) (46.7)Foreign exchange (2.1) (0.1)Release of discount relating to provisions (1.1) 0.1(31.3) (40.3)The decrease in interest receivable reflected lower market interest rates in <strong>2003</strong> compared with 2002.Group cash and deposit balances during <strong>2003</strong> were not materially different from 2002, although balancesdecreased at the end of the year due to the acquisition in December <strong>2003</strong> of the water concession for cash.Cash balances were US$195.7 million at the end of <strong>2003</strong> compared with US$252.4 million at the end of 2002.Deposits are typically held on short-term maturities of less than three months. 89% of the year-end cashand deposit balances were denominated in US dollars with the remainder mainly held in Chilean pesos.ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>The decrease in interest payable resulted mainly from lower interest rates and regular principal repaymentsby Los Pelambres and El Tesoro. Interest costs at Los Pelambres were US$22.7 million compared withUS$31.7 million the previous year. Interest costs at El Tesoro for <strong>2003</strong> were US$9.7 million compared withUS$14.6 million in 2002.In <strong>2003</strong>, the ratio of operating profit to net interest was 12.4 times (2002 – 5.3 times) and the ratio ofEBITDA to net interest and principal repayments (excluding amounts repaid on refinancing and voluntaryprepayments) was 3.0 times (2002 – 2.4 times).20