view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

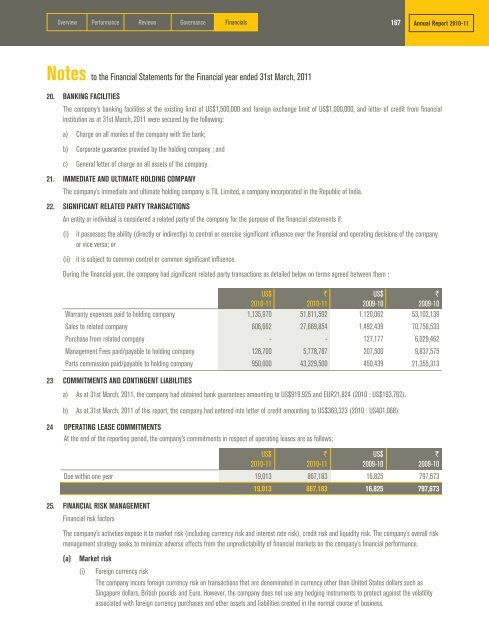

Over<strong>view</strong> Performance Re<strong>view</strong>s Governance Financials167Annual Report 2010-11Notes to <strong>the</strong> Financial Statements for <strong>the</strong> Financial year ended 31st March, 201120. BANKING FACILITIESThe company’s banking facilities at <strong>the</strong> existing limit of US$1,500,000 and foreign exchange limit of US$1,000,000, and letter of credit from financialinstitution as at 31st March, 2011 were secured by <strong>the</strong> following:a) Charge on all monies of <strong>the</strong> company with <strong>the</strong> bank;b) Corporate guarantee provided by <strong>the</strong> holding company ; andc) General letter of charge on all assets of <strong>the</strong> company.21. IMMEDIATE AND ULTIMATE HOLDING COMPANYThe company’s immediate and ultimate holding company is TIL Limited, a company incorporated in <strong>the</strong> Republic of India.22. SIGNIFICANT RELATED PARTY TRANSACTIONSAn entity or individual is considered a related party of <strong>the</strong> company for <strong>the</strong> purpose of <strong>the</strong> financial statements if:(i)it possesses <strong>the</strong> ability (directly or indirectly) to control or exercise significant influence over <strong>the</strong> financial and operating decisions of <strong>the</strong> companyor vice versa; or(ii) it is subject to common control or common significant influence.During <strong>the</strong> financial year, <strong>the</strong> company had significant related party transactions as detailed below on terms agreed between <strong>the</strong>m :US$2010-11`2010-11US$2009-10`2009-10Warranty expenses paid to holding company 1,135,970 51,811,592 1,120,062 53,102,139Sales to related company 606,662 27,669,854 1,492,439 70,756,533Purchase from related company - - 127,177 6,029,462Management Fees paid/payable to holding company 126,700 5,778,787 207,500 9,837,575Parts commission paid/payable to holding company 950,000 43,329,500 450,439 21,355,31323 COMMITMENTS AND CONTINGENT LIABILITIESa) As at 31st March, 2011, <strong>the</strong> company had obtained bank guarantees amounting to US$919,925 and EUR21,824 (2010 : US$193,762).b) As at 31st March, 2011 of this report, <strong>the</strong> company had entered into letter of credit amounting to US$363,323 (2010 : US401,068).24 OPERATING LEASE COMMITMENTSAt <strong>the</strong> end of <strong>the</strong> reporting period, <strong>the</strong> company’s commitments in respect of operating leases are as follows;US$2010-11`2010-11US$2009-10`2009-10Due within one year 19,013 867,183 16,825 797,67319,013 867,183 16,825 797,67325. FINANCIAL RISK MANAGEMENTFinancial risk factorsThe company’s activities expose it to market risk (including currency risk and interest rate risk), credit risk and liquidity risk. The company’s overall riskmanagement strategy seeks to minimize adverse effects from <strong>the</strong> unpredictability of financial markets on <strong>the</strong> company’s financial performance.(a)Market risk(i) Foreign currency riskThe company incurs foreign currency risk on transactions that are denominated in currency o<strong>the</strong>r than United States dollars such asSingapore dollars, British pounds and Euro. However, <strong>the</strong> company does not use any hedging instruments to protect against <strong>the</strong> vola<strong>til</strong>ityassociated with foreign currency purchases and o<strong>the</strong>r assets and liabilities created in <strong>the</strong> normal course of business.