view / download the documents. - til india

view / download the documents. - til india

view / download the documents. - til india

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

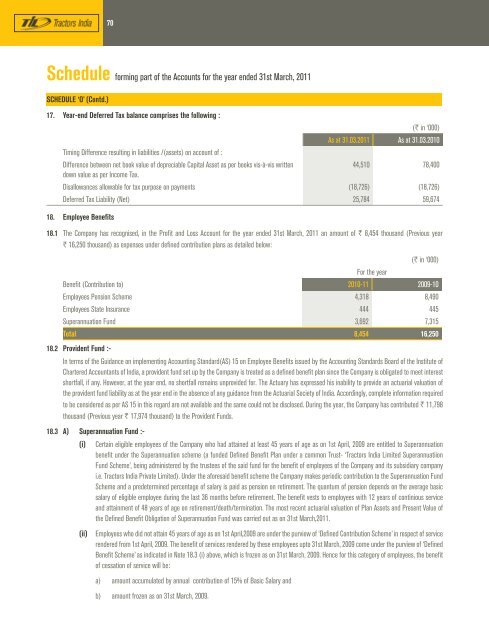

70Schedule forming part of <strong>the</strong> Accounts for <strong>the</strong> year ended 31st March, 2011SCHEDULE ‘O’ (Contd.)17. Year-end Deferred Tax balance comprises <strong>the</strong> following :(` in ‘000)As at 31.03.2011 As at 31.03.2010Timing Difference resulting in liabilities /(assets) on account of :Difference between net book value of depreciable Capital Asset as per books vis-à-vis written44,510 78,400down value as per Income Tax.Disallowances allowable for tax purpose on payments (18,726) (18,726)Deferred Tax Liability (Net) 25,784 59,67418. Employee Benefits18.1 The Company has recognised, in <strong>the</strong> Profit and Loss Account for <strong>the</strong> year ended 31st March, 2011 an amount of ` 8,454 thousand (Previous year` 16,250 thousand) as expenses under defined contribution plans as detailed below:(` in ‘000)For <strong>the</strong> yearBenefit (Contribution to) 2010-11 2009-10Employees Pension Scheme 4,318 8,490Employees State Insurance 444 445Superannuation Fund 3,692 7,315Total 8,454 16,25018.2 Provident Fund :-In terms of <strong>the</strong> Guidance on implementing Accounting Standard(AS) 15 on Employee Benefits issued by <strong>the</strong> Accounting Standards Board of <strong>the</strong> Institute ofChartered Accountants of India, a provident fund set up by <strong>the</strong> Company is treated as a defined benefit plan since <strong>the</strong> Company is obligated to meet interestshortfall, if any. However, at <strong>the</strong> year end, no shortfall remains unprovided for. The Actuary has expressed his inability to provide an actuarial valuation of<strong>the</strong> provident fund liability as at <strong>the</strong> year end in <strong>the</strong> absence of any guidance from <strong>the</strong> Actuarial Society of India. Accordingly, complete information requiredto be considered as per AS 15 in this regard are not available and <strong>the</strong> same could not be disclosed. During <strong>the</strong> year, <strong>the</strong> Company has contributed ` 11,798thousand (Previous year ` 17,974 thousand) to <strong>the</strong> Provident Funds.18.3 A) Superannuation Fund :-(i) Certain eligible employees of <strong>the</strong> Company who had attained at least 45 years of age as on 1st April, 2009 are entitled to Superannuationbenefit under <strong>the</strong> Superannuation scheme (a funded Defined Benefit Plan under a common Trust- ‘Tractors India Limited SuperannuatiionFund Scheme’, being administered by <strong>the</strong> trustees of <strong>the</strong> said fund for <strong>the</strong> benefit of employees of <strong>the</strong> Company and its subsidiary companyi.e. Tractors India Private Limited). Under <strong>the</strong> aforesaid benefit scheme <strong>the</strong> Company makes periodic contribution to <strong>the</strong> Superannuation FundScheme and a predetermined percentage of salary is paid as pension on retirement. The quantum of pension depends on <strong>the</strong> average basicsalary of eligible employee during <strong>the</strong> last 36 months before retirement. The benefit vests to employees with 12 years of continious serviceand attainment of 48 years of age on retirement/death/termination. The most recent actuarial valuation of Plan Assets and Present Value of<strong>the</strong> Defined Benefit Obligation of Superannuation Fund was carried out as on 31st March,2011.(ii)Employees who did not attain 45 years of age as on 1st April,2009 are under <strong>the</strong> pur<strong>view</strong> of ‘Defined Contribution Scheme’ in respect of servicerendered from 1st April, 2009. The benefit of services rendered by <strong>the</strong>se employees upto 31st March, 2009 come under <strong>the</strong> pur<strong>view</strong> of ‘DefinedBenefit Scheme’ as indicated in Note 18.3 (i) above, which is frozen as on 31st March, 2009. Hence for this category of employees, <strong>the</strong> benefitof cessation of service will be:a) amount accumulated by annual contribution of 15% of Basic Salary andb) amount frozen as on 31st March, 2009.