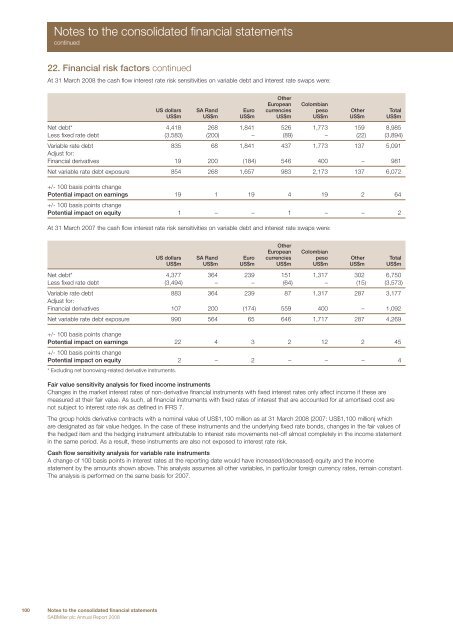

Notes to the consolidated financial statementscontinued22. Financial risk factors continuedAt 31 March 2008 the cash flow interest rate risk sensitivities on variable debt and interest rate swaps were:OtherEuropean ColombianUS dollars SA Rand Euro currencies peso Other TotalUS$m US$m US$m US$m US$m US$m US$mNet debt* 4,418 268 1,841 526 1,773 159 8,985Less fixed rate debt (3,583) (200) – (89) – (22) (3,894)Variable rate debt 835 68 1,841 437 1,773 137 5,091Adjust for:Financial derivatives 19 200 (184) 546 400 – 981Net variable rate debt exposure 854 268 1,657 983 2,173 137 6,072+/- 100 basis points changePotential impact on earnings 19 1 19 4 19 2 64+/- 100 basis points changePotential impact on equity 1 – – 1 – – 2At 31 March 2007 the cash flow interest rate risk sensitivities on variable debt and interest rate swaps were:OtherEuropean ColombianUS dollars SA Rand Euro currencies peso Other TotalUS$m US$m US$m US$m US$m US$m US$mNet debt* 4,377 364 239 151 1,317 302 6,750Less fixed rate debt (3,494) – – (64) – (15) (3,573)Variable rate debt 883 364 239 87 1,317 287 3,177Adjust for:Financial derivatives 107 200 (174) 559 400 – 1,092Net variable rate debt exposure 990 564 65 646 1,717 287 4,269+/- 100 basis points changePotential impact on earnings 22 4 3 2 12 2 45+/- 100 basis points changePotential impact on equity 2 – 2 – – – 4* Excluding net borrowing-related derivative instruments.Fair value sensitivity analysis for fixed income instrumentsChanges in the market interest rates of non-derivative financial instruments with fixed interest rates only affect income if these aremeasured at their fair value. As such, all financial instruments with fixed rates of interest that are accounted for at amortised cost arenot subject to interest rate risk as defined in IFRS 7.The group holds derivative contracts with a nominal value of US$1,100 million as at 31 March 2008 (2007: US$1,100 million) whichare designated as fair value hedges. In the case of these instruments and the underlying fixed rate bonds, changes in the fair values ofthe hedged item and the hedging instrument attributable to interest rate movements net-off almost completely in the income statementin the same period. As a result, these instruments are also not exposed to interest rate risk.Cash flow sensitivity analysis for variable rate instrumentsA change of 100 basis points in interest rates at the reporting date would have increased/(decreased) equity and the incomestatement by the amounts shown above. This analysis assumes all other variables, in particular foreign currency rates, remain constant.The analysis is performed on the same basis for 2007.100 Notes to the consolidated financial statements<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2008

22. Financial risk factors continuedInterest rate profiles of financial assets and financial liabilitiesThe following table sets out the contractual repricing included within the underlying borrowings (excluding net borrowing-relatedderivatives) exposed to either fixed interest rates, floating interest rates or no interest rates and revises this for the repricing effectof interest rate and cross currency swaps.2008 2007Total Effect of Total Total Effect of Totalborrowings derivatives exposure borrowings derivatives exposureFinancial liabilities US$m US$m US$m US$m US$m US$mRepricing due:Within one year 6,464 1,286 7,750 3,658 1,092 4,750Between one and two years – 104 104 668 317 985Between two and five years 823 (400) 423 636 (309) 327In five years or more 2,371 (990) 1,381 2,269 (1,100) 1,169Total interest bearing 9,658 – 9,658 7,231 – 7,231Analysed as:Fixed rate interest 3,894 (981) 2,913 3,573 (1,092) 2,481Floating rate interest 5,764 981 6,745 3,658 1,092 4,750Total interest bearing 9,658 – 9,658 7,231 – 7,231(iii) Price riskCommodity price riskThe group is exposed to variability in the price of commodities used in the production or in the packaging of finished products,such as the price of malt, barley, sugar and aluminium. These price risks are managed principally through multi year fixed pricecontracts with suppliers internationally.At 31 March 2008 the notional value of commodity derivatives amounted to US$48 million (2007: US$nil). No sensitivity analysishas been provided on these outstanding contracts.Equity securities price riskThe group is exposed to equity securities price risk on investments held by the group and classified on the balance sheet as availablefor sale.b) Credit riskCredit risk is the risk of financial loss to the group if a customer or counterparty to a financial instrument fails to meet its contractualobligations.Cash and cash equivalentsThe group limits its exposure to financial institutions by setting credit limits on a sliding scale based on credit ratings and generallyonly with counterparties with a credit rating of at least BBB- by Standard & Poor’s and Baa3 from Moody’s. For banks with a lowercredit rating, or with no international credit rating, a maximum limit of US$3 million is applied, unless specific approval is obtainedfrom either the Chief Financial Officer or the audit committee of the board.Derivative financial assetsThe group calculates credit exposures on derivatives based on their positive market values and including a percentage of thenotional amount, representing the potential increased credit risk during the unwind period. This credit exposure is included in theoverall exposure to financial institutions. The group has ISDA Master Agreements with most of its counterparties for financial derivatives,which permits net settlement of assets and liabilities in certain circumstances, thereby reducing the group’s credit exposure to individualcounterparties.Trade and other receivablesThere is no concentration of credit risk with respect to trade receivables as the group has a large number of customers whichare internationally dispersed. The type of customers range from wholesalers and distributors to smaller retailers. The group hasimplemented policies that require appropriate credit checks on potential customers before sales commence. Credit risk is managedby limiting the aggregate amount of exposure to any one counterparty.The group considers its maximum credit risk to be $2,760m (2007: $1,900m) which is the total of the group’s financial assets.Overview Operating and financial review Governance Financial statements Shareholder informationNotes to the consolidated financial statements 101<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2008