Annual Report - SABMiller India

Annual Report - SABMiller India

Annual Report - SABMiller India

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

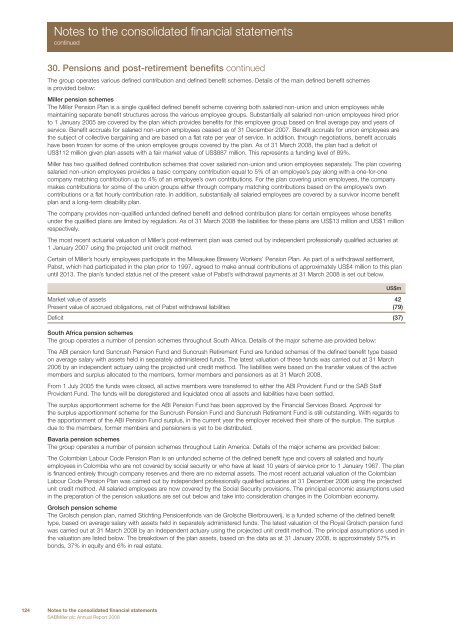

Notes to the consolidated financial statementscontinued30. Pensions and post-retirement benefits continuedThe group operates various defined contribution and defined benefit schemes. Details of the main defined benefit schemesis provided below:Miller pension schemesThe Miller Pension Plan is a single qualified defined benefit scheme covering both salaried non-union and union employees whilemaintaining separate benefit structures across the various employee groups. Substantially all salaried non-union employees hired priorto 1 January 2005 are covered by the plan which provides benefits for this employee group based on final average pay and years ofservice. Benefit accruals for salaried non-union employees ceased as of 31 December 2007. Benefit accruals for union employees arethe subject of collective bargaining and are based on a flat rate per year of service. In addition, through negotiations, benefit accrualshave been frozen for some of the union employee groups covered by the plan. As of 31 March 2008, the plan had a deficit ofUS$112 million given plan assets with a fair market value of US$887 million. This represents a funding level of 89%.Miller has two qualified defined contribution schemes that cover salaried non-union and union employees separately. The plan coveringsalaried non-union employees provides a basic company contribution equal to 5% of an employee’s pay along with a one-for-onecompany matching contribution up to 4% of an employee’s own contributions. For the plan covering union employees, the companymakes contributions for some of the union groups either through company matching contributions based on the employee’s owncontributions or a flat hourly contribution rate. In addition, substantially all salaried employees are covered by a survivor income benefitplan and a long-term disability plan.The company provides non-qualified unfunded defined benefit and defined contribution plans for certain employees whose benefitsunder the qualified plans are limited by regulation. As of 31 March 2008 the liabilities for these plans are US$13 million and US$1 millionrespectively.The most recent actuarial valuation of Miller’s post-retirement plan was carried out by independent professionally qualified actuaries at1 January 2007 using the projected unit credit method.Certain of Miller’s hourly employees participate in the Milwaukee Brewery Workers’ Pension Plan. As part of a withdrawal settlement,Pabst, which had participated in the plan prior to 1997, agreed to make annual contributions of approximately US$4 million to this planuntil 2013. The plan’s funded status net of the present value of Pabst’s withdrawal payments at 31 March 2008 is set out below.Market value of assets 42Present value of accrued obligations, net of Pabst withdrawal liabilities (79)Deficit (37)South Africa pension schemesThe group operates a number of pension schemes throughout South Africa. Details of the major scheme are provided below:The ABI pension fund Suncrush Pension Fund and Suncrush Retirement Fund are funded schemes of the defined benefit type basedon average salary with assets held in separately administered funds. The latest valuation of these funds was carried out at 31 March2008 by an independent actuary using the projected unit credit method. The liabilities were based on the transfer values of the activemembers and surplus allocated to the members, former members and pensioners as at 31 March 2008.From 1 July 2005 the funds were closed, all active members were transferred to either the ABI Provident Fund or the SAB StaffProvident Fund. The funds will be deregistered and liquidated once all assets and liabilities have been settled.The surplus apportionment scheme for the ABI Pension Fund has been approved by the Financial Services Board. Approval forthe surplus apportionment scheme for the Suncrush Pension Fund and Suncrush Retirement Fund is still outstanding. With regards tothe apportionment of the ABI Pension Fund surplus, in the current year the employer received their share of the surplus. The surplusdue to the members, former members and pensioners is yet to be distributed.Bavaria pension schemesThe group operates a number of pension schemes throughout Latin America. Details of the major scheme are provided below:The Colombian Labour Code Pension Plan is an unfunded scheme of the defined benefit type and covers all salaried and hourlyemployees in Colombia who are not covered by social security or who have at least 10 years of service prior to 1 January 1967. The planis financed entirely through company reserves and there are no external assets. The most recent actuarial valuation of the ColombianLabour Code Pension Plan was carried out by independent professionally qualified actuaries at 31 December 2006 using the projectedunit credit method. All salaried employees are now covered by the Social Security provisions. The principal economic assumptions usedin the preparation of the pension valuations are set out below and take into consideration changes in the Colombian economy.Grolsch pension schemeThe Grolsch pension plan, named Stichting Pensioenfonds van de Grolsche Bierbrouwerij, is a funded scheme of the defined benefittype, based on average salary with assets held in separately administered funds. The latest valuation of the Royal Grolsch pension fundwas carried out at 31 March 2008 by an independent actuary using the projected unit credit method. The principal assumptions used inthe valuation are listed below. The breakdown of the plan assets, based on the data as at 31 January 2008, is approximately 57% inbonds, 37% in equity and 6% in real estate.US$m124 Notes to the consolidated financial statements<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2008