Annual Report - SABMiller India

Annual Report - SABMiller India

Annual Report - SABMiller India

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

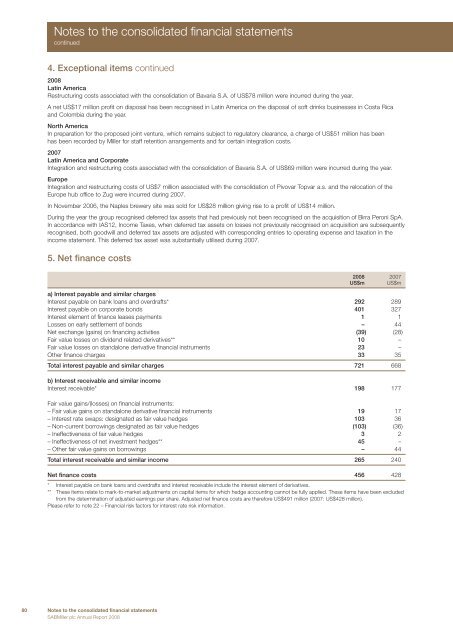

Notes to the consolidated financial statementscontinued4. Exceptional items continued2008Latin AmericaRestructuring costs associated with the consolidation of Bavaria S.A. of US$78 million were incurred during the year.A net US$17 million profit on disposal has been recognised in Latin America on the disposal of soft drinks businesses in Costa Ricaand Colombia during the year.North AmericaIn preparation for the proposed joint venture, which remains subject to regulatory clearance, a charge of US$51 million has beenhas been recorded by Miller for staff retention arrangements and for certain integration costs.2007Latin America and CorporateIntegration and restructuring costs associated with the consolidation of Bavaria S.A. of US$69 million were incurred during the year.EuropeIntegration and restructuring costs of US$7 million associated with the consolidation of Pivovar Topvar a.s. and the relocation of theEurope hub office to Zug were incurred during 2007.In November 2006, the Naples brewery site was sold for US$28 million giving rise to a profit of US$14 million.During the year the group recognised deferred tax assets that had previously not been recognised on the acquisition of Birra Peroni SpA.In accordance with IAS12, Income Taxes, when deferred tax assets on losses not previously recognised on acquisition are subsequentlyrecognised, both goodwill and deferred tax assets are adjusted with corresponding entries to operating expense and taxation in theincome statement. This deferred tax asset was substantially utilised during 2007.5. Net finance costs2008 2007US$m US$ma) Interest payable and similar chargesInterest payable on bank loans and overdrafts* 292 289Interest payable on corporate bonds 401 327Interest element of finance leases payments 1 1Losses on early settlement of bonds – 44Net exchange (gains) on financing activities (39) (28)Fair value losses on dividend related derivatives** 10 –Fair value losses on standalone derivative financial instruments 23 –Other finance charges 33 35Total interest payable and similar charges 721 668b) Interest receivable and similar incomeInterest receivable* 198 177Fair value gains/(losses) on financial instruments:– Fair value gains on standalone derivative financial instruments 19 17– Interest rate swaps: designated as fair value hedges 103 36– Non-current borrowings designated as fair value hedges (103) (36)– Ineffectiveness of fair value hedges 3 2– Ineffectiveness of net investment hedges** 45 –– Other fair value gains on borrowings – 44Total interest receivable and similar income 265 240Net finance costs 456 428* Interest payable on bank loans and overdrafts and interest receivable include the interest element of derivatives.** These items relate to mark-to-market adjustments on capital items for which hedge accounting cannot be fully applied. These items have been excludedfrom the determination of adjusted earnings per share. Adjusted net finance costs are therefore US$491 million (2007: US$428 million).Please refer to note 22 – Financial risk factors for interest rate risk information.80 Notes to the consolidated financial statements<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2008