Annual Report - SABMiller India

Annual Report - SABMiller India

Annual Report - SABMiller India

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

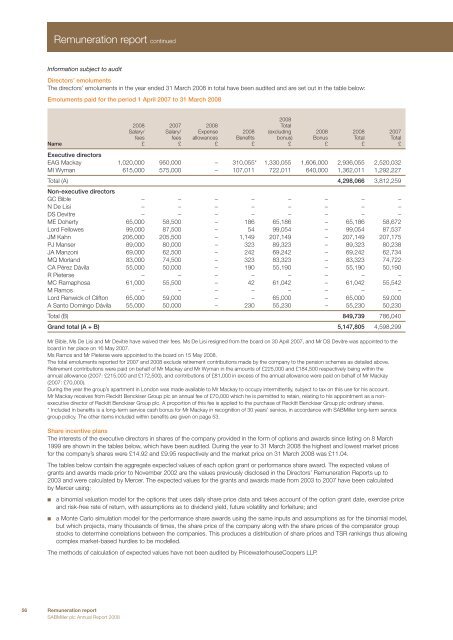

Remuneration report continuedInformation subject to auditDirectors’ emolumentsThe directors’ emoluments in the year ended 31 March 2008 in total have been audited and are set out in the table below:Emoluments paid for the period 1 April 2007 to 31 March 200820082008 2007 2008 TotalSalary/ Salary/ Expense 2008 (excluding 2008 2008 2007fees fees allowances Benefits bonus) Bonus Total TotalName £ £ £ £ £ £ £ £Executive directorsEAG Mackay 1,020,000 950,000 – 310,055* 1,330,055 1,606,000 2,936,055 2,520,032MI Wyman 615,000 575,000 – 107,011 722,011 640,000 1,362,011 1,292,227Total (A) 4,298,066 3,812,259Non-executive directorsGC Bible – – – – – – – –N De Lisi – – – – – – – –DS Devitre – – – – – – – –ME Doherty 65,000 58,500 – 186 65,186 – 65,186 58,672Lord Fellowes 99,000 87,500 – 54 99,054 – 99,054 87,537JM Kahn 206,000 205,500 – 1,149 207,149 – 207,149 207,175PJ Manser 89,000 80,000 – 323 89,323 – 89,323 80,238JA Manzoni 69,000 62,500 – 242 69,242 – 69,242 62,734MQ Morland 83,000 74,500 – 323 83,323 – 83,323 74,722CA Pérez Dávila 55,000 50,000 – 190 55,190 – 55,190 50,190R Pieterse – – – – – – – –MC Ramaphosa 61,000 55,500 – 42 61,042 – 61,042 55,542M Ramos – – – – – – – –Lord Renwick of Clifton 65,000 59,000 – – 65,000 – 65,000 59,000A Santo Domingo Dávila 55,000 50,000 – 230 55,230 – 55,230 50,230Total (B) 849,739 786,040Grand total (A + B) 5,147,805 4,598,299Mr Bible, Ms De Lisi and Mr Devitre have waived their fees. Ms De Lisi resigned from the board on 30 April 2007, and Mr DS Devitre was appointed to theboard in her place on 16 May 2007.Ms Ramos and Mr Pieterse were appointed to the board on 15 May 2008.The total emoluments reported for 2007 and 2008 exclude retirement contributions made by the company to the pension schemes as detailed above.Retirement contributions were paid on behalf of Mr Mackay and Mr Wyman in the amounts of £225,000 and £184,500 respectively being within theannual allowance (2007: £215,000 and £172,500), and contributions of £81,000 in excess of the annual allowance were paid on behalf of Mr Mackay(2007: £70,000).During the year the group’s apartment in London was made available to Mr Mackay to occupy intermittently, subject to tax on this use for his account.Mr Mackay receives from Reckitt Benckiser Group plc an annual fee of £70,000 which he is permitted to retain, relating to his appointment as a nonexecutivedirector of Reckitt Benckiser Group plc. A proportion of this fee is applied to the purchase of Reckitt Benckiser Group plc ordinary shares.* Included in benefits is a long-term service cash bonus for Mr Mackay in recognition of 30 years’ service, in accordance with <strong>SABMiller</strong> long-term servicegroup policy. The other items included within benefits are given on page 53.Share incentive plansThe interests of the executive directors in shares of the company provided in the form of options and awards since listing on 8 March1999 are shown in the tables below, which have been audited. During the year to 31 March 2008 the highest and lowest market pricesfor the company’s shares were £14.92 and £9.95 respectively and the market price on 31 March 2008 was £11.04.The tables below contain the aggregate expected values of each option grant or performance share award. The expected values ofgrants and awards made prior to November 2002 are the values previously disclosed in the Directors’ Remuneration <strong>Report</strong>s up to2003 and were calculated by Mercer. The expected values for the grants and awards made from 2003 to 2007 have been calculatedby Mercer using:■a binomial valuation model for the options that uses daily share price data and takes account of the option grant date, exercise priceand risk-free rate of return, with assumptions as to dividend yield, future volatility and forfeiture; and■ a Monte Carlo simulation model for the performance share awards using the same inputs and assumptions as for the binomial model,but which projects, many thousands of times, the share price of the company along with the share prices of the comparator groupstocks to determine correlations between the companies. This produces a distribution of share prices and TSR rankings thus allowingcomplex market-based hurdles to be modelled.The methods of calculation of expected values have not been audited by PricewaterhouseCoopers LLP.56 Remuneration report<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2008