Annual Report - SABMiller India

Annual Report - SABMiller India

Annual Report - SABMiller India

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

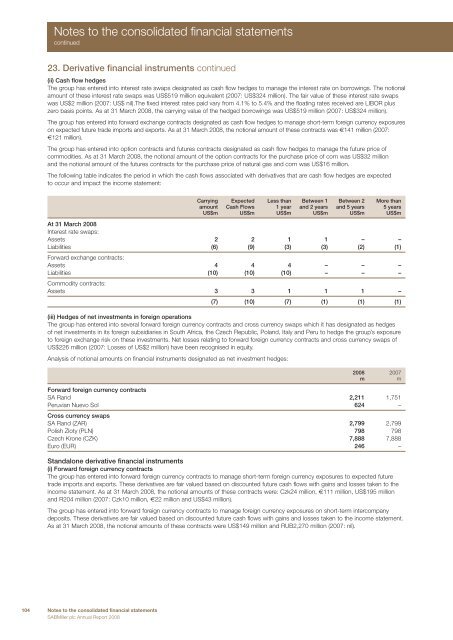

Notes to the consolidated financial statementscontinued23. Derivative financial instruments continued(ii) Cash flow hedgesThe group has entered into interest rate swaps designated as cash flow hedges to manage the interest rate on borrowings. The notionalamount of these interest rate swaps was US$519 million equivalent (2007: US$324 million). The fair value of these interest rate swapswas US$2 million (2007: US$ nil).The fixed interest rates paid vary from 4.1% to 5.4% and the floating rates received are LIBOR pluszero basis points. As at 31 March 2008, the carrying value of the hedged borrowings was US$519 million (2007: US$324 million).The group has entered into forward exchange contracts designated as cash flow hedges to manage short-term foreign currency exposureson expected future trade imports and exports. As at 31 March 2008, the notional amount of these contracts was €141 million (2007:€121 million).The group has entered into option contracts and futures contracts designated as cash flow hedges to manage the future price ofcommodities. As at 31 March 2008, the notional amount of the option contracts for the purchase price of corn was US$32 millionand the notional amount of the futures contracts for the purchase price of natural gas and corn was US$16 million.The following table indicates the period in which the cash flows associated with derivatives that are cash flow hedges are expectedto occur and impact the income statement:Carrying Expected Less than Between 1 Between 2 More thanamount Cash Flows 1 year and 2 years and 5 years 5 yearsUS$m US$m US$m US$m US$m US$mAt 31 March 2008Interest rate swaps:Assets 2 2 1 1 – –Liabilities (6) (9) (3) (3) (2) (1)Forward exchange contracts:Assets 4 4 4 – – –Liabilities (10) (10) (10) – – –Commodity contracts:Assets 3 3 1 1 1 –(7) (10) (7) (1) (1) (1)(iii) Hedges of net investments in foreign operationsThe group has entered into several forward foreign currency contracts and cross currency swaps which it has designated as hedgesof net investments in its foreign subsidiaries in South Africa, the Czech Republic, Poland, Italy and Peru to hedge the group’s exposureto foreign exchange risk on these investments. Net losses relating to forward foreign currency contracts and cross currency swaps ofUS$226 million (2007: Losses of US$2 million) have been recognised in equity.Analysis of notional amounts on financial instruments designated as net investment hedges:2008 2007mmForward foreign currency contractsSA Rand 2,211 1,751Peruvian Nuevo Sol 624 –Cross currency swapsSA Rand (ZAR) 2,799 2,799Polish Zloty (PLN) 798 798Czech Krone (CZK) 7,888 7,888Euro (EUR) 246 –Standalone derivative financial instruments(i) Forward foreign currency contractsThe group has entered into forward foreign currency contracts to manage short-term foreign currency exposures to expected futuretrade imports and exports. These derivatives are fair valued based on discounted future cash flows with gains and losses taken to theincome statement. As at 31 March 2008, the notional amounts of these contracts were: Czk24 million, €111 million, US$195 millionand R204 million (2007: Czk10 million, €22 million and US$43 million).The group has entered into forward foreign currency contracts to manage foreign currency exposures on short-term intercompanydeposits. These derivatives are fair valued based on discounted future cash flows with gains and losses taken to the income statement.As at 31 March 2008, the notional amounts of these contracts were US$149 million and RUB2,270 million (2007: nil).104 Notes to the consolidated financial statements<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2008