Annual Report - SABMiller India

Annual Report - SABMiller India

Annual Report - SABMiller India

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

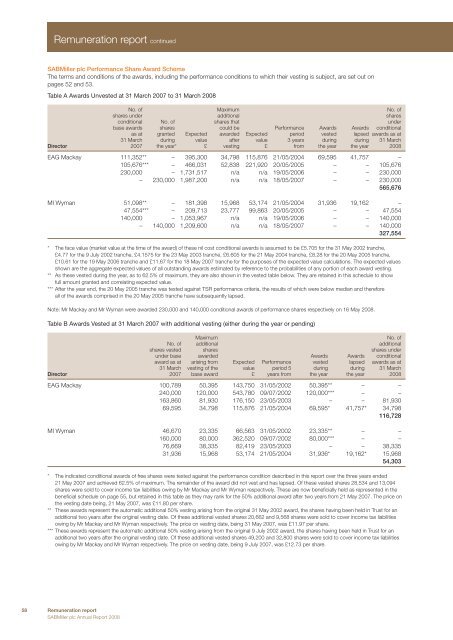

Remuneration report continued<strong>SABMiller</strong> plc Performance Share Award SchemeThe terms and conditions of the awards, including the performance conditions to which their vesting is subject, are set out onpages 52 and 53.Table A Awards Unvested at 31 March 2007 to 31 March 2008No. of Maximum No. ofshares under additional sharesconditional No. of shares that underbase awards shares could be Performance Awards Awards conditionalas at granted Expected awarded Expected period vested lapsed awards as at31 March during value after value 3 years during during 31 MarchDirector 2007 the year* £ vesting £ from the year the year 2008EAG Mackay 111,352** – 395,300 34,798 115,876 21/05/2004 69,595 41,757 –105,676*** – 466,031 52,838 221,920 20/05/2005 – – 105,676230,000 – 1,731,517 n/a n/a 19/05/2006 – – 230,000– 230,000 1,987,200 n/a n/a 18/05/2007 – – 230,000565,676MI Wyman 51,098** – 181,398 15,968 53,174 21/05/2004 31,936 19,162 –47,554*** – 209,713 23,777 99,863 20/05/2005 – – 47,554140,000 – 1,053,967 n/a n/a 19/05/2006 – – 140,000– 140,000 1,209,600 n/a n/a 18/05/2007 – – 140,000327,554* The face value (market value at the time of the award) of these nil cost conditional awards is assumed to be £5.705 for the 31 May 2002 tranche,£4.77 for the 9 July 2002 tranche, £4.1575 for the 23 May 2003 tranche, £6.605 for the 21 May 2004 tranche, £8.28 for the 20 May 2005 tranche,£10.61 for the 19 May 2006 tranche and £11.67 for the 18 May 2007 tranche for the purposes of the expected value calculations. The expected valuesshown are the aggregate expected values of all outstanding awards estimated by reference to the probabilities of any portion of each award vesting.** As these vested during the year, as to 62.5% of maximum, they are also shown in the vested table below. They are retained in this schedule to showfull amount granted and correlating expected value.*** After the year end, the 20 May 2005 tranche was tested against TSR performance criteria, the results of which were below median and thereforeall of the awards comprised in the 20 May 2005 tranche have subsequently lapsed.Note: Mr Mackay and Mr Wyman were awarded 230,000 and 140,000 conditional awards of performance shares respectively on 16 May 2008.Table B Awards Vested at 31 March 2007 with additional vesting (either during the year or pending)MaximumNo. ofNo. of additional additionalshares vested shares shares underunder base awarded Awards Awards conditionalaward as at arising from Expected Performance vested lapsed awards as at31 March vesting of the value period 5 during during 31 MarchDirector 2007 base award £ years from the year the year 2008EAG Mackay 100,789 50,395 143,750 31/05/2002 50,395** – –240,000 120,000 543,780 09/07/2002 120,000*** – –163,860 81,930 176,150 23/05/2003 – – 81,93069,595 34,798 115,876 21/05/2004 69,595* 41,757* 34,798116,728MI Wyman 46,670 23,335 66,563 31/05/2002 23,335** – –160,000 80,000 362,520 09/07/2002 80,000*** – –76,669 38,335 82,419 23/05/2003 – – 38,33531,936 15,968 53,174 21/05/2004 31,936* 19,162* 15,96854,303* The indicated conditional awards of free shares were tested against the performance condition described in this report over the three years ended21 May 2007 and achieved 62.5% of maximum. The remainder of the award did not vest and has lapsed. Of these vested shares 28,534 and 13,094shares were sold to cover income tax liabilities owing by Mr Mackay and Mr Wyman respectively. These are now beneficially held as represented in thebeneficial schedule on page 55, but retained in this table as they may rank for the 50% additional award after two years from 21 May 2007. The price onthe vesting date being, 21 May 2007, was £11.80 per share.** These awards represent the automatic additional 50% vesting arising from the original 31 May 2002 award, the shares having been held in Trust for anadditional two years after the original vesting date. Of these additional vested shares 20,662 and 9,568 shares were sold to cover income tax liabilitiesowing by Mr Mackay and Mr Wyman respectively. The price on vesting date, being 31 May 2007, was £11.97 per share.*** These awards represent the automatic additional 50% vesting arising from the original 9 July 2002 award, the shares having been held in Trust for anadditional two years after the original vesting date. Of these additional vested shares 49,200 and 32,800 shares were sold to cover income tax liabilitiesowing by Mr Mackay and Mr Wyman respectively. The price on vesting date, being 9 July 2007, was £12.73 per share.58 Remuneration report<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2008