Annual Report - SABMiller India

Annual Report - SABMiller India

Annual Report - SABMiller India

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

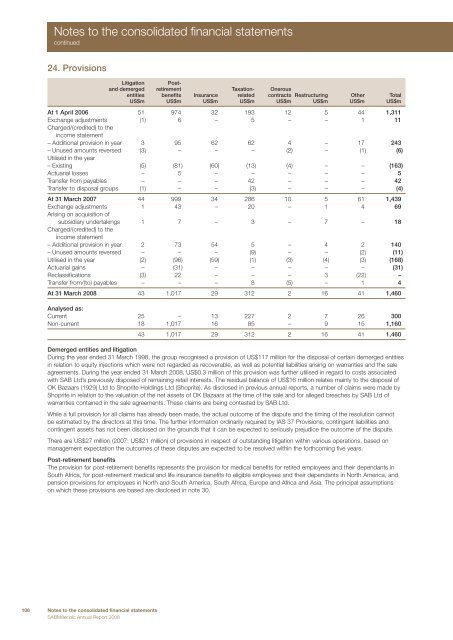

Notes to the consolidated financial statementscontinued24. ProvisionsLitigation Postanddemerged retirement Taxation- Onerousentities benefits Insurance related contracts Restructuring Other TotalUS$m US$m US$m US$m US$m US$m US$m US$mAt 1 April 2006 51 974 32 193 12 5 44 1,311Exchange adjustments (1) 6 – 5 – – 1 11Charged/(credited) to theincome statement– Additional provision in year 3 95 62 62 4 – 17 243– Unused amounts reversed (3) – – – (2) – (1) (6)Utilised in the year– Existing (5) (81) (60) (13) (4) – – (163)Actuarial losses – 5 – – – – – 5Transfer from payables – – – 42 – – – 42Transfer to disposal groups (1) – – (3) – – – (4)At 31 March 2007 44 999 34 286 10 5 61 1,439Exchange adjustments 1 43 – 20 – 1 4 69Arising on acquisition ofsubsidiary undertakings 1 7 – 3 – 7 – 18Charged/(credited) to theincome statement– Additional provision in year 2 73 54 5 – 4 2 140– Unused amounts reversed – – – (9) – – (2) (11)Utilised in the year (2) (96) (59) (1) (3) (4) (3) (168)Actuarial gains – (31) – – – – – (31)Reclassifications (3) 22 – – – 3 (22) –Transfer from/(to) payables – – – 8 (5) – 1 4At 31 March 2008 43 1,017 29 312 2 16 41 1,460Analysed as:Current 25 – 13 227 2 7 26 300Non-current 18 1,017 16 85 – 9 15 1,16043 1,017 29 312 2 16 41 1,460Demerged entities and litigationDuring the year ended 31 March 1998, the group recognised a provision of US$117 million for the disposal of certain demerged entitiesin relation to equity injections which were not regarded as recoverable, as well as potential liabilities arising on warranties and the saleagreements. During the year ended 31 March 2008, US$0.3 million of this provision was further utilised in regard to costs associatedwith SAB Ltd’s previously disposed of remaining retail interests. The residual balance of US$16 million relates mainly to the disposal ofOK Bazaars (1929) Ltd to Shoprite Holdings Ltd (Shoprite). As disclosed in previous annual reports, a number of claims were made byShoprite in relation to the valuation of the net assets of OK Bazaars at the time of the sale and for alleged breaches by SAB Ltd ofwarranties contained in the sale agreements. These claims are being contested by SAB Ltd.While a full provision for all claims has already been made, the actual outcome of the dispute and the timing of the resolution cannotbe estimated by the directors at this time. The further information ordinarily required by IAS 37 Provisions, contingent liabilities andcontingent assets has not been disclosed on the grounds that it can be expected to seriously prejudice the outcome of the dispute.There are US$27 million (2007: US$21 million) of provisions in respect of outstanding litigation within various operations, based onmanagement expectation the outcomes of these disputes are expected to be resolved within the forthcoming five years.Post-retirement benefitsThe provision for post-retirement benefits represents the provision for medical benefits for retired employees and their dependants inSouth Africa, for post-retirement medical and life insurance benefits to eligible employees and their dependants in North America, andpension provisions for employees in North and South America, South Africa, Europe and Africa and Asia. The principal assumptionson which these provisions are based are disclosed in note 30.106 Notes to the consolidated financial statements<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2008