Annual report 2011 - VTB

Annual report 2011 - VTB

Annual report 2011 - VTB

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

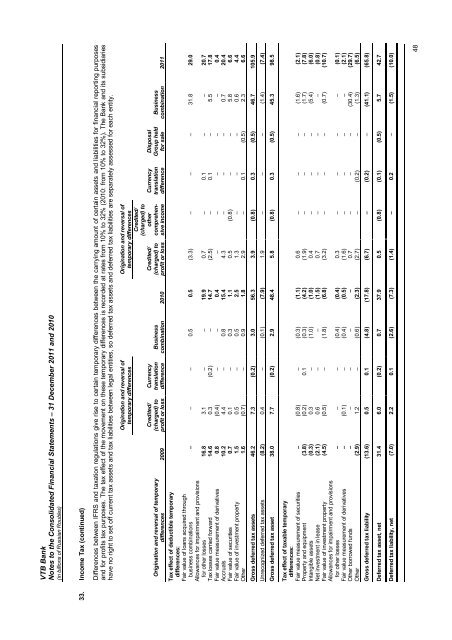

<strong>VTB</strong> BankNotes to the Consolidated Financial Statements – 31 December <strong>2011</strong> and 2010(in billions of Russian Roubles)33. Income Tax (continued)Differences between IFRS and taxation regulations give rise to certain temporary differences between the carrying amount of certain assets and liabilities for financial <strong>report</strong>ing purposesand for profits tax purposes. The tax effect of the movement on these temporary differences is recorded at rates from 10% to 32% (2010: from 10% to 32%). The Bank and its subsidiarieshave no right to set off current tax assets and tax liabilities between legal entities, so deferred tax assets and deferred tax liabilities are separately assessed for each entity.Origination and reversal of temporarydifferences 2009Origination and reversal oftemporary differencesCredited/(charged) toprofit or lossCurrencytranslationdifferenceBusinesscombination 2010Origination and reversal oftemporary differencesCredited/(charged) toprofit or lossCredited/(charged) toothercomprehensiveincomeCurrencytranslationdifferenceDisposalGroup heldfor saleBusinesscombination <strong>2011</strong>Tax effect of deductible temporarydifferences:Fair value of loans acquired throughbusiness combinations – – – 0.5 0.5 (3.3) – – – 31.8 29.0Allowances for impairment and provisionsfor other losses 16.8 3.1 – – 19.9 0.7 – 0.1 – – 20.7Tax losses carried forward 14.6 0.3 (0.2) – 14.7 (2.5) – 0.1 – 5.5 17.8Fair value measurement of derivatives 0.8 (0.4) – – 0.4 – – – – – 0.4Accruals 10.2 4.4 – 0.8 15.4 4.3 – – – 0.7 20.4Fair value of securities 0.7 0.1 – 0.3 1.1 0.5 (0.8) – – 5.8 6.6Fair value of investment property 1.5 0.5 – 0.5 2.5 1.3 – – – 0.6 4.4Other 1.6 (0.7) – 0.9 1.8 2.9 – 0.1 (0.5) 2.3 6.6Gross deferred tax assets 46.2 7.3 (0.2) 3.0 56.3 3.9 (0.8) 0.3 (0.5) 46.7 105.9Unrecognized deferred tax assets (8.2) 0.4 – (0.1) (7.9) 1.9 – – – (1.4) (7.4)Gross deferred tax asset 38.0 7.7 (0.2) 2.9 48.4 5.8 (0.8) 0.3 (0.5) 45.3 98.5Tax effect of taxable temporarydifferences:Fair value measurement of securities – (0.8) – (0.3) (1.1) 0.6 – – – (1.6) (2.1)Property and equipment (3.8) (0.2) 0.1 (0.3) (4.2) (1.9) – – – (1.7) (7.8)Intangible assets (0.3) 0.3 – (1.0) (1.0) 0.4 – – – (5.4) (6.0)Net investment in lease (2.1) 0.6 – – (1.5) 0.7 – – – – (0.8)Fair value of investment property (4.5) (0.5) – (1.8) (6.8) (3.2) – – – (0.7) (10.7)Allowances for impairment and provisionsfor other losses – – – (0.4) (0.4) 0.3 – – – – (0.1)Fair value measurement of derivatives – (0.1) – (0.4) (0.5) (1.6) – – – – (2.1)Other borrowed funds – – – – – 0.7 – – – (30.4) (29.7)Other (2.9) 1.2 – (0.6) (2.3) (2.7) – (0.2) – (1.3) (6.5)Gross deferred tax liability (13.6) 0.5 0.1 (4.8) (17.8) (6.7) – (0.2) – (41.1) (65.8)Deferred tax asset, net 31.4 6.0 (0.2) 0.7 37.9 0.5 (0.8) (0.1) (0.5) 5.7 42.7Deferred tax liability, net (7.0) 2.2 0.1 (2.6) (7.3) (1.4) – 0.2 – (1.5) (10.0)48