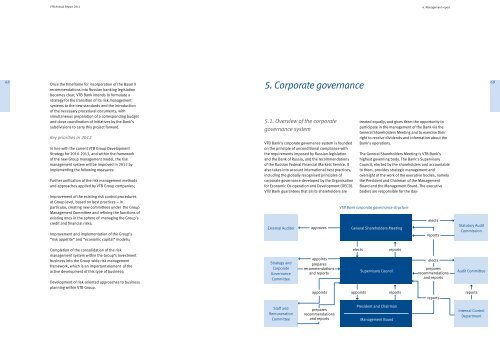

<strong>VTB</strong> <strong>Annual</strong> Report <strong>2011</strong>4. Management <strong>report</strong>68Once the timeframe for incorporation of the Basel IIrecommendations into Russian banking legislationbecomes clear, <strong>VTB</strong> Bank intends to formulate astrategy for the transition of its risk managementsystems to the new standards and the introductionof the necessary procedural documents, withsimultaneous preparation of a corresponding budgetand close coordination of initiatives by the Bank’ssubdivisions to carry this project forward.Key priorities in 2012In line with the current <strong>VTB</strong> Group DevelopmentStrategy for 2010-2013, and within the frameworkof the new Group management model, the riskmanagement system will be improved in 2012 byimplementing the following measures:Further unification of the risk management methodsand approaches applied by <strong>VTB</strong> Group companies;Improvement of the existing risk control proceduresat Group level, based on best practices – inparticular, creating new committees under the GroupManagement Committee and refining the functions ofexisting ones in the sphere of managing the Group’scredit and financial risks;Improvement and implementation of the Group’s“risk appetite” and “economic capital” models;5. Corporate governance5.1. Overview of the corporategovernance system<strong>VTB</strong> Bank’s corporate governance system is foundedon the principle of unconditional compliance withthe requirements imposed by Russian legislationand the Bank of Russia, and the recommendationsof the Russian Federal Financial Markets Service. Italso takes into account international best practices,including the globally recognised principles ofcorporate governance developed by the Organisationfor Economic Co-operation and Development (OECD).<strong>VTB</strong> Bank guarantees that all its shareholders areExternal Auditorapprovestreated equally, and gives them the opportunity toparticipate in the management of the Bank via theGeneral Shareholders Meeting and to exercise theirright to receive dividends and information about theBank’s operations.The General Shareholders Meeting is <strong>VTB</strong> Bank’shighest governing body. The Bank’s SupervisoryCouncil, elected by the shareholders and accountableto them, provides strategic management andoversight of the work of the executive bodies, namelythe President and Chairman of the ManagementBoard and the Management Board. The executivebodies are responsible for the day-<strong>VTB</strong> Bank corporate governance structureGeneral Shareholders Meetingelects<strong>report</strong>sStatutory AuditCommission69Completion of the consolidation of the riskmanagement system within the Group’s investmentbusiness into the Group-wide risk managementframework, which is an important element of theactive development of this type of business;Development of risk-oriented approaches to businessplanning within <strong>VTB</strong> Group.Strategy andCorporateGovernanceCommitteeappointspreparesrecommendationsand <strong>report</strong>sappointselects<strong>report</strong>sSupervisory Councilappoints<strong>report</strong>selectspreparesrecommendationsand <strong>report</strong>s<strong>report</strong>sAudit Committee<strong>report</strong>sStaff andRemunerationCommitteepreparesrecommendationsand <strong>report</strong>sPresident and ChairmanManagement BoardInternal ControlDepartment

<strong>VTB</strong> <strong>Annual</strong> Report <strong>2011</strong>5. Corporate governance70to-day management of the Bank and carry out thetasks entrusted to them by the shareholders and theSupervisory Council.<strong>VTB</strong> Bank has built an effective system of corporategovernance and internal control of its financial andeconomic affairs as a means of safeguarding therights and lawful interests of its shareholders.The Supervisory Council oversees the AuditCommittee which, in conjunction with the InternalControl Department, supports the managementfunction in ensuring the smooth running of theBank’s operations. The Audit Commission monitorsthe Bank’s compliance with the relevant lawsand regulations and the legality of its businesstransactions.<strong>VTB</strong> annually engages an external auditor, who hasno connection to the Bank’s or its shareholders’proprietary interests, to inspect and verify the Bank’sfinancial <strong>report</strong>s.The Staff and Remuneration Committee <strong>report</strong>s to theSupervisory Council and drafts recommendations onkey appointments and incentives for members of theSupervisory Council and the Bank’s executive andcontrol bodies.The Strategy and Corporate Governance Committeeunder the Supervisory Council, was established inorder to optimise the decision-making process of theSupervisory Council on issues of strategic developmentand to improve <strong>VTB</strong>’s corporate governance.The Bank operates a policy of timely and fulldisclosure of reliable information, including detailsof its financial position, economic performance andownership structure, thereby giving shareholders andinvestors the opportunity to make properly informeddecisions. Information is disclosed in compliancewith the requirements of Russian legislation andthe UK financial regulator, the Financial ServicesAuthority (FSA). In 2008, <strong>VTB</strong> Bank introduced its ownRegulation on Information Policy which, inter alia,establishes rules for the protection of confidentialand insider information.5.2. Development of the corporategovernance system in <strong>2011</strong>In <strong>2011</strong>, the Bank continued to develop its corporategovernance system in line with best practices.The main activities in this area included:Introducing the office of Corporate Secretary, whichentailed election of the Corporate Secretary by theBank’s Supervisory Council and approval of theregulations governing the Corporate Secretary, whichcomply with the relevant recommendations of theCode of Corporate Conduct of the Federal FinancialMarkets Service of Russia;Establishing the Strategy and Corporate GovernanceCommittee under the Supervisory Council, whoserole is to provide a thorough preliminary reviewof strategic and corporate governance issues forconsideration by the Supervisory Council;The election of representatives of large institutionalinvestors to the Supervisory Council;Approval by the Supervisory Council of methodsfor evaluating the corporate governance system,developed in accordance with internationalbest practices and in compliance with therecommendations of the Bank of Russia;The annual evaluation of <strong>VTB</strong>’s corporate governancesystem by the Russian Institute of Directors, a leadingindependent corporate governance expert body.The result of the evaluation was to confirm thescore of seven received by the Bank in 2010 onthe RID-Expert RA National Corporate GovernanceScale, which corresponds to the level of “DevelopedCorporate Governance Practice”;Conducting a number of meetings and seminars withshareholders as part of a nationwide programmeaimed at improving financial literacy in Russia’sregions.In <strong>2011</strong>, the Bank also actively participatedin discussions with experts and the businesscommunity to develop a national model of corporategovernance. <strong>VTB</strong> sponsored and participated in theTenth National Congress of Corporate Directors, whichfocused on the development of corporate governancesystems in companies with state participation,the implementation of innovative developmentprogrammes, and the enhancement of the efficiencyof boards of directors.<strong>VTB</strong> won the prestigious “Bank of the Year <strong>2011</strong>”award in November <strong>2011</strong>. The award marks theachievements of highly efficient Russian companiesthat combine stability with rapid development, andare also considered to have a corporate policy that istransparent to foreign investors. The other good newsin <strong>2011</strong> was the recognition of the <strong>VTB</strong> 2010 <strong>Annual</strong>Report as “The Best <strong>Annual</strong> Report in the FinancialSector of the Economy” in two independent annual<strong>report</strong> competitions, one arranged by the RTS andMICEX stock exchanges and the other by the ExpertRA Rating Agency. This is not the first time <strong>VTB</strong> hasbeen successful in such competitions. The Bank’sannual <strong>report</strong>s consistently earn the highest ratingsgiven by the professional financial community.5.3. The General ShareholdersMeeting of JSC <strong>VTB</strong> BankThe General Shareholders Meeting is <strong>VTB</strong> Bank’shighest governing body. In making decisions atshareholders meetings, the Bank’s owners exercisetheir right to participate in its management.General Shareholders Meetings can be annual orextraordinary. The <strong>Annual</strong> General ShareholdersMeeting must be held once every year. Accordingto the applicable Russian law, the <strong>Annual</strong> GeneralShareholders Meeting must be held no earlier thanthe 1st of March and no later than the 30th of June.The procedure at the Meeting is governed by theRegulation on Procedures for Preparing and Holdingthe General Shareholders Meeting.The <strong>2011</strong> <strong>Annual</strong> General Shareholders Meeting of<strong>VTB</strong> Bank was held on the 3rd of June in Moscowunder the chairmanship of Alexey Ulyukaev,First Deputy Chairman of the Bank of Russiaand a member of the <strong>VTB</strong> Supervisory Council.The Meeting was attended by 733 shareholdersand their representatives. For the first time the<strong>Annual</strong> General Shareholders Meeting was held inaccordance with the new Regulation on GeneralShareholders Meetings, which was adopted in 2010.The shareholders’ debate on issues included in theagenda and the answering of questions submitted byshareholders in writing were moved to the last partof the meeting, after all the speakers had made theirpresentations. This enabled time to be allocated in amore rational manner, and full answers to be given toshareholders’ questions.During the Meeting, shareholders took part indiscussions and voted on the following matters:approval of <strong>VTB</strong> Bank’s <strong>Annual</strong> Report for 2010;approval of the annual accounts for 2010;distribution of profits and the announcement ofdividends for 2010;approval of remuneration payments to thoseSupervisory Council members that are not stateemployees;approval of the composition of the SupervisoryCouncil and election of its members;approval of the composition of the Audit Commissionand election of its members;approval of the external auditor;approval of the new edition of the <strong>VTB</strong> Bank Charter;approval of the new edition of the SupervisoryCouncil Regulation;71