Annual report 2011 - VTB

Annual report 2011 - VTB

Annual report 2011 - VTB

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

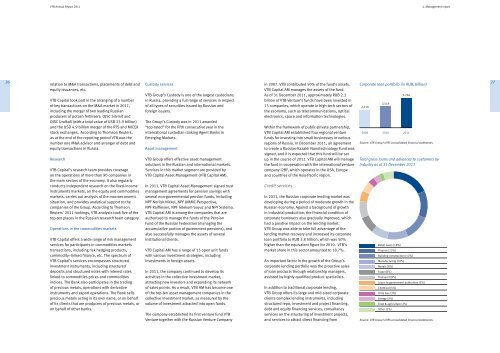

<strong>VTB</strong> <strong>Annual</strong> Report <strong>2011</strong>4. Management <strong>report</strong>26relation to M&A transactions, placements of debt andequity issuances, etc.<strong>VTB</strong> Capital took part in the arranging of a numberof key transactions on the M&A market in <strong>2011</strong>,including the merger of two leading Russianproducers of potash fertilisers: OJSC Silvinit andOJSC Uralkali (with a total value of USD 23.9 billion)and the USD 4.9 billion merger of the RTS and MICEXstock exchanges. According to Thomson Reuters,as at the end of the <strong>report</strong>ing period <strong>VTB</strong> was thenumber one M&A advisor and arranger of debt andequity transactions in Russia.Research<strong>VTB</strong> Capital’s research team provides coverageon the operations of more than 90 companies inthe main sectors of the economy. It also regularlyconducts independent research on the fixed-incomeinstruments markets, on the equity and commoditiesmarkets, carries out analysis of the macroeconomicsituation, and provides analytical support to thecompanies of the Group. According to ThomsonReuters’ <strong>2011</strong> rankings, <strong>VTB</strong> analysts took five of thetop-ten places in the Russian research team category.Operations in the commodities markets<strong>VTB</strong> Capital offers a wide range of risk managementservices for participants in commodities marketstransactions, including risk hedging products,commodity–linked finance, etc. The spectrum of<strong>VTB</strong> Capital’s services encompasses structuredinvestment instruments, including structureddeposits and structured notes with interest rateslinked to commodities prices and commoditiesindices. The Bank also participates in the tradingof precious metals, operations with derivativeinstruments and export operations. The Bank sellsprecious metals acting in its own name, or on behalfof its clients that are producers of precious metals, oron behalf of other banks.Custody services<strong>VTB</strong> Group’s Custody is one of the largest custodiansin Russia, providing a full range of services in respectof all types of securities issued by Russian andforeign issuers.The Group’s Custody was in <strong>2011</strong> awarded“top-rated” for the fifth consecutive year in theinternational custodian ranking Agent Banks inEmerging Markets.Asset management<strong>VTB</strong> Group offers effective asset managementsolutions in the Russian and international markets.Services in this market segment are provided by<strong>VTB</strong> Capital Asset Management (<strong>VTB</strong> Capital AM).In <strong>2011</strong>, <strong>VTB</strong> Capital Asset Management signed trustmanagement agreements for pension savings withseveral non-governmental pension funds, includingNPF Norilsk Nickel, NPF UMMC-Perspective,NPF Raiffeisen, NPF Telekom-Soyuz and NPF Sistema.<strong>VTB</strong> Capital AM is among the companies that areauthorised to manage the funds of the PensionFund of the Russian Federation (managing theaccumulative portion of government pensions), andalso successfully manages the assets of severalinstitutional clients.<strong>VTB</strong> Capital AM has a range of 15 open unit fundswith various investment strategies, includinginvestments in foreign assets.In <strong>2011</strong>, the company continued to develop itsactivities in the collective investment market,attracting new investors and expanding its networkof sales points. As a result, <strong>VTB</strong> AM has become oneof the top-ten asset management companies in thecollective investment market, as measured by thevolume of investment attracted into open funds.The company established its first venture fund <strong>VTB</strong>Venture together with the Russian Venture Companyin 2007. <strong>VTB</strong> contributed 50% of the fund’s assets.<strong>VTB</strong> Capital AM manages the assets of the fund.As of 31 December <strong>2011</strong>, approximately RUB 2.2billion of <strong>VTB</strong> Venture’s funds have been invested in15 companies, which operate in high-tech sectors ofthe economy, such as telecommunications, opticalelectronics, space and information technologies.Within the framework of public-private partnership,<strong>VTB</strong> Capital AM established four regional venturefunds for investing into small businesses in variousregions of Russia. In December <strong>2011</strong>, an agreementto create a Russian-Kazakh Nanotechnology Fund wassigned, and it is expected that this fund will be setup in the course of 2012. <strong>VTB</strong> Capital AM will managethe fund in cooperation with the international venturecompany I2BF, which operates in the USA, Europeand countries of the Asia-Pacific region.Credit servicesIn <strong>2011</strong>, the Russian corporate lending market wasdeveloping during a period of moderate growth in theRussian economy. Against a background of growthin industrial production, the financial condition ofcorporate borrowers also gradually improved, whichhad a positive impact on the lending market.<strong>VTB</strong> Group was able to take full advantage of thelending market recovery and increased its corporateloan portfolio to RUB 3.8 trillion, which was 50%higher than the equivalent figure for 2010. <strong>VTB</strong>’smarket share in this sector amounted to 18.7%.An important factor in the growth of the Group’scorporate lending portfolio was the proactive salesof loan products through relationship managers,assisted by highly-qualified product specialists.In addition to traditional corporate lending,<strong>VTB</strong> Group offers its large and mid-sized corporateclients complex lending instruments, includingstructured repo, investment and project financing,debt and equity financing services, consultancyservices on the structuring of investment projects,and services to attract direct financing fromCorporate loan portfolio (in RUB, billion)2,11020092,51820103,766<strong>2011</strong>Source: <strong>VTB</strong> Group’s IFRS consolidated financial statements.Total gross loans and advances to customers byindustry as at 31 December <strong>2011</strong>Retail loans (18%)Finance (13%)Building construction (12%)Manufacturing (10%)Metals (8%)Trade (8%)Transport (8%)Loans to government authorities (5%)Chemical (5%)Oil & Gas (3%)Energy (3%)Food & agriculture (2%)Other (5%)Source: <strong>VTB</strong> Group’s IFRS consolidated financial statements.27