Annual report 2011 - VTB

Annual report 2011 - VTB

Annual report 2011 - VTB

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

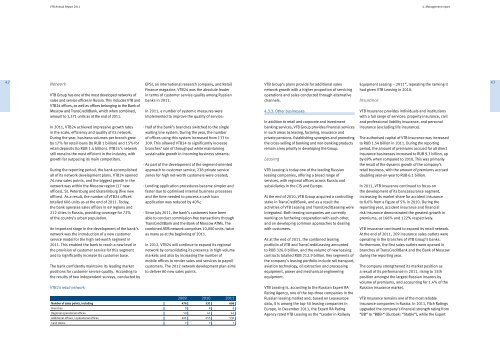

<strong>VTB</strong> <strong>Annual</strong> Report <strong>2011</strong>4. Management <strong>report</strong>42Network<strong>VTB</strong> Group has one of the most developed networks ofsales and service offices in Russia. This includes <strong>VTB</strong> and<strong>VTB</strong>24 offices, as well as offices belonging to the Bank ofMoscow and TransCreditBank, which when combined,amount to 1,371 units as at the end of <strong>2011</strong>.In <strong>2011</strong>, <strong>VTB</strong>24 achieved impressive growth ratesin the scale, efficiency and quality of its network.During the year, business volumes per branch grewby 17% for retail loans (to RUB 1 billion) and 15% forretail deposits (to RUB 1.4 billion). <strong>VTB</strong>24’s networkstill remains the most efficient in the industry, withgrowth far outpacing its main competitors.During the <strong>report</strong>ing period, the bank accomplishedall of its network development plans. <strong>VTB</strong>24 opened76 new sales points, and the biggest growth in thenetwork was within the Moscow region (17 newoffices), St. Petersburg and Ekaterinburg (five newoffices). As a result, the number of <strong>VTB</strong>24 officestotalled 606 units as at the end of <strong>2011</strong>. Today,the bank operates sales offices in 69 regions and212 cities in Russia, providing coverage for 72%of the country’s urban population.An important stage in the development of the bank’snetwork was the introduction of a new customerservice model for the high net-worth segment in<strong>2011</strong>. This enabled the bank to reach a new level inthe provision of customer service for this segmentand to significantly increase its customer base.The bank confidently maintains its leading marketpositions for customer service quality. According tothe results of two independent surveys, conducted by<strong>VTB</strong>24 retail networkEPSI, an international research company, and RetailFinance magazine, <strong>VTB</strong>24 was the absolute leaderin terms of customer service quality among Russianbanks in <strong>2011</strong>.In <strong>2011</strong>, a number of systemic measures wereimplemented to improve the quality of service:Half of the bank’s branches switched to the singlewaiting line system. During the year, the numberof offices using this system increased from 133 to309. This allowed <strong>VTB</strong>24 to significantly increasebranches’ rate of throughput while maintainingsustainable growth in incoming business streams;As part of the development of the segment-orientedapproach to customer service, 238 private servicezones for high net-worth customers were created;Lending application procedures became simpler andfaster due to optimised internal business processesand the time needed to process a cash loanapplication was reduced by 40%;Since July <strong>2011</strong>, the bank’s customers have beenable to conduct commission-free transactions throughTransCreditBank and the Bank of Moscow ATMs. Thecombined ATM network comprises 10,000 units, twiceas many as at the beginning of <strong>2011</strong>.In 2012, <strong>VTB</strong>24 will continue to expand its regionalnetwork by consolidating its presence in high-volumemarkets and also by increasing the number ofmobile offices to render sales and services to payrollcustomers. The 2012 network development plan aimsto deliver 80 new sales points.2009 2010 <strong>2011</strong>Number of sales points, including 476 531 606Branches 9 8 8Regional operational offices 59 61 61Additional offices / operational offices 401 455 530Cash desks 7 7 7<strong>VTB</strong> Group’s plans provide for additional salesnetwork growth with a higher proportion of servicingoperations and sales conducted through alternativechannels.4.3.3. Other businessesIn addition to retail and corporate and investmentbanking services, <strong>VTB</strong> Group provides financial servicesin such areas as leasing, factoring, insurance andprivate pensions. Establishing synergies and promotingthe cross-selling of banking and non-banking productsremain a key priority in developing the Group.Leasing<strong>VTB</strong> Leasing is today one of the leading Russianleasing companies, offering a broad range ofservices, with regional offices across Russia andsubsidiaries in the CIS and Europe.At the end of 2010, <strong>VTB</strong> Group acquired a controllingstake in TransCreditBank, and as a result theactivities of <strong>VTB</strong> Leasing and TransCreditLeasing wereintegrated. Both leasing companies are currentlyworking on furthering cooperation with each other,and on developing common approaches to dealingwith customers.As at the end of <strong>2011</strong>, the combined leasingportfolio of <strong>VTB</strong> and TransCreditLeasing amountedto RUB 326.8 billion, and the volume of new leasingcontracts totalled RUB 212.9 billion. Key segments ofthe company’s leasing portfolio include rail transport,aviation technology, oil extraction and processingequipment, power and mechanical engineeringequipment.<strong>VTB</strong> Leasing is, according to the Russian Expert RARating Agency, one of the top-three companies in theRussian leasing market and, based on Leaseuropedata, it is among the top-50 leasing companies inEurope. In December <strong>2011</strong>, the Expert RA RatingAgency rated <strong>VTB</strong> Leasing as the “Leader in RailwayEquipment Leasing – <strong>2011</strong>”, repeating the ranking ithad given <strong>VTB</strong> Leasing in 2010.Insurance<strong>VTB</strong> Insurance provides individuals and institutionswith a full range of services: property insurance, civiland professional liability insurance, and personalinsurance (excluding life insurance).The authorised capital of <strong>VTB</strong> Insurance was increasedto RUB 1.54 billion in <strong>2011</strong>. During the <strong>report</strong>ingperiod, the amount of premiums accrued for all directinsurance businesses increased to RUB 9.3 billion, upby 69% when compared to 2010. This was primarilythe result of the dynamic growth of the company’sretail business, with the amount of premiums accrueddoubling year-on-year to RUB 6.1 billion.In <strong>2011</strong>, <strong>VTB</strong> Insurance continued to focus onthe development of its bancassurance segment,increasing its market share for accident insuranceto 8.6% from a figure of 5% in 2010. During the<strong>report</strong>ing year, accident insurance and financialrisk insurance demonstrated the greatest growth inpremiums, at 166% and 122% respectively.<strong>VTB</strong> Insurance continued to expand its retail network.At the end of <strong>2011</strong>, 209 insurance sales outlets wereoperating in the branches of <strong>VTB</strong> Group’s banks.Furthermore, the first sales outlets were opened inbranches of TransCreditBank and the Bank of Moscowduring the <strong>report</strong>ing year.The company strengthened its market position asa result of its performance in <strong>2011</strong>, rising to 15thposition amongst the largest Russian insurers byvolume of premiums, and accounting for 1.4% of theRussian insurance market.<strong>VTB</strong> Insurance remains one of the most reliableinsurance companies in Russia. In <strong>2011</strong>, Fitch Ratingsupgraded the company’s financial strength rating from“BB” to “BBB-“ (Outlook: “Stable”), while the Expert43