Annual Report 2006 - Euromaint

Annual Report 2006 - Euromaint

Annual Report 2006 - Euromaint

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Discretion – a natural part of the change process<br />

Continuous improvement of the operation is absolutely crucial for a Group like EuroMaint that operates on a market<br />

exposed to competition. Every change affects a host of different factors both within and outside of the Group. It is<br />

paramount that we analyse the potential consequences of changes in advance and minimise the risk of adverse effects.<br />

All major planned operational changes in EuroMaint are preceded by<br />

a risk analysis to establish what the consequences might be for the<br />

company, its customers or the wider outside world. All to minimise<br />

risks and maintain high preparedness.<br />

analysis ahead of changes<br />

Analysis is used continuously during the companies’ tendering process<br />

and deliveries to examine the consequences on finances, safety, the<br />

environment and working environment, for example. Events which<br />

are not the initiative of EuroMaint are also examined in the form of<br />

various conceivable scenarios.<br />

For example, a risk analysis was carried out before the bid for<br />

Stockholm Train commuter traffic was even submitted. The analysis<br />

was then successfully used to eliminate risks once the contract had<br />

been won and the operation taken over. Activities that aim to reduce<br />

risks have been incorporated into the operation’s ongoing action plans.<br />

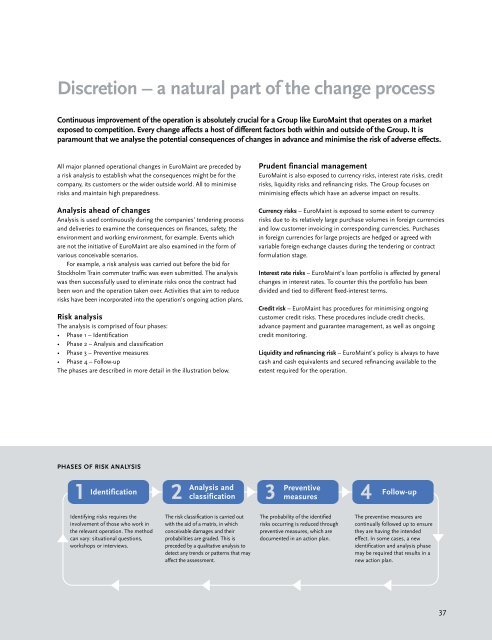

Risk analysis<br />

The analysis is comprised of four phases:<br />

• Phase 1 – Identification<br />

• Phase 2 – Analysis and classification<br />

• Phase 3 – Preventive measures<br />

• Phase 4 – Follow-up<br />

The phases are described in more detail in the illustration below.<br />

PhaSES OF RISK aNaLySIS<br />

Identifying risks requires the<br />

involvement of those who work in<br />

the relevant operation. The method<br />

can vary: situational questions,<br />

workshops or interviews.<br />

The risk classification is carried out<br />

with the aid of a matrix, in which<br />

conceivable damages and their<br />

probabilities are graded. This is<br />

preceded by a qualitative analysis to<br />

detect any trends or patterns that may<br />

affect the assessment.<br />

Prudent financial management<br />

EuroMaint is also exposed to currency risks, interest rate risks, credit<br />

risks, liquidity risks and refinancing risks. The Group focuses on<br />

minimising effects which have an adverse impact on results.<br />

Currency risks – EuroMaint is exposed to some extent to currency<br />

risks due to its relatively large purchase volumes in foreign currencies<br />

and low customer invoicing in corresponding currencies. Purchases<br />

in foreign currencies for large projects are hedged or agreed with<br />

variable foreign exchange clauses during the tendering or contract<br />

formulation stage.<br />

Interest rate risks – EuroMaint’s loan portfolio is affected by general<br />

changes in interest rates. To counter this the portfolio has been<br />

divided and tied to different fixed-interest terms.<br />

Credit risk – EuroMaint has procedures for minimising ongoing<br />

customer credit risks. These procedures include credit checks,<br />

advance payment and guarantee management, as well as ongoing<br />

credit monitoring.<br />

Liquidity and refinancing risk – EuroMaint’s policy is always to have<br />

cash and cash equivalents and secured refinancing available to the<br />

extent required for the operation.<br />

The probability of the identified<br />

risks occurring is reduced through<br />

preventive measures, which are<br />

documented in an action plan.<br />

The preventive measures are<br />

continually followed up to ensure<br />

they are having the intended<br />

effect. In some cases, a new<br />

identification and analysis phase<br />

may be required that results in a<br />

new action plan.<br />

37