CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

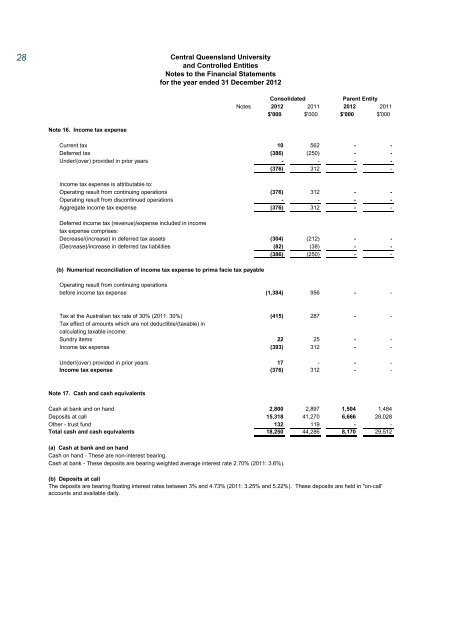

28<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong>and Controlled EntitiesNotes to the Financial Statementsfor the year ended 31 December 2012ConsolidatedParent EntityNotes 2012 2011 2012 2011$'000 $'000 $'000 $'000Note 16. Income tax expenseCurrent tax 10 562 - -Deferred tax (386) (250) - -Under/(over) provided in prior years - - - -(376) 312 - -Income tax expense is attributable to:Operating result from continuing operations (376) 312 - -Operating result from discontinued operations - - - -Aggregate income tax expense (376) 312 - -Deferred income tax (revenue)/expense included in incometax expense comprises:Decrease/(increase) in deferred tax assets (304) (212) - -(Decrease)/increase in deferred tax liabilities (82) (38) - -(386) (250) - -(b) Numerical reconciliation of income tax expense to prima facie tax payableOperating result from continuing operationsbefore income tax expense (1,384) 956 - -Tax at the Australian tax rate of 30% (2011: 30%) (415) 287 - -Tax effect of amounts which are not deductible/(taxable) incalculating taxable income:Sundry items 22 25 - -Income tax expense (393) 312 - -Under/(over) provided in prior years 17 - - -Income tax expense (376) 312 - -Note 17. Cash and cash equivalentsCash at bank and on hand 2,800 2,897 1,504 1,484Deposits at call 15,318 41,270 6,666 28,028Other - trust fund 132 119 - -Total cash and cash equivalents 18,250 44,286 8,170 29,512(a) Cash at bank and on handCash on hand - These are non-interest bearing.Cash at bank - These deposits are bearing weighted average interest rate 2.70% (2011: 3.6%).(b) Deposits at callThe deposits are bearing floating interest rates between 3% and 4.73% (2011: 3.25% and 5.22%). These deposits are held in "on-call'accounts and available daily.