CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

CQUniversity Annual Report - Central Queensland University

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

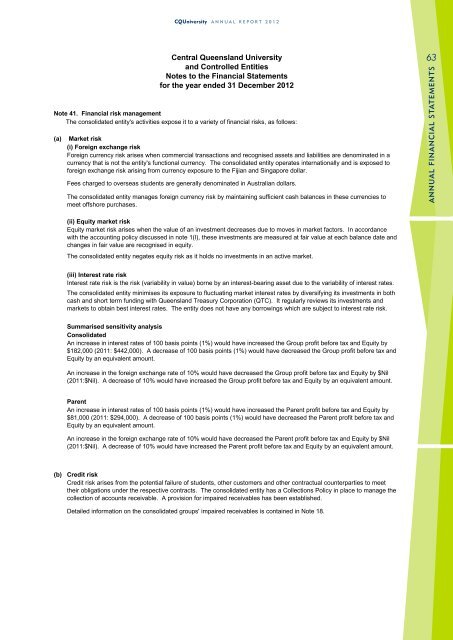

<strong>CQ<strong>University</strong></strong> ANNUAL REPORT 2012Note 41. Financial risk managementThe consolidated entity's activities expose it to a variety of financial risks, as follows:(a)<strong>Central</strong> <strong>Queensland</strong> <strong>University</strong>and Controlled EntitiesNotes to the Financial Statementsfor the year ended 31 December 2012Market risk(i) Foreign exchange riskForeign currency risk arises when commercial transactions and recognised assets and liabilities are denominated in acurrency that is not the entity's functional currency. The consolidated entity operates internationally and is exposed toforeign exchange risk arising from currency exposure to the Fijian and Singapore dollar.Fees charged to overseas students are generally denominated in Australian dollars.The consolidated entity manages foreign currency risk by maintaining sufficient cash balances in these currencies tomeet offshore purchases.63ANNUAL FINANCIAL STATEMENTS(ii) Equity market riskEquity market risk arises when the value of an investment decreases due to moves in market factors. In accordancewith the accounting policy discussed in note 1(l), these investments are measured at fair value at each balance date andchanges in fair value are recognised in equity.The consolidated entity negates equity risk as it holds no investments in an active market.(iii) Interest rate riskInterest rate risk is the risk (variability in value) borne by an interest-bearing asset due to the variability of interest rates.The consolidated entity minimises its exposure to fluctuating market interest rates by diversifying its investments in bothcash and short term funding with <strong>Queensland</strong> Treasury Corporation (QTC). It regularly reviews its investments andmarkets to obtain best interest rates. The entity does not have any borrowings which are subject to interest rate risk.Summarised sensitivity analysisConsolidatedAn increase in interest rates of 100 basis points (1%) would have increased the Group profit before tax and Equity by$182,000 (2011: $442,000). A decrease of 100 basis points (1%) would have decreased the Group profit before tax andEquity by an equivalent amount.An increase in the foreign exchange rate of 10% would have decreased the Group profit before tax and Equity by $Nil(2011:$Nil). A decrease of 10% would have increased the Group profit before tax and Equity by an equivalent amount.ParentAn increase in interest rates of 100 basis points (1%) would have increased the Parent profit before tax and Equity by$81,000 (2011: $294,000). A decrease of 100 basis points (1%) would have decreased the Parent profit before tax andEquity by an equivalent amount.An increase in the foreign exchange rate of 10% would have decreased the Parent profit before tax and Equity by $Nil(2011:$Nil). A decrease of 10% would have increased the Parent profit before tax and Equity by an equivalent amount.(b) Credit riskCredit risk arises from the potential failure of students, other customers and other contractual counterparties to meettheir obligations under the respective contracts. The consolidated entity has a Collections Policy in place to manage thecollection of accounts receivable. A provision for impaired receivables has been established.Detailed information on the consolidated groups' impaired receivables is contained in Note 18.