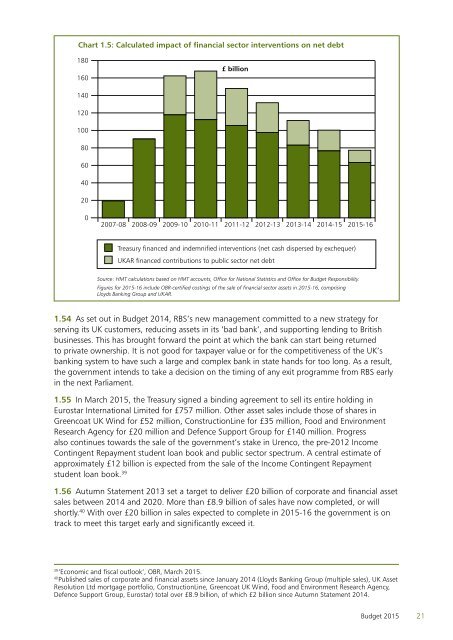

Financial sector and other asset sales1.50 During this Parliament the government has made substantial progress in selling assets itno longer needs to hold, and in getting taxpayers’ money back from the bank bailouts. Totalsales of corporate and financial assets since May 2010 amount to over £19.9 billion. 37 As set outin the OBR’s March <strong>2015</strong> ‘Economic and fiscal outlook’, this government has recovered from itsfinancial sector interventions:••nearly £9 billion through selling shares in Lloyds Banking Group, which has reduced thegovernment’s shareholding to below 23% – Lloyds’ announcement on 27 February <strong>2015</strong> ofa dividend payment will further contribute at least £100 million to the Exchequer••in excess of £9.5 billion in fees from Lloyds Banking Group and Royal Bank of Scotland (RBS)relating to government support and participation in government intervention schemes – allof which are no longer required••more than £21 billion in repayments from the sale of Northern Rock plc, and the ongoingwind-down of NRAM plc and Bradford & Bingley••over £1 billion in respect of the Dunfermline Building Society administration••over £2.6 billion in repayments from the Landsbanki LBI (Icesave) estate in Iceland••a total of £11 billion from the Financial Services Compensation Scheme, from the estatesof failed banks, and fees from the wider banking sector in respect of the Credit GuaranteeScheme and Special Liquidity Scheme (not including RBS or Lloyds)1.51 Chart 1.5 sets out the calculated impact of previous financial sector interventions on netdebt over 2007-08 to <strong>2015</strong>-16. The government remains determined to complete the state’sexit from ownership of banks, delivering value for money for the taxpayer, boosting competitionin the financial sector, and paying down the debt. Having de-risked the financial sector andreturned the economy to a stable and sustainable path, the government is now in a position toset out the next steps in reducing the taxpayers’ exposure to the financial sector.1.52 The government’s long-term economic plan has underpinned positive market conditions.Together with Lloyds moving into profit and paying a dividend, this will enable the governmentto continue its sales programme for the taxpayers’ remaining stake in the bank. As a result this<strong>Budget</strong> announces the government’s plan to sell £9 billion of Lloyds shares overthe next year, continuing the progress of the last year. The government will continue toconsider options for allowing the British public to participate directly in future sales of bank shares.1.53 The government is also taking action to continue to exit from the nationalised banks.UK Asset Resolution (UKAR), which manages the government’s ownership of NRAMplc and Bradford & Bingley plc, is announcing a major sale of assets held from theforced nationalisation of Northern Rock and Bradford & Bingley plc. In parallel, UKARwill explore potential options for the sale or outsourcing of its mortgage servicing activities. Anysales will be contingent on ensuring value for money for the taxpayer. The government’s centralestimate, certified by the OBR, is that these sales of Lloyds shares and UKAR assets are expectedto raise approximately £20 billion in <strong>2015</strong>-16. 3837Published sales of corporate and financial assets (800MHz and 2.6 GHz spectrum, the Tote, Northern Rock, HighSpeed 1 (30 year concession), Lloyds Banking Group (multiple sales), Royal Mail, mortgage style student loan book,Plasma Resources UK, UK Asset Resolution Ltd mortgage portfolio, ConstructionLine, Greencoat UK Wind, Food andEnvironment Research Agency, Defence Support Group, Eurostar) total over £19.9 billion. In general proceeds fromsales of corporate and financial assets will reduce public sector net debt. There may also be an impact on public sectornet borrowing as future income (or costs) are foregone, such as dividend payments, loan repayments, or the need forfuture investment. The specific arrangements for some assets may vary.38‘Economic and fiscal outlook’, OBR, March <strong>2015</strong>.20 <strong>Budget</strong> <strong>2015</strong>

Chart 1.5: Calculated impact of financial sector interventions on net debt180160£ billion1401201008060402002007-082008-092009-102010-112011-122012-132013-142014-15<strong>2015</strong>-16Treasury financed and indemnified interventions (net cash dispersed by exchequer)UKAR financed contributions to public sector net debtSource: HMT calculations based on HMT accounts, Office for National Statistics and Office for <strong>Budget</strong> Responsibility.Figures for <strong>2015</strong>-16 include OBR-certified costings of the sale of financial sector assets in <strong>2015</strong>-16, comprisingLloyds Banking Group and UKAR.1.54 As set out in <strong>Budget</strong> 2014, RBS’s new management committed to a new strategy forserving its UK customers, reducing assets in its ‘bad bank’, and supporting lending to Britishbusinesses. This has brought forward the point at which the bank can start being returnedto private ownership. It is not good for taxpayer value or for the competitiveness of the UK’sbanking system to have such a large and complex bank in state hands for too long. As a result,the government intends to take a decision on the timing of any exit programme from RBS earlyin the next Parliament.1.55 In March <strong>2015</strong>, the Treasury signed a binding agreement to sell its entire holding inEurostar International Limited for £757 million. Other asset sales include those of shares inGreencoat UK Wind for £52 million, ConstructionLine for £35 million, Food and EnvironmentResearch Agency for £20 million and Defence Support Group for £140 million. Progressalso continues towards the sale of the government’s stake in Urenco, the pre-2012 IncomeContingent Repayment student loan book and public sector spectrum. A central estimate ofapproximately £12 billion is expected from the sale of the Income Contingent Repaymentstudent loan book. 391.56 Autumn Statement 2013 set a target to deliver £20 billion of corporate and financial assetsales between 2014 and 2020. More than £8.9 billion of sales have now completed, or willshortly. 40 With over £20 billion in sales expected to complete in <strong>2015</strong>-16 the government is ontrack to meet this target early and significantly exceed it.39‘Economic and fiscal outlook’, OBR, March <strong>2015</strong>.40Published sales of corporate and financial assets since January 2014 (Lloyds Banking Group (multiple sales), UK AssetResolution Ltd mortgage portfolio, ConstructionLine, Greencoat UK Wind, Food and Environment Research Agency,Defence Support Group, Eurostar) total over £8.9 billion, of which £2 billion since Autumn Statement 2014.<strong>Budget</strong> <strong>2015</strong>21