You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

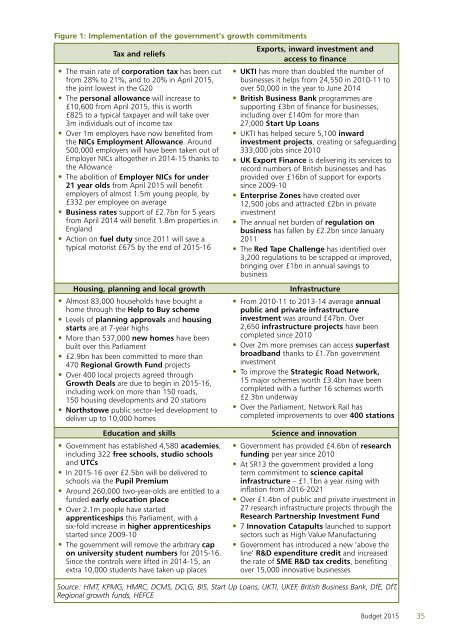

Figure 1: Implementation of the government’s growth commitmentsTax and reliefs••The main rate of corporation tax has been cutfrom 28% to 21%, and to 20% in April <strong>2015</strong>,the joint lowest in the G20••The personal allowance will increase to£10,600 from April <strong>2015</strong>, this is worth£825 to a typical taxpayer and will take over3m individuals out of income tax••Over 1m employers have now benefited fromthe NICs Employment Allowance. Around500,000 employers will have been taken out ofEmployer NICs altogether in 2014-15 thanks tothe Allowance••The abolition of Employer NICs for under21 year olds from April <strong>2015</strong> will benefitemployers of almost 1.5m young people, by£332 per employee on average••Business rates support of £2.7bn for 5 yearsfrom April 2014 will benefit 1.8m properties inEngland••Action on fuel duty since 2011 will save atypical motorist £675 by the end of <strong>2015</strong>-16Exports, inward investment andaccess to finance••UKTI has more than doubled the number ofbusinesses it helps from 24,550 in 2010-11 toover 50,000 in the year to June 2014••British Business Bank programmes aresupporting £3bn of finance for businesses,including over £140m for more than27,000 Start Up Loans••UKTI has helped secure 5,100 inwardinvestment projects, creating or safeguarding333,000 jobs since 2010••UK Export Finance is delivering its services torecord numbers of British businesses and hasprovided over £16bn of support for exportssince 2009-10••Enterprise Zones have created over12,500 jobs and attracted £2bn in privateinvestment••The annual net burden of regulation onbusiness has fallen by £2.2bn since January2011••The Red Tape Challenge has identified over3,200 regulations to be scrapped or improved,bringing over £1bn in annual savings tobusinessHousing, planning and local growth••Almost 83,000 households have bought ahome through the Help to Buy scheme••Levels of planning approvals and housingstarts are at 7-year highs••More than 537,000 new homes have beenbuilt over this Parliament••£2.9bn has been committed to more than470 Regional Growth Fund projects••Over 400 local projects agreed throughGrowth Deals are due to begin in <strong>2015</strong>‐16,including work on more than 150 roads,150 housing developments and 20 stations••Northstowe public sector-led development todeliver up to 10,000 homesEducation and skills••Government has established 4,580 academies,including 322 free schools, studio schoolsand UTCs••In <strong>2015</strong>-16 over £2.5bn will be delivered toschools via the Pupil Premium••Around 260,000 two-year-olds are entitled to afunded early education place••Over 2.1m people have startedapprenticeships this Parliament, with asix-fold increase in higher apprenticeshipsstarted since 2009-10••The government will remove the arbitrary capon university student numbers for <strong>2015</strong>‐16.Since the controls were lifted in 2014-15, anextra 10,000 students have taken up placesInfrastructure••From 2010-11 to 2013-14 average annualpublic and private infrastructureinvestment was around £47bn. Over2,650 infrastructure projects have beencompleted since 2010••Over 2m more premises can access superfastbroadband thanks to £1.7bn governmentinvestment••To improve the Strategic Road Network,15 major schemes worth £3.4bn have beencompleted with a further 16 schemes worth£2.3bn underway••Over the Parliament, Network Rail hascompleted improvements to over 400 stationsScience and innovation••Government has provided £4.6bn of researchfunding per year since 2010••At SR13 the government provided a longterm commitment to science capitalinfrastructure – £1.1bn a year rising withinflation from 2016-2021••Over £1.4bn of public and private investment in27 research infrastructure projects through theResearch Partnership Investment Fund••7 Innovation Catapults launched to supportsectors such as High Value Manufacturing••Government has introduced a new ‘above theline’ R&D expenditure credit and increasedthe rate of SME R&D tax credits, benefitingover 15,000 innovative businessesSource: HMT, KPMG, HMRC, DCMS, DCLG, BIS, Start Up Loans, UKTI, UKEF, British Business Bank, DfE, DfT,Regional growth funds, HEFCE<strong>Budget</strong> <strong>2015</strong>35