of options to integrate spending around some of the most vulnerable groups ofpeople, including:••taking the next steps on from the Better Care Fund to continue to join up services for peoplewith health and social care needs, and learning from Greater Manchester’s experiencefollowing their recent landmark agreement to bring together commissioning of around £6billion of local health and social care budgets••improving the links between health and employment support for people who are unable towork because of a health condition, learning from the roll out of Fit for Work and the mentalhealth pilots agreed as part of the Growth Deals and at Autumn Statement 2014 – <strong>Budget</strong><strong>2015</strong> takes a major step forward through a package of measures to improve employmentoutcomes for people with mental health conditions••exploring whether improving housing can help people with care needs stay in their homeslonger and reduce costs to the NHS••assessing the scope to reduce the estimated £4.3 billion spent because of a failure tosupport troubled individuals struggling with homelessness, addiction and mental healthproblems including through social investment 57••designing a more integrated, multi-agency approach to divert from custody, whereappropriate, female offenders who are convicted of petty, non-violent offencesFuture welfare spending1.88 Since 2010, the government has legislated for measures in the welfare system in order toreduce spending by £21 billion in <strong>2015</strong>-16, through reform of benefit structures, and changesto eligibility and rates. 58 The reforms promote work and personal responsibility while protectingthe most vulnerable members of society. The government is introducing Universal Credit, whichwill help more people off welfare and into work. However, as the OBR has noted in its ‘Welfaretrends report’, over the next Parliament and beyond a number of factors will continue to putupward pressure on spending in some areas. 59 Outcomes could also be further improved forclaimants. While 46% of disabled people of working age are in work, in each quarter only oneeconomically-inactive disabled person in a hundred moves into work. 60 The government remainscommitted to helping people into work and improving outcomes.Welfare cap1.89 At <strong>Budget</strong> 2014, the government introduced the welfare cap to ensure that significantincreases in welfare spending do not go uncorrected. The cap is a firm limit on total welfarespending, applying to all welfare spending in AME with the exception of the state pension andautomatic stabilisers. The OBR’s assessment at Autumn Statement 2014 was that the welfarecap was met. The OBR will next assess performance against the cap in autumn <strong>2015</strong>, when thecap will cover from 2016-17 until the end of the rolling forecast period. At <strong>Budget</strong> <strong>2015</strong>, theOBR’s forecast for spending within scope of the cap is on average £2 billion per year lower thanat Autumn Statement 2014 and in total £9.7 billion lower over the forecast period.57‘Hard edges: mapping severe and multiple disadvantage in England’, Lankelly Chase Foundation, January <strong>2015</strong>.58‘Policy measures database’, OBR, February <strong>2015</strong>.59‘Welfare trends report’, OBR, October 2014.60‘Labour market status of disabled people (Equality Act core disabled)’, ONS Statistical Bulletin: UK Labour Market,February <strong>2015</strong>; ‘The disability and health employment strategy: the discussion so far’, Department for Work andPensions, December 2013.30 <strong>Budget</strong> <strong>2015</strong>

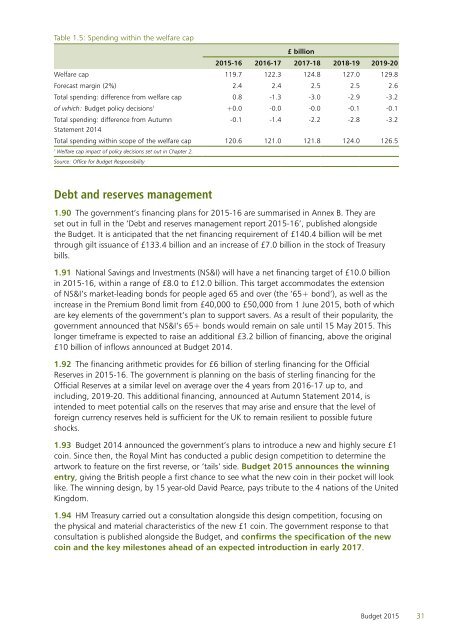

Table 1.5: Spending within the welfare cap£ billion<strong>2015</strong>-16 2016-17 2017-18 2018-19 2019-20Welfare cap 119.7 122.3 124.8 127.0 129.8Forecast margin (2%) 2.4 2.4 2.5 2.5 2.6Total spending: difference from welfare cap 0.8 -1.3 -3.0 -2.9 -3.2of which: <strong>Budget</strong> policy decisions 1 +0.0 -0.0 -0.0 -0.1 -0.1Total spending: difference from Autumn-0.1 -1.4 -2.2 -2.8 -3.2Statement 2014Total spending within scope of the welfare cap 120.6 121.0 121.8 124.0 126.51Welfare cap impact of policy decisions set out in Chapter 2.Source: Office for <strong>Budget</strong> ResponsibilityDebt and reserves management1.90 The government’s financing plans for <strong>2015</strong>-16 are summarised in Annex B. They areset out in full in the ‘Debt and reserves management report <strong>2015</strong>-16’, published alongsidethe <strong>Budget</strong>. It is anticipated that the net financing requirement of £140.4 billion will be metthrough gilt issuance of £133.4 billion and an increase of £7.0 billion in the stock of Treasurybills.1.91 National Savings and Investments (NS&I) will have a net financing target of £10.0 billionin <strong>2015</strong>-16, within a range of £8.0 to £12.0 billion. This target accommodates the extensionof NS&I’s market-leading bonds for people aged 65 and over (the ‘65+ bond’), as well as theincrease in the Premium Bond limit from £40,000 to £50,000 from 1 June <strong>2015</strong>, both of whichare key elements of the government’s plan to support savers. As a result of their popularity, thegovernment announced that NS&I’s 65+ bonds would remain on sale until 15 May <strong>2015</strong>. Thislonger timeframe is expected to raise an additional £3.2 billion of financing, above the original£10 billion of inflows announced at <strong>Budget</strong> 2014.1.92 The financing arithmetic provides for £6 billion of sterling financing for the OfficialReserves in <strong>2015</strong>-16. The government is planning on the basis of sterling financing for theOfficial Reserves at a similar level on average over the 4 years from 2016-17 up to, andincluding, 2019-20. This additional financing, announced at Autumn Statement 2014, isintended to meet potential calls on the reserves that may arise and ensure that the level offoreign currency reserves held is sufficient for the UK to remain resilient to possible futureshocks.1.93 <strong>Budget</strong> 2014 announced the government’s plans to introduce a new and highly secure £1coin. Since then, the Royal Mint has conducted a public design competition to determine theartwork to feature on the first reverse, or ‘tails’ side. <strong>Budget</strong> <strong>2015</strong> announces the winningentry, giving the British people a first chance to see what the new coin in their pocket will looklike. The winning design, by 15 year-old David Pearce, pays tribute to the 4 nations of the UnitedKingdom.1.94 HM Treasury carried out a consultation alongside this design competition, focusing onthe physical and material characteristics of the new £1 coin. The government response to thatconsultation is published alongside the <strong>Budget</strong>, and confirms the specification of the newcoin and the key milestones ahead of an expected introduction in early 2017.<strong>Budget</strong> <strong>2015</strong>31