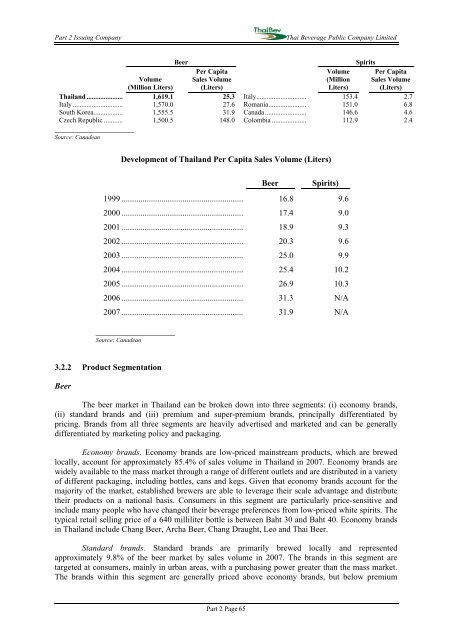

Part 2 Issuing CompanyThai Beverage Public Company LimitedBeerSpiritsVolume(Million Liters)Per CapitaSales Volume(Liters)Volume(MillionLiters)Per CapitaSales Volume(Liters)Thailand ..................... 1,619.1 25.3 Italy............................. 153.4 2.7Italy ............................. 1,570.0 27.6 Romania...................... 151.0 6.8South Korea................. 1,555.5 31.9 Canada........................ 146.6 4.6Czech Republic ........... 1,500.5 148.0 Colombia .................... 112.9 2.4___________________Source: CanadeanDevelopment of Thailand Per Capita Sales Volume (Liters)___________________Source: CanadeanBeerSpirits)1999 .......................................................... 16.8 9.62000 .......................................................... 17.4 9.02001 .......................................................... 18.9 9.32002 .......................................................... 20.3 9.62003 .......................................................... 25.0 9.92004 .......................................................... 25.4 10.22005 .......................................................... 26.9 10.32006 .......................................................... 31.3 N/A2007 .......................................................... 31.9 N/A3.2.2 Product SegmentationBeerThe beer market in Thailand can be broken down into three segments: (i) economy brands,(ii) standard brands and (iii) premium and super-premium brands, principally differentiated bypricing. Brands from all three segments are heavily advertised and marketed and can be generallydifferentiated by marketing policy and packaging.Economy brands. Economy brands are low-priced mainstream products, which are brewedlocally, account for approximately 85.4% of sales volume in Thailand in 2007. Economy brands arewidely available to the mass market through a range of different outlets and are distributed in a varietyof different packaging, including bottles, cans and kegs. Given that economy brands account for themajority of the market, established brewers are able to leverage their scale advantage and distributetheir products on a national basis. Consumers in this segment are particularly price-sensitive andinclude many people who have changed their beverage preferences from low-priced white spirits. Thetypical retail selling price of a 640 milliliter bottle is between Baht 30 and Baht 40. Economy brandsin Thailand include Chang Beer, Archa Beer, Chang Draught, Leo and Thai Beer.Standard brands. Standard brands are primarily brewed locally and representedapproximately 9.8% of the beer market by sales volume in 2007. The brands in this segment aretargeted at consumers, mainly in urban areas, with a purchasing power greater than the mass market.The brands within this segment are generally priced above economy brands, but below premiumPart 2 Page 65

Part 2 Issuing CompanyThai Beverage Public Company Limitedbrands, with the typical retail selling price of a 640 milliliter bottle between Baht 41 and Baht 50.Standard brands have found themselves competing for market share with both economy brands andimported premium brands. The most popular standard brand in Thailand is Singha.Premium and super-premium brands. This segment represented the remaining 4.8% of thebeer market by sales volume in Thailand in 2007, and comprises mainly international brands.Premium brands are primarily brewed locally but super-premium brands are primarily imported intoThailand. The brands in this segment are targeted at urban consumers with relatively high purchasingpower and tourists. In highly populated areas, a large number of premium and super-premium brandsare widely available, particularly in hotels, restaurants and bars. Premium brands are significantlymore expensive than economy and standard brands and use more sophisticated packaging designed toappeal to urban consumers. The typical retail price of a 640 milliliter bottle is approximately Baht 51upwards. Heineken is the most popular premium brand in Thailand and is brewed locally.SpiritsThe spirits market in Thailand can be broken down into three segments: (i) white spirits andChinese herb spirits; (ii) brown spirits, admix whisky and blended/standard Scotch whisky; and (iii)imported premium spirits.White spirits and Chinese herb spirits. White spirits are distilled from molasses, and Chineseherb spirits are produced from alcohol or white spirits compounded with Chinese herbs. White spiritsand Chinese herb spirits are the most popular and lowest priced type of spirits in Thailand andrepresented approximately 69.3% of the spirits market by sales volume in 2005. They are consumedwidely in rural regions and are perceived to be one of the most affordable kinds of alcoholic beverage.The main types of spirits in this segment are Ruang Khao, Pai-Thong and Chiang-Chun. Branding isnot an important factor in this segment, although many consumers take into account the origin of thespirits, which is usually identified on the packaging. The typical retail selling price of a 625 milliliterbottle is between Baht 50 and Baht 85 for white spirits and between Baht 75 and Baht 95 for Chineseherb spirits. The price range for a given packaging format is driven by the variety of alcoholic contentavailable, with higher alcoholic content spirits being more expensive than lower alcoholic contentspirits.Brown spirits, admix whisky and blended/standard Scotch whisky. This segment representedapproximately 30.0% of the spirits market by sales volume in 2005. Brown spirits are primarily localvarieties of whisky and rum, distilled from either molasses or glutinous rice. Brown spirits areconsumed nationwide, although there are regional preferences. Branding is an important factor in thissegment, which includes Sangsom, Mekhong, Hong Thong and 100 Pipers. Increasingly, theinternational spirits companies are targeting this market segment with affordable imported admixwhiskies, which are blends of imported aged malt and neutral spirits as well as with importedblended/standard Scotch whisky. The most popular admix whisky is Crown 99 produced by theCompany and the best selling blended Scotch whisky is 100 Pipers, produced by Pernod Ricard. Thepopular blended/standard Scotch whisky is Johnnie Walker Red Label, an international brandproduced by Diageo Plc. The typical retail selling price for a 700 milliliter bottle is between Baht 115and Baht 210 for locally distilled brown spirits, between Baht 185 and Baht 195 for admix whisky,between Baht 345 and Baht 430 for blended Scotch whisky and up to Baht 580-620 for standardScotch whisky.Imported premium spirits. Imported premium spirits include all international spirits brandsincluding imported white spirits (such as vodka, tequila and gin) and imported brown spirits (such aspremium malt whisky, rum and brandy). In this segment, a highly fragmented, large number ofinternational brands are widely available, particularly in hotels, restaurants and bars. Importedpremium spirits are a relatively niche market in Thailand as they are significantly more expensivethan locally distilled spirits and are therefore not affordable for the majority of Thai consumers. Themarket share by sales volume of imported premium spirits was approximately 0.7% of the spiritsPart 2 Page 66