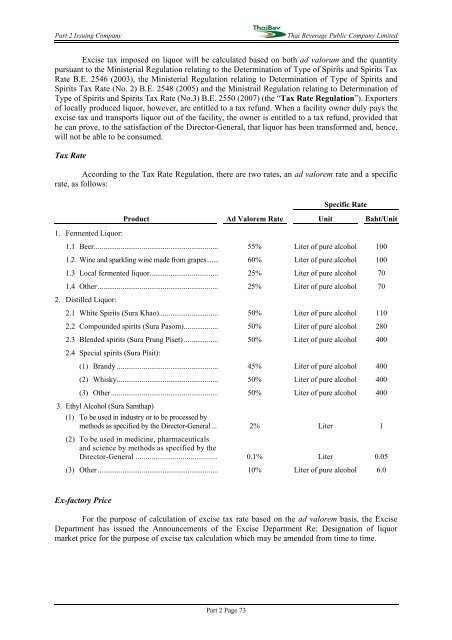

Part 2 Issuing CompanyThai Beverage Public Company LimitedExcise tax imposed on liquor will be calculated based on both ad valorum and the quantitypursuant to the Ministerial Regulation relating to the Determination of Type of Spirits and Spirits TaxRate B.E. 2546 (2003), the Ministerial Regulation relating to Determination of Type of Spirits andSpirits Tax Rate (No. 2) B.E. 2548 (2005) and the Ministrail Regulation relating to Determination ofType of Spirits and Spirits Tax Rate (No.3) B.E. 2550 (2007) (the “Tax Rate Regulation”). Exportersof locally produced liquor, however, are entitled to a tax refund. When a facility owner duly pays theexcise tax and transports liquor out of the facility, the owner is entitled to a tax refund, provided thathe can prove, to the satisfaction of the Director-General, that liquor has been transformed and, hence,will not be able to be consumed.Tax RateAccording to the Tax Rate Regulation, there are two rates, an ad valorem rate and a specificrate, as follows:Specific RateProduct Ad Valorem Rate Unit Baht/Unit1. Fermented Liquor:1.1 Beer................................................................. 55% Liter of pure alcohol 1001.2 Wine and sparkling wine made from grapes....... 60% Liter of pure alcohol 1001.3 Local fermented liquor.................................... 25% Liter of pure alcohol 701.4 Other ............................................................... 25% Liter of pure alcohol 702. Distilled Liquor:2.1 White Spirits (Sura Khao)............................... 50% Liter of pure alcohol 1102.2 Compounded spirits (Sura Pasom).................. 50% Liter of pure alcohol 2802.3 Blended spirits (Sura Prung Piset) .................. 50% Liter of pure alcohol 4002.4 Special spirits (Sura Pisit):(1) Brandy ..................................................... 45% Liter of pure alcohol 400(2) Whisky..................................................... 50% Liter of pure alcohol 400(3) Other........................................................ 50% Liter of pure alcohol 4003. Ethyl Alcohol (Sura Samthap)(1) To be used in industry or to be processed bymethods as specified by the Director-General ... 2% Liter 1(2) To be used in medicine, pharmaceuticalsand science by methods as specified by theDirector-General ........................................ 0.1% Liter 0.05(3) Other ............................................................... 10% Liter of pure alcohol 6.0Ex-factory PriceFor the purpose of calculation of excise tax rate based on the ad valorem basis, the ExciseDepartment has issued the Announcements of the Excise Department Re: Designation of liquormarket price for the purpose of excise tax calculation which may be amended from time to time.Part 2 Page 73

Part 2 Issuing CompanyThai Beverage Public Company LimitedImport duties and import restrictionsThe Customs Department collects import duties on various types of liquor based on either aspecific or an ad valorem rate, whichever yields greater tax revenue to the Government, as follows:ProductAd Valorem Rate(% of CIF Value)Specific Rate(Baht per liter)Sake.......................................... 60.00 10.00Brandy...................................... 60.00 120.00Whisky ..................................... 60.00 120.00Rum.......................................... 60.00 120.00Gin............................................ 60.00 120.00Liquor....................................... 60.00 120.00Chinese spirits.......................... 60.00 120.00Other spirits.............................. 60.00 120.00However, the import duty on liquor from members of the World Trade Organization iscurrently either Baht 63.05 per liter or 58.2% of the CIF value, whichever yields greater tax revenueto the Government.There are no quantitative restrictions on spirits imports.3.3.2 Regulation by Other LawsAlcoholic Control ActPursuant to the Alcoholic Control Act, it is prohibited to sell alcoholic beverages in variousplaces such as temples or places for holding religious rites, state’s public health service places,government public parks provided for recreational purposes of the general public and oil fuel servicestations. Additionally, no one shall sell alcoholic beverages to a person who is under twenty years oldor a person who is intoxicated to an extent that he/she cannot control himself/herself. The act alsoprohibits selling alcoholic beverages by various methods, such as automatic vending machine,rendering, price reduction for the purpose of sale promotion, handing out, giving as free gift, givingaway or exchanging with alcoholic beverages or with other goods or services as the case may be.In addition, the act prohibits advertising an alcoholic beverage or showing the name or themark of the alcoholic beverage which boasts of its efficacy or induces others to drink such alcoholicbeverage, either directly or indirectly. Pursuant to the act, an advertisement or a public relations by themanufacturer of all categories of alcoholic beverages may be made specifically in a description ofgiving information and social creative knowledge, whereby there shall not be shown any picture ofthe goods or the container of said alcoholic beverage, except it is a picture of the symbol of thealcoholic beverage or a symbol of the manufacturing company of such alcoholic beverage only.However, the provisions shall not be applied to an advertisement that originates outside the Kingdom.Licensing and Requirements under Factory LawUnder the Factory Act B.E. 2535 (1992), as amended (the “Factory Act”), a license must beobtained from the Ministry of Industry, prior to operation of a brewery, distillery or productionfacility for drinking water having machinery capacity of more than 50 horse power. The operator mustcomply with the requirements of the Factory Act, including (i) the location, environment, buildingstructure and interior of the factory, (ii) characteristic or type of machinery and equipment used in thefactory, (iii) rules relating to employees, (iv) pollution control, including wastewater treatment andnoise control and (v) safety arrangements. The factory license is generally valid for five years fromthe initial operation. The operator is required to apply for a license renewal within 60 days prior to theexpiry of the license. The factory license will then be extended for another five years, provided thatPart 2 Page 74