Using an Agency Credit Card for Payments - TRAMS, Inc.

Using an Agency Credit Card for Payments - TRAMS, Inc.

Using an Agency Credit Card for Payments - TRAMS, Inc.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

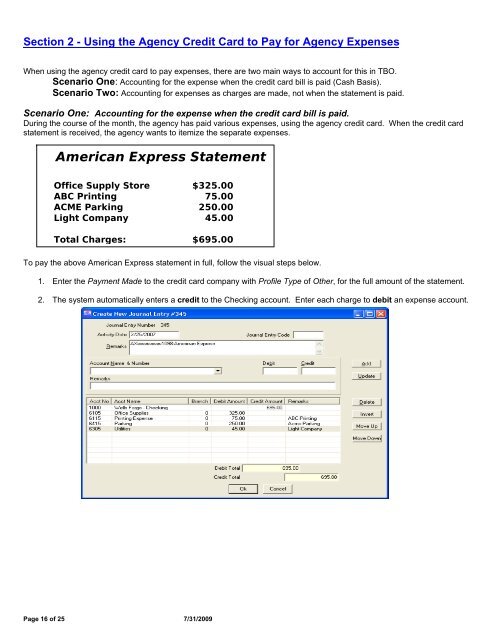

Section 2 - <strong>Using</strong> the <strong>Agency</strong> <strong>Credit</strong> <strong>Card</strong> to Pay <strong>for</strong> <strong>Agency</strong> ExpensesWhen using the agency credit card to pay expenses, there are two main ways to account <strong>for</strong> this in TBO.Scenario One: Accounting <strong>for</strong> the expense when the credit card bill is paid (Cash Basis).Scenario Two: Accounting <strong>for</strong> expenses as charges are made, not when the statement is paid.Scenario One: Accounting <strong>for</strong> the expense when the credit card bill is paid.During the course of the month, the agency has paid various expenses, using the agency credit card. When the credit cardstatement is received, the agency w<strong>an</strong>ts to itemize the separate expenses.Americ<strong>an</strong> Express StatementOffice Supply Store $325.00ABC Printing 75.00ACME Parking 250.00Light Comp<strong>an</strong>y 45.00Total Charges: $695.00To pay the above Americ<strong>an</strong> Express statement in full, follow the visual steps below.1. Enter the Payment Made to the credit card comp<strong>an</strong>y with Profile Type of Other, <strong>for</strong> the full amount of the statement.2. The system automatically enters a credit to the Checking account. Enter each charge to debit <strong>an</strong> expense account.Page 16 of 25 7/31/2009