Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

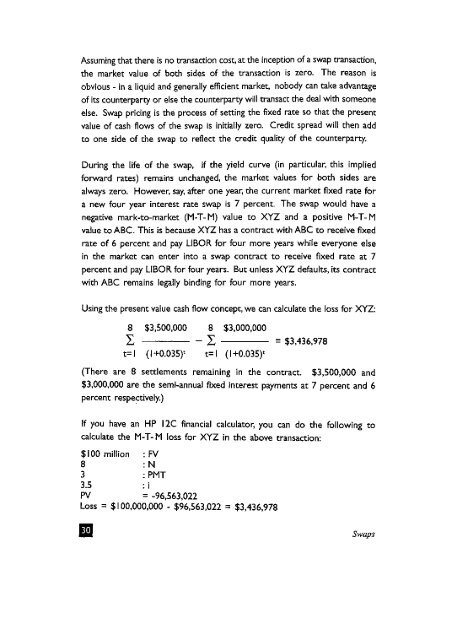

Assum<strong>in</strong>g that there is no transaction cost, at the <strong>in</strong>ception of a swap transaction,the market value of both sides of the transaction is zero. The reason isobvious - <strong>in</strong> a liquid and generally efficient market, nobody can take advantageof its counterparty or else the counterparty will transact the deal <strong>with</strong> someoneelse. Swap pric<strong>in</strong>g is the process of sett<strong>in</strong>g the fixed rate so that the presentvalue of cash flows of the swap is <strong>in</strong>itially zero. Credit spread will then addto one side of the swap to reflect the credit quality of the counterparty.Dur<strong>in</strong>g the life of the swap, if the yield curve (<strong>in</strong> particular, this impliedforward rates) rema<strong>in</strong>s unchanged, the market values for both sides arealways zero. However, say, after one year, the current market fixed rate fora new four year <strong>in</strong>terest rate swap is 7 percent. The swap would have anegative mark-to-market (M-T-M) value to XYZ and a positive M-T-Mvalue to ABC. This is because XYZ has a contract <strong>with</strong> ABC to receive fixedrate of 6 percent and pay LIBOR for four more years while everyone else<strong>in</strong> the market can enter <strong>in</strong>to a swap contract to receive fixed rate at 7percent and pay LIBOR for four years. But unless XYZ defaults, its contract<strong>with</strong> ABC rema<strong>in</strong>s legally b<strong>in</strong>d<strong>in</strong>g for four more years.Us<strong>in</strong>g the present value cash flow concept, we can calculate the loss for XYZ:8 $3,500,000 8 $3,000,000Z £ = $3,436,978t=l (1+0.035)' t=l (1+0.035)*(There are 8 settlements rema<strong>in</strong><strong>in</strong>g <strong>in</strong> the contract. $3,500,000 and$3,000,000 are the semi-annual fixed <strong>in</strong>terest payments at 7 percent and 6percent respectively.)If you have an HP I2C f<strong>in</strong>ancial calculator, you can do the follow<strong>in</strong>g tocalculate the M-T- M loss for XYZ <strong>in</strong> the above transaction:$100 million : FV8 :N3 :PMT3.5 : iPV = -96,563,022Loss = $100,000,000 - $96,563,022 = $3,436,978Swaps