Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

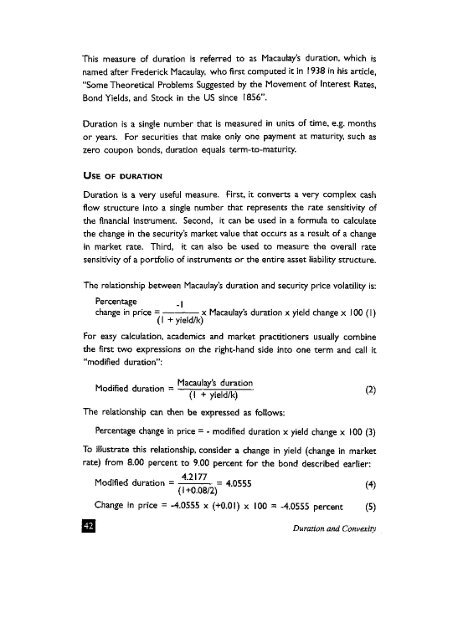

This measure of duration is referred to as Macaulay's duration, which isnamed after <strong>Frederic</strong>k Macaulay, who first computed it <strong>in</strong> 1 938 <strong>in</strong> his article,"Some Theoretical Problems Suggested <strong>by</strong> the Movement of Interest Rates,Bond Yields, and Stock <strong>in</strong> the US s<strong>in</strong>ce 1856".Duration is a s<strong>in</strong>gle number that is measured <strong>in</strong> units of time, e.g. monthsor years. For securities that make only one payment at maturity, such aszero coupon bonds, duration equals term-to-maturity.USE OF DURATIONDuration is a very useful measure. First, it converts a very complex cashflow structure <strong>in</strong>to a s<strong>in</strong>gle number that represents the rate sensitivity ofthe f<strong>in</strong>ancial <strong>in</strong>strument. Second, it can be used <strong>in</strong> a formula to calculatethe change <strong>in</strong> the security's market value that occurs as a result of a change<strong>in</strong> market rate. Third, it can also be used to measure the overall ratesensitivity of a portfolio of <strong>in</strong>struments or the entire asset liability structure.The relationship between Macaulay's duration and security price volatility is:Percentage _ |change <strong>in</strong> price = - x Macaulay's duration x yield change x 100 (I)(I + yield/k)For easy calculation, academics and market practitioners usually comb<strong>in</strong>ethe first two expressions on the right-hand side <strong>in</strong>to one term and call it"modified duration":M ,.* , , . Macaulay's duration , xModified duration = — / . - (2)(I + yield/k)v 'The relationship can then be expressed as follows:Percentage change <strong>in</strong> price = - modified duration x yield change x 100 (3)To illustrate this relationship, consider a change <strong>in</strong> yield (change <strong>in</strong> marketrate) from 8.00 percent to 9.00 percent for the bond described earlier:Modified duration = -~~~ 4.0555 (4)Change <strong>in</strong> price = -4.0555 x (+0.01) x 100 = -4.0555 percent (5)Duration and Convexity