Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

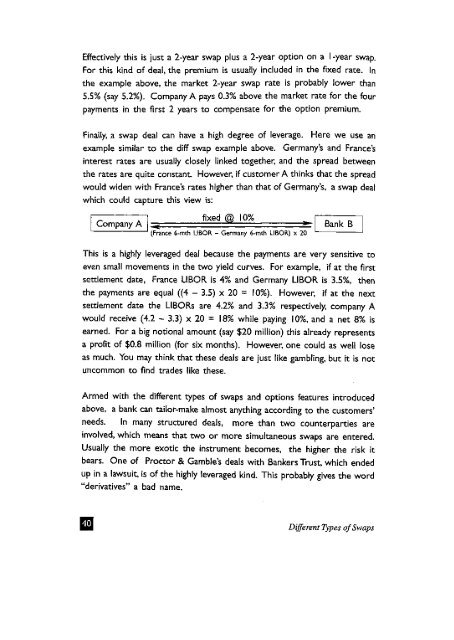

Effectively this is just a 2-year swap plus a 2-year option on a I -year swap.For this k<strong>in</strong>d of deal, the premium is usually <strong>in</strong>cluded <strong>in</strong> the fixed rate. Inthe example above, the market 2-year swap rate is probably lower than5.5% (say 5.2%). Company A pays 0.3% above the market rate for the fourpayments <strong>in</strong> the first 2 years to compensate for the option premium.F<strong>in</strong>ally, a swap deal can have a high degree of leverage. Here we use anexample similar to the diff swap example above. Germany's and France's<strong>in</strong>terest rates are usually closely l<strong>in</strong>ked together, and the spread betweenthe rates are quite constant. However, if customer A th<strong>in</strong>ks that the spreadwould widen <strong>with</strong> France's rates higher than that of Germany's, a swap dealwhich could capture this view is:fixed @ 10%(France 6-mth LIBOR - Germany 6-mth LIBOR) x 20This is a highly leveraged deal because the payments are very sensitive toeven small movements <strong>in</strong> the two yield curves. For example, if at the firstsettlement date, France LIBOR is 4% and Germany LIBOR is 3.5%, thenthe payments are equal ((4 - 3.5) x 20 = 10%). However, if at the nextsettlement date the LIBORs are 4.2% and 3.3% respectively, company Awould receive (4.2 - 3.3) x 20 = 18% while pay<strong>in</strong>g 10%, and a net 8% isearned. For a big notional amount (say $20 million) this already representsa profit of $0.8 million (for six months). However, one could as well loseas much. You may th<strong>in</strong>k that these deals are just like gambl<strong>in</strong>g, but it is notuncommon to f<strong>in</strong>d trades like these.Armed <strong>with</strong> the different types of swaps and options features <strong>in</strong>troducedabove, a bank can tailor-make almost anyth<strong>in</strong>g accord<strong>in</strong>g to the customers'needs. In many structured deals, more than two counterparties are<strong>in</strong>volved, which means that two or more simultaneous swaps are entered.Usually the more exotic the <strong>in</strong>strument becomes, the higher the risk itbears. One of Proctor & Gamble's deals <strong>with</strong> Bankers Trust, which endedup <strong>in</strong> a lawsuit, is of the highly leveraged k<strong>in</strong>d. This probably gives the word"derivatives" a bad name.Different Types of Swaps