Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

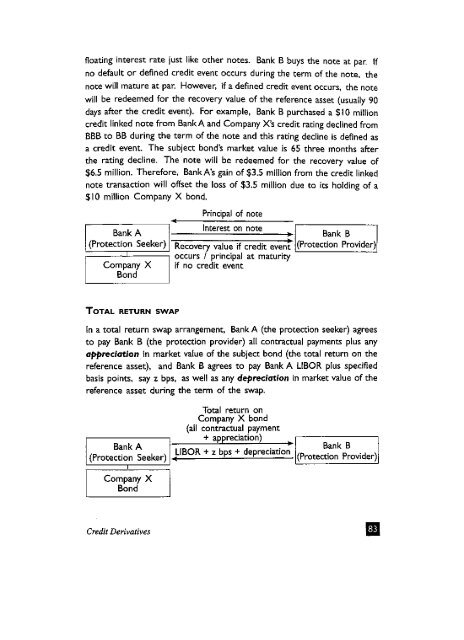

float<strong>in</strong>g <strong>in</strong>terest rate just like other notes. Bank B buys the note at par. Ifno default or def<strong>in</strong>ed credit event occurs dur<strong>in</strong>g the term of the note, thenote will mature at par. However, if a def<strong>in</strong>ed credit event occurs, the notewill be redeemed for the recovery value of the reference asset (usually 90days after the credit event). For example, Bank B purchased a $10 millioncredit l<strong>in</strong>ked note from Bank A and Company X's credit rat<strong>in</strong>g decl<strong>in</strong>ed fromBBB to BB dur<strong>in</strong>g the term of the note and this rat<strong>in</strong>g decl<strong>in</strong>e is def<strong>in</strong>ed asa credit event. The subject bond's market value is 65 three months afterthe rat<strong>in</strong>g decl<strong>in</strong>e. The note will be redeemed for the recovery value of$6.5 million. Therefore, Bank A's ga<strong>in</strong> of $3.5 million from the credit l<strong>in</strong>kednote transaction will offset the loss of $3.5 million due to its hold<strong>in</strong>g of a$10 million Company X bond.Bank A(Protection Seeker)iCompany XBondPr<strong>in</strong>cipal of noteInterest on noteRecovery value if credit eventoccurs / pr<strong>in</strong>cipal at maturityif no credit eventBank B(Protection Provider)TOTAL RETURN SWAPIn a total return swap arrangement, Bank A (the protection seeker) agreesto pay Bank B (the protection provider) all contractual payments plus anyappreciation <strong>in</strong> market value of the subject bond (the total return on thereference asset), and Bank B agrees to pay Bank A LIBOR plus specifiedbasis po<strong>in</strong>ts, say z bps, as well as any depreciation <strong>in</strong> market value of thereference asset dur<strong>in</strong>g the term of the swap.Bank A(Protection Seeker)Company XBondTotal return onCompany X bond(all contractual payment+ appreciation)LIBOR + z bps + depreciationBank B(Protection Provider)Credit <strong>Derivatives</strong>