Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

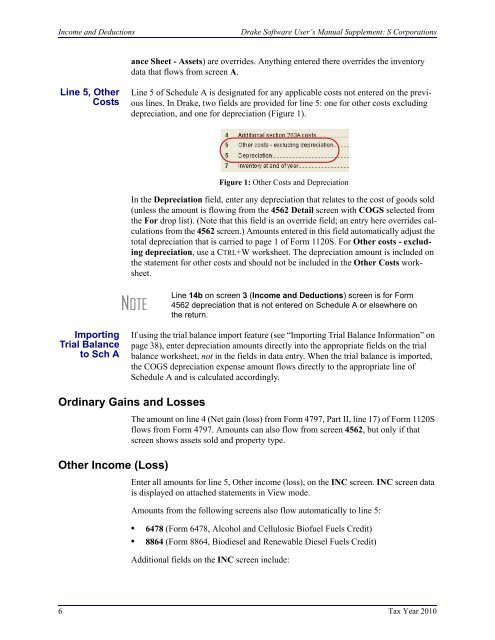

Income and Deductions<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S <strong>Corporations</strong>ance Sheet - Assets) are overrides. Anything entered there overrides the inventorydata that flows from screen A.Line 5, OtherCostsLine 5 of Schedule A is designated for any applicable costs not entered on the previouslines. In <strong>Drake</strong>, two fields are provided for line 5: one for other costs excludingdepreciation, and one for depreciation (Figure 1).Figure 1: Other Costs and DepreciationIn the Depreciation field, enter any depreciation that relates to the cost of goods sold(unless the amount is flowing from the 4562 Detail screen with COGS selected fromthe For drop list). (Note that this field is an override field; an entry here overrides calculationsfrom the 4562 screen.) Amounts entered in this field automatically adjust thetotal depreciation that is carried to page 1 of Form <strong>1120S</strong>. For Other costs - excludingdepreciation, use a CTRL+W worksheet. The depreciation amount is included onthe statement for other costs and should not be included in the Other Costs worksheet.NOTELine 14b on screen 3 (Income and Deductions) screen is for Form4562 depreciation that is not entered on Schedule A or elsewhere onthe return.ImportingTrial Balanceto Sch AIf using the trial balance import feature (see “Importing Trial Balance Information” onpage 38), enter depreciation amounts directly into the appropriate fields on the trialbalance worksheet, not in the fields in data entry. When the trial balance is imported,the COGS depreciation expense amount flows directly to the appropriate line ofSchedule A and is calculated accordingly.Ordinary Gains and LossesOther Income (Loss)The amount on line 4 (Net gain (loss) from Form 4797, Part II, line 17) of Form <strong>1120S</strong>flows from Form 4797. Amounts can also flow from screen 4562, but only if thatscreen shows assets sold and property type.Enter all amounts for line 5, Other income (loss), on the INC screen. INC screen datais displayed on attached statements in View mode.Amounts from the following screens also flow automatically to line 5:• 6478 (Form 6478, Alcohol and Cellulosic Biofuel Fuels Credit)• 8864 (Form 8864, Biodiesel and Renewable Diesel Fuels Credit)Additional fields on the INC screen include:6 Tax Year 2010