Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

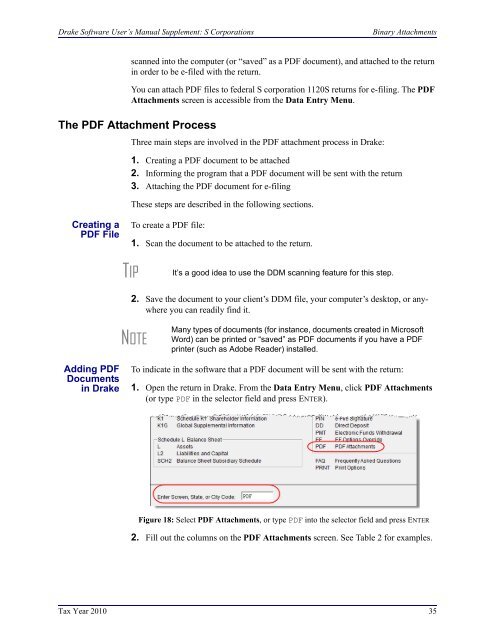

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S <strong>Corporations</strong>Binary Attachmentsscanned into the computer (or “saved” as a PDF document), and attached to the returnin order to be e-filed with the return.You can attach PDF files to federal S corporation <strong>1120S</strong> returns for e-filing. The PDFAttachments screen is accessible from the Data Entry Menu.The PDF Attachment ProcessThree main steps are involved in the PDF attachment process in <strong>Drake</strong>:1. Creating a PDF document to be attached2. Informing the program that a PDF document will be sent with the return3. Attaching the PDF document for e-filingThese steps are described in the following sections.Creating aPDF FileTo create a PDF file:1. Scan the document to be attached to the return.TIPIt’s a good idea to use the DDM scanning feature for this step.2. Save the document to your client’s DDM file, your computer’s desktop, or anywhereyou can readily find it.NOTEMany types of documents (for instance, documents created in MicrosoftWord) can be printed or “saved” as PDF documents if you have a PDFprinter (such as Adobe Reader) installed.Adding PDFDocumentsin <strong>Drake</strong>To indicate in the software that a PDF document will be sent with the return:1. Open the return in <strong>Drake</strong>. From the Data Entry Menu, click PDF Attachments(or type PDF in the selector field and press ENTER).Figure 18: Select PDF Attachments, or type PDF into the selector field and press ENTER2. Fill out the columns on the PDF Attachments screen. See Table 2 for examples.Tax Year 2010 35