Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

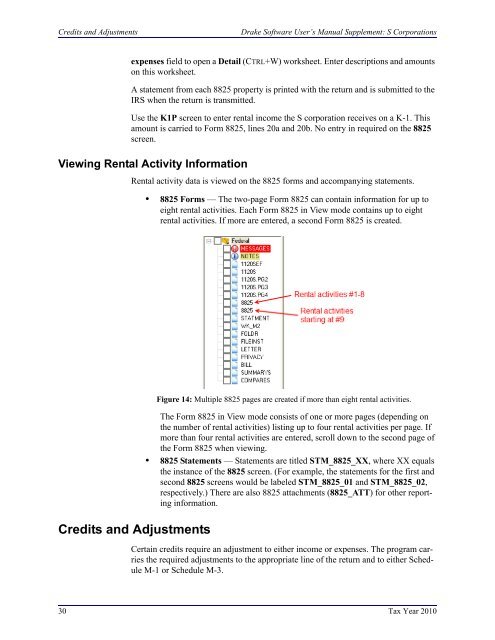

Credits and Adjustments<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S <strong>Corporations</strong>expenses field to open a Detail (CTRL+W) worksheet. Enter descriptions and amountson this worksheet.A statement from each 8825 property is printed with the return and is submitted to theIRS when the return is transmitted.Use the K1P screen to enter rental income the S corporation receives on a K-1. Thisamount is carried to Form 8825, lines 20a and 20b. No entry in required on the 8825screen.Viewing Rental Activity InformationRental activity data is viewed on the 8825 forms and accompanying statements.• 8825 Forms — The two-page Form 8825 can contain information for up toeight rental activities. Each Form 8825 in View mode contains up to eightrental activities. If more are entered, a second Form 8825 is created.Credits and AdjustmentsFigure 14: Multiple 8825 pages are created if more than eight rental activities.The Form 8825 in View mode consists of one or more pages (depending onthe number of rental activities) listing up to four rental activities per page. Ifmore than four rental activities are entered, scroll down to the second page ofthe Form 8825 when viewing.• 8825 Statements — Statements are titled STM_8825_XX, where XX equalsthe instance of the 8825 screen. (For example, the statements for the first andsecond 8825 screens would be labeled STM_8825_01 and STM_8825_02,respectively.) There are also 8825 attachments (8825_ATT) for other reportinginformation.Certain credits require an adjustment to either income or expenses. The program carriesthe required adjustments to the appropriate line of the return and to either ScheduleM-1 or Schedule M-3.30 Tax Year 2010