Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

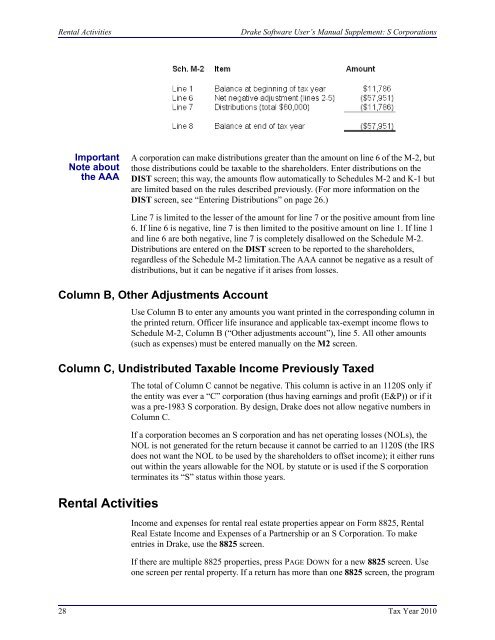

Rental Activities<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S <strong>Corporations</strong>ImportantNote aboutthe AAAA corporation can make distributions greater than the amount on line 6 of the M-2, butthose distributions could be taxable to the shareholders. Enter distributions on theDIST screen; this way, the amounts flow automatically to Schedules M-2 and K-1 butare limited based on the rules described previously. (For more information on theDIST screen, see “Entering Distributions” on page 26.)Line 7 is limited to the lesser of the amount for line 7 or the positive amount from line6. If line 6 is negative, line 7 is then limited to the positive amount on line 1. If line 1and line 6 are both negative, line 7 is completely disallowed on the Schedule M-2.Distributions are entered on the DIST screen to be reported to the shareholders,regardless of the Schedule M-2 limitation.The AAA cannot be negative as a result ofdistributions, but it can be negative if it arises from losses.Column B, Other Adjustments AccountUse Column B to enter any amounts you want printed in the corresponding column inthe printed return. Officer life insurance and applicable tax-exempt income flows toSchedule M-2, Column B (“Other adjustments account”), line 5. All other amounts(such as expenses) must be entered manually on the M2 screen.Column C, Undistributed Taxable Income Previously TaxedRental ActivitiesThe total of Column C cannot be negative. This column is active in an <strong>1120S</strong> only ifthe entity was ever a “C” corporation (thus having earnings and profit (E&P)) or if itwas a pre-1983 S corporation. By design, <strong>Drake</strong> does not allow negative numbers inColumn C.If a corporation becomes an S corporation and has net operating losses (NOLs), theNOL is not generated for the return because it cannot be carried to an <strong>1120S</strong> (the IRSdoes not want the NOL to be used by the shareholders to offset income); it either runsout within the years allowable for the NOL by statute or is used if the S corporationterminates its “S” status within those years.Income and expenses for rental real estate properties appear on Form 8825, RentalReal Estate Income and Expenses of a Partnership or an S Corporation. To makeentries in <strong>Drake</strong>, use the 8825 screen.If there are multiple 8825 properties, press PAGE DOWN for a new 8825 screen. Useone screen per rental property. If a return has more than one 8825 screen, the program28 Tax Year 2010