Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

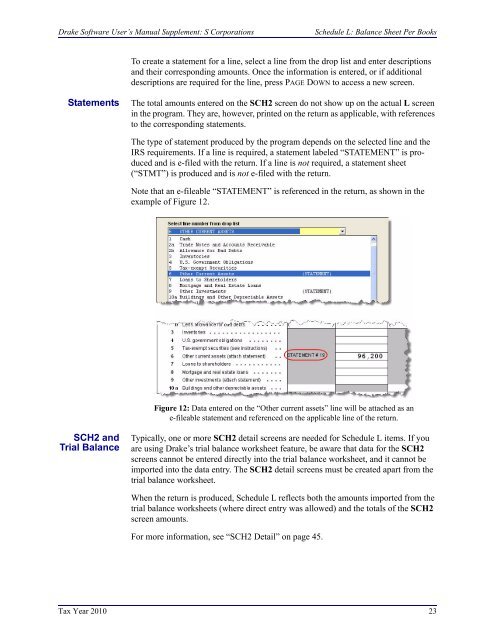

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S <strong>Corporations</strong>Schedule L: Balance Sheet Per BooksTo create a statement for a line, select a line from the drop list and enter descriptionsand their corresponding amounts. Once the information is entered, or if additionaldescriptions are required for the line, press PAGE DOWN to access a new screen.StatementsThe total amounts entered on the SCH2 screen do not show up on the actual L screenin the program. They are, however, printed on the return as applicable, with referencesto the corresponding statements.The type of statement produced by the program depends on the selected line and theIRS requirements. If a line is required, a statement labeled “STATEMENT” is producedand is e-filed with the return. If a line is not required, a statement sheet(“STMT”) is produced and is not e-filed with the return.Note that an e-fileable “STATEMENT” is referenced in the return, as shown in theexample of Figure 12.Figure 12: Data entered on the “Other current assets” line will be attached as ane-fileable statement and referenced on the applicable line of the return.SCH2 andTrial BalanceTypically, one or more SCH2 detail screens are needed for Schedule L items. If youare using <strong>Drake</strong>’s trial balance worksheet feature, be aware that data for the SCH2screens cannot be entered directly into the trial balance worksheet, and it cannot beimported into the data entry. The SCH2 detail screens must be created apart from thetrial balance worksheet.When the return is produced, Schedule L reflects both the amounts imported from thetrial balance worksheets (where direct entry was allowed) and the totals of the SCH2screen amounts.For more information, see “SCH2 Detail” on page 45.Tax Year 2010 23