Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

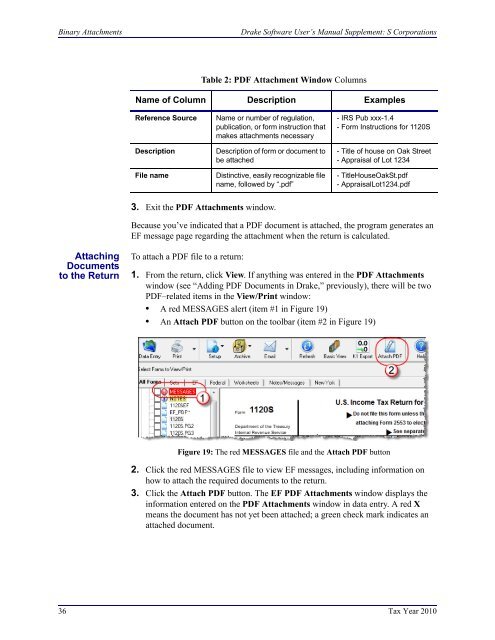

Binary Attachments<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S <strong>Corporations</strong>Table 2: PDF Attachment Window ColumnsName of Column Description ExamplesReference SourceDescriptionFile nameName or number of regulation,publication, or form instruction thatmakes attachments necessaryDescription of form or document tobe attachedDistinctive, easily recognizable filename, followed by “.pdf”- IRS Pub xxx-1.4- Form Instructions for <strong>1120S</strong>- Title of house on Oak Street- Appraisal of Lot 1234- TitleHouseOakSt.pdf- AppraisalLot1234.pdf3. Exit the PDF Attachments window.Because you’ve indicated that a PDF document is attached, the program generates anEF message page regarding the attachment when the return is calculated.AttachingDocumentsto the ReturnTo attach a PDF file to a return:1. From the return, click View. If anything was entered in the PDF Attachmentswindow (see “Adding PDF Documents in <strong>Drake</strong>,” previously), there will be twoPDF–related items in the View/Print window:• A red MESSAGES alert (item #1 in Figure 19)• An Attach PDF button on the toolbar (item #2 in Figure 19)Figure 19: The red MESSAGES file and the Attach PDF button2. Click the red MESSAGES file to view EF messages, including information onhow to attach the required documents to the return.3. Click the Attach PDF button. The EF PDF Attachments window displays theinformation entered on the PDF Attachments window in data entry. A red Xmeans the document has not yet been attached; a green check mark indicates anattached document.36 Tax Year 2010