Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Drake Software User's Manual Supplement: S Corporations (1120S)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

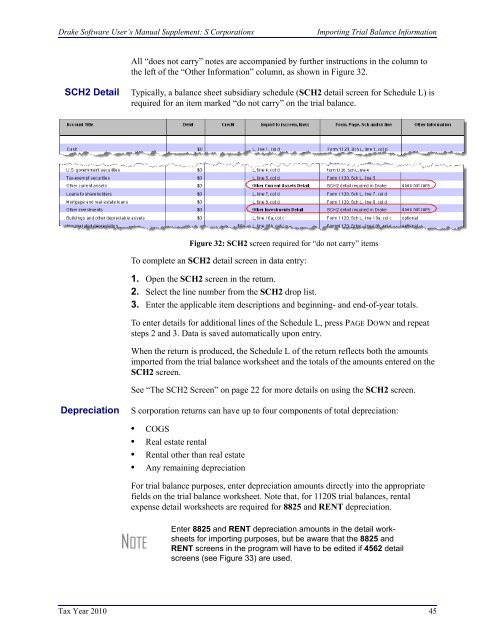

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S <strong>Corporations</strong>Importing Trial Balance InformationAll “does not carry” notes are accompanied by further instructions in the column tothe left of the “Other Information” column, as shown in Figure 32.SCH2 DetailTypically, a balance sheet subsidiary schedule (SCH2 detail screen for Schedule L) isrequired for an item marked “do not carry” on the trial balance.Figure 32: SCH2 screen required for “do not carry” itemsTo complete an SCH2 detail screen in data entry:1. Open the SCH2 screen in the return.2. Select the line number from the SCH2 drop list.3. Enter the applicable item descriptions and beginning- and end-of-year totals.To enter details for additional lines of the Schedule L, press PAGE DOWN and repeatsteps 2 and 3. Data is saved automatically upon entry.When the return is produced, the Schedule L of the return reflects both the amountsimported from the trial balance worksheet and the totals of the amounts entered on theSCH2 screen.See “The SCH2 Screen” on page 22 for more details on using the SCH2 screen.DepreciationS corporation returns can have up to four components of total depreciation:• COGS• Real estate rental• Rental other than real estate• Any remaining depreciationFor trial balance purposes, enter depreciation amounts directly into the appropriatefields on the trial balance worksheet. Note that, for <strong>1120S</strong> trial balances, rentalexpense detail worksheets are required for 8825 and RENT depreciation.NOTEEnter 8825 and RENT depreciation amounts in the detail worksheetsfor importing purposes, but be aware that the 8825 andRENT screens in the program will have to be edited if 4562 detailscreens (see Figure 33) are used.Tax Year 2010 45