PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

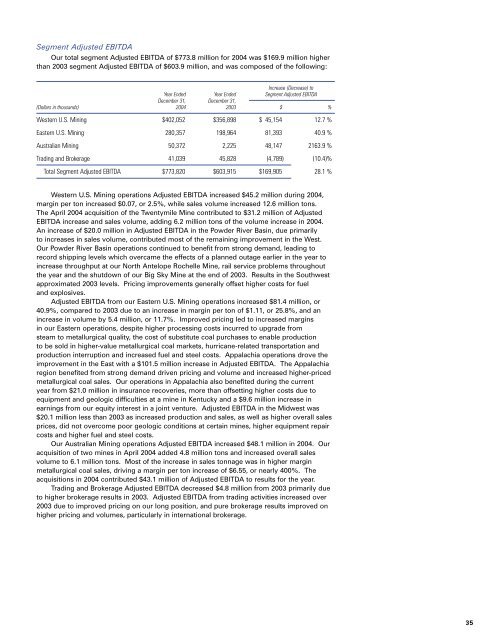

Segment Adjusted EBITDAOur total segment Adjusted EBITDA of $773.8 million for 2004 was $169.9 million higherthan 2003 segment Adjusted EBITDA of $603.9 million, and was composed of the following:Increase (Decrease) toYear Ended Year Ended Segment Adjusted EBITDADecember <strong>31</strong>, December <strong>31</strong>,(Dollars in thousands) 2004 2003 $ %Western U.S. Mining $402,052 $356,898 $ 45,154 12.7 %Eastern U.S. Mining 280,357 198,964 81,393 40.9 %Australian Mining 50,372 2,225 48,147 2163.9 %Trading and Brokerage 41,039 45,828 (4,789) (10.4)%Total Segment Adjusted EBITDA $773,820 $603,915 $169,905 28.1 %Western U.S. Mining operations Adjusted EBITDA increased $45.2 million during 2004,margin per ton increased $0.07, or 2.5%, while sales volume increased 12.6 million tons.The April 2004 acquisition of the Twentymile Mine contributed to $<strong>31</strong>.2 million of AdjustedEBITDA increase and sales volume, adding 6.2 million tons of the volume increase in 2004.An increase of $20.0 million in Adjusted EBITDA in the Powder River Basin, due primarilyto increases in sales volume, contributed most of the remaining improvement in the West.Our Powder River Basin operations continued to benefit from strong demand, leading torecord shipping levels which overcame the effects of a planned outage earlier in the year toincrease throughput at our North Antelope Rochelle Mine, rail service problems throughoutthe year and the shutdown of our Big Sky Mine at the end of 2003. Results in the Southwestapproximated 2003 levels. Pricing improvements generally offset higher costs for fueland explosives.Adjusted EBITDA from our Eastern U.S. Mining operations increased $81.4 million, or40.9%, compared to 2003 due to an increase in margin per ton of $1.11, or 25.8%, and anincrease in volume by 5.4 million, or 11.7%. Improved pricing led to increased marginsin our Eastern operations, despite higher processing costs incurred to upgrade fromsteam to metallurgical quality, the cost of substitute coal purchases to enable productionto be sold in higher-value metallurgical coal markets, hurricane-related transportation andproduction interruption and increased fuel and steel costs. Appalachia operations drove theimprovement in the East with a $101.5 million increase in Adjusted EBITDA. The Appalachiaregion benefited from strong demand driven pricing and volume and increased higher-pricedmetallurgical coal sales. Our operations in Appalachia also benefited during the currentyear from $21.0 million in insurance recoveries, more than offsetting higher costs due toequipment and geologic difficulties at a mine in Kentucky and a $9.6 million increase inearnings from our equity interest in a joint venture. Adjusted EBITDA in the Midwest was$20.1 million less than 2003 as increased production and sales, as well as higher overall salesprices, did not overcome poor geologic conditions at certain mines, higher equipment repaircosts and higher fuel and steel costs.Our Australian Mining operations Adjusted EBITDA increased $48.1 million in 2004. Ouracquisition of two mines in April 2004 added 4.8 million tons and increased overall salesvolume to 6.1 million tons. Most of the increase in sales tonnage was in higher marginmetallurgical coal sales, driving a margin per ton increase of $6.55, or nearly 400%. Theacquisitions in 2004 contributed $43.1 million of Adjusted EBITDA to results for the year.Trading and Brokerage Adjusted EBITDA decreased $4.8 million from 2003 primarily dueto higher brokerage results in 2003. Adjusted EBITDA from trading activities increased over2003 due to improved pricing on our long position, and pure brokerage results improved onhigher pricing and volumes, particularly in international brokerage.35