PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

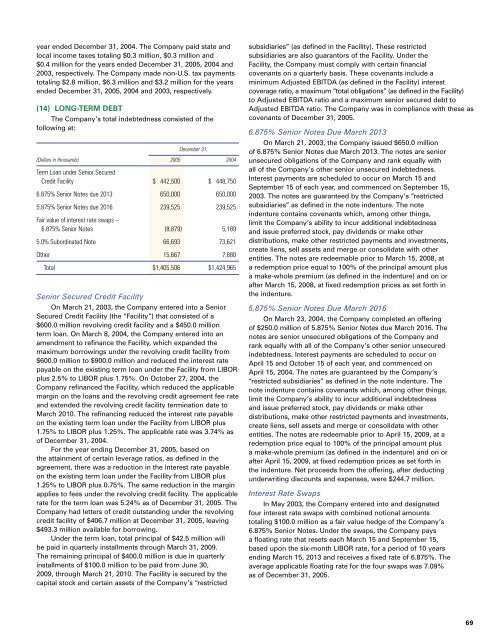

year ended December <strong>31</strong>, 2004. The Company paid state andlocal income taxes totaling $0.3 million, $0.3 million and$0.4 million for the years ended December <strong>31</strong>, <strong>2005</strong>, 2004 and2003, respectively. The Company made non-U.S. tax paymentstotaling $2.8 million, $6.3 million and $3.2 million for the yearsended December <strong>31</strong>, <strong>2005</strong>, 2004 and 2003, respectively.(14) LONG-TERM DEBTThe Company’s total indebtedness consisted of thefollowing at:December <strong>31</strong>,(Dollars in thousands) <strong>2005</strong> 2004Term Loan under Senior SecuredCredit Facility $ 442,500 $ 448,7506.875% Senior Notes due 2013 650,000 650,0005.875% Senior Notes due 2016 239,525 239,525Fair value of interest rate swaps –6.875% Senior Notes (8,879) 5,1895.0% Subordinated Note 66,693 73,621Other 15,667 7,880Total $1,405,506 $1,424,965Senior Secured Credit FacilityOn March 21, 2003, the Company entered into a SeniorSecured Credit Facility (the “Facility”) that consisted of a$600.0 million revolving credit facility and a $450.0 millionterm loan. On March 8, 2004, the Company entered into anamendment to refinance the Facility, which expanded themaximum borrowings under the revolving credit facility from$600.0 million to $900.0 million and reduced the interest ratepayable on the existing term loan under the Facility from LIBORplus 2.5% to LIBOR plus 1.75%. On October 27, 2004, theCompany refinanced the Facility, which reduced the applicablemargin on the loans and the revolving credit agreement fee rateand extended the revolving credit facility termination date toMarch 2010. The refinancing reduced the interest rate payableon the existing term loan under the Facility from LIBOR plus1.75% to LIBOR plus 1.25%. The applicable rate was 3.74% asof December <strong>31</strong>, 2004.For the year ending December <strong>31</strong>, <strong>2005</strong>, based onthe attainment of certain leverage ratios, as defined in theagreement, there was a reduction in the interest rate payableon the existing term loan under the Facility from LIBOR plus1.25% to LIBOR plus 0.75%. The same reduction in the marginapplies to fees under the revolving credit facility. The applicablerate for the term loan was 5.24% as of December <strong>31</strong>, <strong>2005</strong>. TheCompany had letters of credit outstanding under the revolvingcredit facility of $406.7 million at December <strong>31</strong>, <strong>2005</strong>, leaving$493.3 million available for borrowing.Under the term loan, total principal of $42.5 million willbe paid in quarterly installments through March <strong>31</strong>, 2009.The remaining principal of $400.0 million is due in quarterlyinstallments of $100.0 million to be paid from June 30,2009, through March 21, 2010. The Facility is secured by thecapital stock and certain assets of the Company’s “restrictedsubsidiaries” (as defined in the Facility). These restrictedsubsidiaries are also guarantors of the Facility. Under theFacility, the Company must comply with certain financialcovenants on a quarterly basis. These covenants include aminimum Adjusted EBITDA (as defined in the Facility) interestcoverage ratio, a maximum “total obligations” (as defined in the Facility)to Adjusted EBITDA ratio and a maximum senior secured debt toAdjusted EBITDA ratio. The Company was in compliance with these ascovenants of December <strong>31</strong>, <strong>2005</strong>.6.875% Senior Notes Due March 2013On March 21, 2003, the Company issued $650.0 millionof 6.875% Senior Notes due March 2013. The notes are seniorunsecured obligations of the Company and rank equally withall of the Company’s other senior unsecured indebtedness.Interest payments are scheduled to occur on March 15 andSeptember 15 of each year, and commenced on September 15,2003. The notes are guaranteed by the Company’s “restrictedsubsidiaries” as defined in the note indenture. The noteindenture contains covenants which, among other things,limit the Company’s ability to incur additional indebtednessand issue preferred stock, pay dividends or make otherdistributions, make other restricted payments and investments,create liens, sell assets and merge or consolidate with otherentities. The notes are redeemable prior to March 15, 2008, ata redemption price equal to 100% of the principal amount plusa make-whole premium (as defined in the indenture) and on orafter March 15, 2008, at fixed redemption prices as set forth inthe indenture.5.875% Senior Notes Due March 2016On March 23, 2004, the Company completed an offeringof $250.0 million of 5.875% Senior Notes due March 2016. Thenotes are senior unsecured obligations of the Company andrank equally with all of the Company’s other senior unsecuredindebtedness. Interest payments are scheduled to occur onApril 15 and October 15 of each year, and commenced onApril 15, 2004. The notes are guaranteed by the Company’s“restricted subsidiaries” as defined in the note indenture. Thenote indenture contains covenants which, among other things,limit the Company’s ability to incur additional indebtednessand issue preferred stock, pay dividends or make otherdistributions, make other restricted payments and investments,create liens, sell assets and merge or consolidate with otherentities. The notes are redeemable prior to April 15, 2009, at aredemption price equal to 100% of the principal amount plusa make-whole premium (as defined in the indenture) and on orafter April 15, 2009, at fixed redemption prices as set forth inthe indenture. Net proceeds from the offering, after deductingunderwriting discounts and expenses, were $244.7 million.Interest Rate SwapsIn May 2003, the Company entered into and designatedfour interest rate swaps with combined notional amountstotaling $100.0 million as a fair value hedge of the Company’s6.875% Senior Notes. Under the swaps, the Company paysa floating rate that resets each March 15 and September 15,based upon the six-month LIBOR rate, for a period of 10 yearsending March 15, 2013 and receives a fixed rate of 6.875%. Theaverage applicable floating rate for the four swaps was 7.09%as of December <strong>31</strong>, <strong>2005</strong>.69