PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

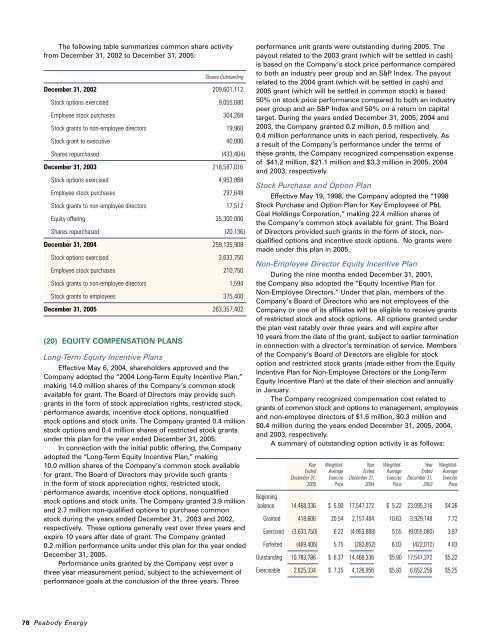

The following table summarizes common share activityfrom December <strong>31</strong>, 2002 to December <strong>31</strong>, <strong>2005</strong>:Shares OutstandingDecember <strong>31</strong>, 2002 209,601,112Stock options exercised 9,055,080Employee stock purchases 304,268Stock grants to non-employee directors 19,960Stock grant to executive 40,000Shares repurchased (433,404)December <strong>31</strong>, 2003 218,587,016Stock options exercised 4,953,868Employee stock purchases 297,648Stock grants to non-employee directors 17,512Equity offering 35,300,000Shares repurchased (20,136)December <strong>31</strong>, 2004 259,135,908Stock options exercised 3,633,750Employee stock purchases 210,750Stock grants to non-employee directors 1,594Stock grants to employees 375,400December <strong>31</strong>, <strong>2005</strong> 263,357,402(20) EQUITY COMPENSATION PLANSLong-Term Equity Incentive PlansEffective May 6, 2004, shareholders approved and theCompany adopted the “2004 Long-Term Equity Incentive Plan,”making 14.0 million shares of the Company’s common stockavailable for grant. The Board of Directors may provide suchgrants in the form of stock appreciation rights, restricted stock,performance awards, incentive stock options, nonqualifiedstock options and stock units. The Company granted 0.4 millionstock options and 0.4 million shares of restricted stock grantsunder this plan for the year ended December <strong>31</strong>, <strong>2005</strong>.In connection with the initial public offering, the Companyadopted the “Long-Term Equity Incentive Plan,” making10.0 million shares of the Company’s common stock availablefor grant. The Board of Directors may provide such grantsin the form of stock appreciation rights, restricted stock,performance awards, incentive stock options, nonqualifiedstock options and stock units. The Company granted 3.9 millionand 2.7 million non-qualified options to purchase commonstock during the years ended December <strong>31</strong>, 2003 and 2002,respectively. These options generally vest over three years andexpire 10 years after date of grant. The Company granted0.2 million performance units under this plan for the year endedDecember <strong>31</strong>, <strong>2005</strong>.Performance units granted by the Company vest over athree year measurement period, subject to the achievement ofperformance goals at the conclusion of the three years. Threeperformance unit grants were outstanding during <strong>2005</strong>. Thepayout related to the 2003 grant (which will be settled in cash)is based on the Company’s stock price performance comparedto both an industry peer group and an S&P Index. The payoutrelated to the 2004 grant (which will be settled in cash) and<strong>2005</strong> grant (which will be settled in common stock) is based50% on stock price performance compared to both an industrypeer group and an S&P Index and 50% on a return on capitaltarget. During the years ended December <strong>31</strong>, <strong>2005</strong>, 2004 and2003, the Company granted 0.2 million, 0.5 million and0.4 million performance units in each period, respectively. Asa result of the Company’s performance under the terms ofthese grants, the Company recognized compensation expenseof $41.2 million, $21.1 million and $3.3 million in <strong>2005</strong>, 2004and 2003, respectively.Stock Purchase and Option PlanEffective May 19, 1998, the Company adopted the “1998Stock Purchase and Option Plan for Key Employees of P&LCoal Holdings Corporation,” making 22.4 million shares ofthe Company’s common stock available for grant. The Boardof Directors provided such grants in the form of stock, nonqualifiedoptions and incentive stock options. No grants weremade under this plan in <strong>2005</strong>.Non-Employee Director Equity Incentive PlanDuring the nine months ended December <strong>31</strong>, 2001,the Company also adopted the “Equity Incentive Plan forNon-Employee Directors.” Under that plan, members of theCompany’s Board of Directors who are not employees of theCompany or one of its affiliates will be eligible to receive grantsof restricted stock and stock options. All options granted underthe plan vest ratably over three years and will expire after10 years from the date of the grant, subject to earlier terminationin connection with a director’s termination of service. Membersof the Company’s Board of Directors are eligible for stockoption and restricted stock grants (made either from the EquityIncentive Plan for Non-Employee Directors or the Long-TermEquity Incentive Plan) at the date of their election and annuallyin January.The Company recognized compensation cost related togrants of common stock and options to management, employeesand non-employee directors of $1.6 million, $0.3 million and$0.4 million during the years ended December <strong>31</strong>, <strong>2005</strong>, 2004,and 2003, respectively.A summary of outstanding option activity is as follows:Year Weighted- Year Weighted- Year Weighted-Ended Average Ended Average Ended AverageDecember <strong>31</strong>, Exercise December <strong>31</strong>, Exercise December <strong>31</strong>, Exercise<strong>2005</strong> Price 2004 Price 2003 PriceBeginningbalance 14,468,336 $ 5.90 17,547,372 $ 5.22 23,095,<strong>31</strong>6 $4.26Granted 418,606 20.54 2,157,484 10.63 3,929,148 7.72Exercised (3,633,750) 6.22 (4,953,868) 5.55 (9,055,080) 3.87Forfeited (469,406) 5.75 (282,652) 6.03 (422,012) 4.83Outstanding 10,783,786 $ 6.37 14,468,336 $5.90 17,547,372 $5.22Exercisable 2,825,334 $ 7.35 4,126,956 $5.93 6,652,256 $5.2578 <strong>Peabody</strong> <strong>Energy</strong>