PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

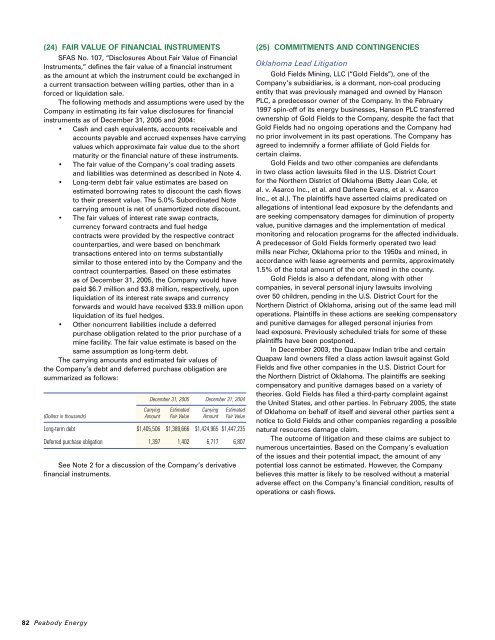

(24) FAIR VALUE OF FINANCIAL INSTRUMENTSSFAS No. 107, “Disclosures About Fair Value of FinancialInstruments,” defines the fair value of a financial instrumentas the amount at which the instrument could be exchanged ina current transaction between willing parties, other than in aforced or liquidation sale.The following methods and assumptions were used by theCompany in estimating its fair value disclosures for financialinstruments as of December <strong>31</strong>, <strong>2005</strong> and 2004:• Cash and cash equivalents, accounts receivable andaccounts payable and accrued expenses have carryingvalues which approximate fair value due to the shortmaturity or the financial nature of these instruments.• The fair value of the Company’s coal trading assetsand liabilities was determined as described in Note 4.• Long-term debt fair value estimates are based onestimated borrowing rates to discount the cash flowsto their present value. The 5.0% Subordinated Notecarrying amount is net of unamortized note discount.• The fair values of interest rate swap contracts,currency forward contracts and fuel hedgecontracts were provided by the respective contractcounterparties, and were based on benchmarktransactions entered into on terms substantiallysimilar to those entered into by the Company and thecontract counterparties. Based on these estimatesas of December <strong>31</strong>, <strong>2005</strong>, the Company would havepaid $6.7 million and $3.8 million, respectively, uponliquidation of its interest rate swaps and currencyforwards and would have received $33.9 million uponliquidation of its fuel hedges.• Other noncurrent liabilities include a deferredpurchase obligation related to the prior purchase of amine facility. The fair value estimate is based on thesame assumption as long-term debt.The carrying amounts and estimated fair values ofthe Company’s debt and deferred purchase obligation aresummarized as follows:December <strong>31</strong>, <strong>2005</strong> December <strong>31</strong>, 2004Carrying Estimated Carrying Estimated(Dollars in thousands) Amount Fair Value Amount Fair ValueLong-term debt $1,405,506 $1,389,666 $1,424,965 $1,447,235Deferred purchase obligation 1,397 1,402 6,717 6,807See Note 2 for a discussion of the Company’s derivativefinancial instruments.(25) COMMITMENTS AND CONTINGENCIESOklahoma Lead LitigationGold Fields Mining, LLC (“Gold Fields”), one of theCompany’s subsidiaries, is a dormant, non-coal producingentity that was previously managed and owned by HansonPLC, a predecessor owner of the Company. In the February1997 spin-off of its energy businesses, Hanson PLC transferredownership of Gold Fields to the Company, despite the fact thatGold Fields had no ongoing operations and the Company hadno prior involvement in its past operations. The Company hasagreed to indemnify a former affiliate of Gold Fields forcertain claims.Gold Fields and two other companies are defendantsin two class action lawsuits filed in the U.S. District Courtfor the Northern District of Oklahoma (Betty Jean Cole, etal. v. Asarco Inc., et al. and Darlene Evans, et al. v. AsarcoInc., et al.). The plaintiffs have asserted claims predicated onallegations of intentional lead exposure by the defendants andare seeking compensatory damages for diminution of propertyvalue, punitive damages and the implementation of medicalmonitoring and relocation programs for the affected individuals.A predecessor of Gold Fields formerly operated two leadmills near Picher, Oklahoma prior to the 1950s and mined, inaccordance with lease agreements and permits, approximately1.5% of the total amount of the ore mined in the county.Gold Fields is also a defendant, along with othercompanies, in several personal injury lawsuits involvingover 50 children, pending in the U.S. District Court for theNorthern District of Oklahoma, arising out of the same lead milloperations. Plaintiffs in these actions are seeking compensatoryand punitive damages for alleged personal injuries fromlead exposure. Previously scheduled trials for some of theseplaintiffs have been postponed.In December 2003, the Quapaw Indian tribe and certainQuapaw land owners filed a class action lawsuit against GoldFields and five other companies in the U.S. District Court forthe Northern District of Oklahoma. The plaintiffs are seekingcompensatory and punitive damages based on a variety oftheories. Gold Fields has filed a third-party complaint againstthe United States, and other parties. In February <strong>2005</strong>, the stateof Oklahoma on behalf of itself and several other parties sent anotice to Gold Fields and other companies regarding a possiblenatural resources damage claim.The outcome of litigation and these claims are subject tonumerous uncertainties. Based on the Company’s evaluationof the issues and their potential impact, the amount of anypotential loss cannot be estimated. However, the Companybelieves this matter is likely to be resolved without a materialadverse effect on the Company’s financial condition, results ofoperations or cash flows.82 <strong>Peabody</strong> <strong>Energy</strong>