forward positions. During the year ended December <strong>31</strong>, <strong>2005</strong>,the low, high, and average values at risk for the Company’s coaltrading portfolio were $1.2 million, $3.9 million and $2.3 million,respectively. Further discussion of the Company’s coal tradingassets and liabilities is included in Note 4.The Company also monitors other types of risk associatedwith its coal trading activities, including credit, market liquidityand counterparty nonperformance.Commodity Price RiskIn addition to the derivatives related to trading activities,the Company enters contracts to manage its exposure to pricevolatility of diesel fuel. As of December <strong>31</strong>, <strong>2005</strong>, the Companyhad derivative contracts designated as cash flow hedges withnotional amounts outstanding totaling 68.9 million gallons, withmaturities extending through 2007. The consolidated balancesheet as of December <strong>31</strong>, <strong>2005</strong>, reflects unrealized gains onthe cash flow hedges of $33.9 million, which is recordednet of a $13.5 million tax provision, in other comprehensiveincome (see Note 21). During <strong>2005</strong>, the Company recognizedapproximately $0.1 million of lower operating costs andexpenses related to the ineffectiveness of its diesel fuel hedges.Hedge ineffectiveness had no effect on results of operations forthe years ended December <strong>31</strong>, 2004 and 2003.Ineffectiveness is inherent in hedging diesel fuelwith derivative positions based on other crude oil relatedcommodities. Due to the volatility in markets for crude oil, andcrude oil related products, and the current refining spreadsthat have widened the price spread between crude oil andother petroleum distillates (such as diesel fuel), the Companyis unable to predict the amount of ineffectiveness in futureperiods, including the loss of hedge accounting (which couldbe determined on a derivative by derivative basis or in theaggregate), which may result in increased volatility in theCompany’s results.The notional amounts outstanding of 68.9 million gallonsincluded derivative swap contracts for 44.5 million gallonsof heating oil and 24.4 million gallons of crude oil that weredesignated as cash flow hedges of future anticipated diesel fuelpurchases as of December <strong>31</strong>, <strong>2005</strong>. The heating oil contractsare used to hedge fuel purchases in the Company’s Easternmining operations and the crude oil derivatives are usedto hedge fuel purchases in the Company’s Western miningoperations. Hedge ineffectiveness is present in the designof both of these hedge relationships since diesel fuel pricesare not perfectly correlated with either heating oil orcrude oil prices.Despite the ineffectiveness present in the hedgerelationships, very little ineffectiveness is recognized in theCompany’s statements of operations, due to two factors. First,the Company’s contract for physical fuel purchases hedgedwith heating oil derivatives are priced based on the derivativecontract (adjusted for a fixed transportation differential),resulting in little ineffectiveness. Second, the crude oil hedges,which have more ineffectiveness present, are nearly all in an“underhedge” position, where change in the fair value of thederivative is less than the change in the fair value of the hedgeditem. Under SFAS No. 133, ineffectiveness in cash flow hedgesis only recognized in the income statement in cases where thederivative has changed in value more than the hedged item.Credit RiskThe Company’s concentration of credit risk is substantiallywith energy producers and marketers and electric utilities,although it also has exposure to international steel producers,brokerage sources and trading counterparties. The Company’spolicy is to independently evaluate each customer’screditworthiness prior to entering into transactions and toconstantly monitor the credit extended. In the event that theCompany engages in a transaction with a counterparty thatdoes not meet its credit standards, the Company may protectits position by requiring the counterparty to provide appropriatecredit enhancement.When appropriate the Company has taken steps to reducethe Company’s credit exposure to customers or counterpartieswhose credit has deteriorated and who may pose a higher risk,as determined by the Company’s credit management function,of failure to perform under their contractual obligations. Thesesteps include obtaining letters of credit or cash collateral,requiring prepayments for shipments or the creation ofcustomer trust accounts held for the Company’s benefit to fundthe payment for coal under existing coal supply agreements.To reduce the Company’s credit exposure related toits trading and brokerage activities, the Company seeks toenter into netting agreements with counterparties that permitthe Company to offset receivables and payables with suchcounterparties. Counterparty risk with respect to interestrate swap and foreign currency forwards transactions is notconsidered to be significant based upon the creditworthiness ofthe participating financial institutions.Foreign Currency RiskThe Company utilizes currency forwards to hedge currencyrisk associated with anticipated Australian dollar expenditures.As of December <strong>31</strong>, <strong>2005</strong>, the Company had forward contractsdesignated as cash flow hedges with notional amountsoutstanding totaling A$915.8 million, with maturities extendingthrough 2008. The consolidated balance sheet as of December <strong>31</strong>,<strong>2005</strong>, reflects unrealized losses on the cash flow hedges of$3.8 million, which is recorded net of a $1.5 million tax benefit,in other comprehensive income (see Note 21).EmployeesAs of December <strong>31</strong>, <strong>2005</strong>, the Company and itssubsidiaries had approximately 8,300 employees. As ofDecember <strong>31</strong>, <strong>2005</strong>, approximately 39% of the Company’shourly employees were represented by organized labor unionsand generated 19% of the <strong>2005</strong> coal production. Relationswith its employees and, where applicable, organized labor areimportant to the Company’s success.In <strong>2005</strong>, the Company opened training centers in theeastern and western regions of the United States underits “Workforce of the Future” initiative. Due to the currentemployee demographics, a significant portion of theCompany’s current hourly employees will retire over the nextdecade. The training centers are educating the Company’sworkforce, particularly the most recent hires, in rigorous safetystandards and the latest in mining techniques and equipment,and the centers serve as centers for dissemination of miningbest practices across all of the Company’s operations. Thetraining efforts exceed minimum government standards forsafety and technical expertise with the intent of developing andretaining a world-class workforce.61

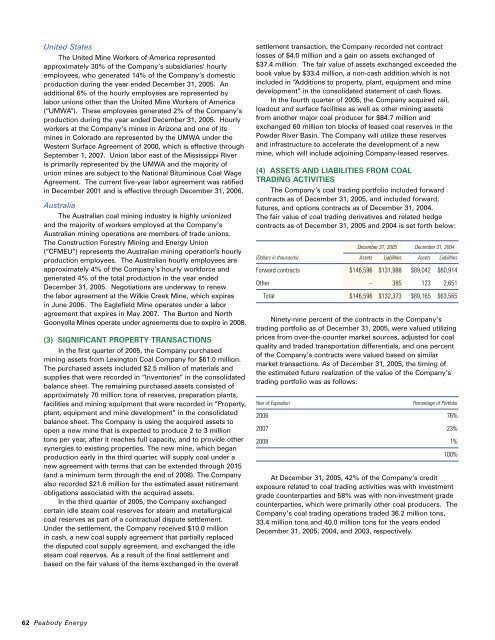

United StatesThe United Mine Workers of America representedapproximately 30% of the Company’s subsidiaries’ hourlyemployees, who generated 14% of the Company’s domesticproduction during the year ended December <strong>31</strong>, <strong>2005</strong>. Anadditional 6% of the hourly employees are represented bylabor unions other than the United Mine Workers of America(“UMWA”). These employees generated 2% of the Company’sproduction during the year ended December <strong>31</strong>, <strong>2005</strong>. Hourlyworkers at the Company’s mines in Arizona and one of itsmines in Colorado are represented by the UMWA under theWestern Surface Agreement of 2000, which is effective throughSeptember 1, 2007. Union labor east of the Mississippi Riveris primarily represented by the UMWA and the majority ofunion mines are subject to the National Bituminous Coal WageAgreement. The current five-year labor agreement was ratifiedin December 2001 and is effective through December <strong>31</strong>, 2006.AustraliaThe Australian coal mining industry is highly unionizedand the majority of workers employed at the Company’sAustralian mining operations are members of trade unions.The Construction Forestry Mining and <strong>Energy</strong> Union(“CFMEU”) represents the Australian mining operation’s hourlyproduction employees. The Australian hourly employees areapproximately 4% of the Company’s hourly workforce andgenerated 4% of the total production in the year endedDecember <strong>31</strong>, <strong>2005</strong>. Negotiations are underway to renewthe labor agreement at the Wilkie Creek Mine, which expiresin June 2006. The Eaglefield Mine operates under a laboragreement that expires in May 2007. The Burton and NorthGoonyella Mines operate under agreements due to expire in 2008.(3) SIGNIFICANT PROPERTY TRANSACTIONSIn the first quarter of <strong>2005</strong>, the Company purchasedmining assets from Lexington Coal Company for $61.0 million.The purchased assets included $2.5 million of materials andsupplies that were recorded in “Inventories” in the consolidatedbalance sheet. The remaining purchased assets consisted ofapproximately 70 million tons of reserves, preparation plants,facilities and mining equipment that were recorded in “Property,plant, equipment and mine development” in the consolidatedbalance sheet. The Company is using the acquired assets toopen a new mine that is expected to produce 2 to 3 milliontons per year, after it reaches full capacity, and to provide othersynergies to existing properties. The new mine, which beganproduction early in the third quarter, will supply coal under anew agreement with terms that can be extended through 2015(and a minimum term through the end of 2008). The Companyalso recorded $21.6 million for the estimated asset retirementobligations associated with the acquired assets.In the third quarter of <strong>2005</strong>, the Company exchangedcertain idle steam coal reserves for steam and metallurgicalcoal reserves as part of a contractual dispute settlement.Under the settlement, the Company received $10.0 millionin cash, a new coal supply agreement that partially replacedthe disputed coal supply agreement, and exchanged the idlesteam coal reserves. As a result of the final settlement andbased on the fair values of the items exchanged in the overallsettlement transaction, the Company recorded net contractlosses of $4.0 million and a gain on assets exchanged of$37.4 million. The fair value of assets exchanged exceeded thebook value by $33.4 million, a non-cash addition which is notincluded in “Additions to property, plant, equipment and minedevelopment” in the consolidated statement of cash flows.In the fourth quarter of <strong>2005</strong>, the Company acquired rail,loadout and surface facilities as well as other mining assetsfrom another major coal producer for $84.7 million andexchanged 60 million ton blocks of leased coal reserves in thePowder River Basin. The Company will utilize these reservesand infrastructure to accelerate the development of a newmine, which will include adjoining Company-leased reserves.(4) ASSETS AND LIABILITIES FROM COALTRADING ACTIVITIESThe Company’s coal trading portfolio included forwardcontracts as of December <strong>31</strong>, <strong>2005</strong>, and included forward,futures, and options contracts as of December <strong>31</strong>, 2004.The fair value of coal trading derivatives and related hedgecontracts as of December <strong>31</strong>, <strong>2005</strong> and 2004 is set forth below:December <strong>31</strong>, <strong>2005</strong> December <strong>31</strong>, 2004(Dollars in thousands) Assets Liabilities Assets LiabilitiesForward contracts $146,596 $1<strong>31</strong>,988 $89,042 $60,914Other – 385 123 2,651Total $146,596 $132,373 $89,165 $63,565Ninety-nine percent of the contracts in the Company’strading portfolio as of December <strong>31</strong>, <strong>2005</strong>, were valued utilizingprices from over-the-counter market sources, adjusted for coalquality and traded transportation differentials, and one percentof the Company’s contracts were valued based on similarmarket transactions. As of December <strong>31</strong>, <strong>2005</strong>, the timing ofthe estimated future realization of the value of the Company’strading portfolio was as follows:Year of ExpirationPercentage of Portfolio2006 76%2007 23%2008 1%100%At December <strong>31</strong>, <strong>2005</strong>, 42% of the Company’s creditexposure related to coal trading activities was with investmentgrade counterparties and 58% was with non-investment gradecounterparties, which were primarily other coal producers. TheCompany’s coal trading operations traded 36.2 million tons,33.4 million tons and 40.0 million tons for the years endedDecember <strong>31</strong>, <strong>2005</strong>, 2004, and 2003, respectively.62 <strong>Peabody</strong> <strong>Energy</strong>