PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

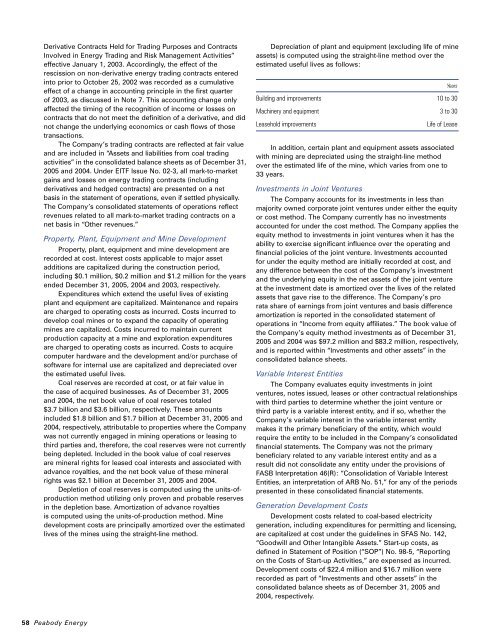

Derivative Contracts Held for Trading Purposes and ContractsInvolved in <strong>Energy</strong> Trading and Risk Management Activities”effective January 1, 2003. Accordingly, the effect of therescission on non-derivative energy trading contracts enteredinto prior to October 25, 2002 was recorded as a cumulativeeffect of a change in accounting principle in the first quarterof 2003, as discussed in Note 7. This accounting change onlyaffected the timing of the recognition of income or losses oncontracts that do not meet the definition of a derivative, and didnot change the underlying economics or cash flows of thosetransactions.The Company’s trading contracts are reflected at fair valueand are included in “Assets and liabilities from coal tradingactivities” in the consolidated balance sheets as of December <strong>31</strong>,<strong>2005</strong> and 2004. Under EITF Issue No. 02-3, all mark-to-marketgains and losses on energy trading contracts (includingderivatives and hedged contracts) are presented on a netbasis in the statement of operations, even if settled physically.The Company’s consolidated statements of operations reflectrevenues related to all mark-to-market trading contracts on anet basis in “Other revenues.”Property, Plant, Equipment and Mine DevelopmentProperty, plant, equipment and mine development arerecorded at cost. Interest costs applicable to major assetadditions are capitalized during the construction period,including $0.1 million, $0.2 million and $1.2 million for the yearsended December <strong>31</strong>, <strong>2005</strong>, 2004 and 2003, respectively.Expenditures which extend the useful lives of existingplant and equipment are capitalized. Maintenance and repairsare charged to operating costs as incurred. Costs incurred todevelop coal mines or to expand the capacity of operatingmines are capitalized. Costs incurred to maintain currentproduction capacity at a mine and exploration expendituresare charged to operating costs as incurred. Costs to acquirecomputer hardware and the development and/or purchase ofsoftware for internal use are capitalized and depreciated overthe estimated useful lives.Coal reserves are recorded at cost, or at fair value inthe case of acquired businesses. As of December <strong>31</strong>, <strong>2005</strong>and 2004, the net book value of coal reserves totaled$3.7 billion and $3.6 billion, respectively. These amountsincluded $1.8 billion and $1.7 billion at December <strong>31</strong>, <strong>2005</strong> and2004, respectively, attributable to properties where the Companywas not currently engaged in mining operations or leasing tothird parties and, therefore, the coal reserves were not currentlybeing depleted. Included in the book value of coal reservesare mineral rights for leased coal interests and associated withadvance royalties, and the net book value of these mineralrights was $2.1 billion at December <strong>31</strong>, <strong>2005</strong> and 2004.Depletion of coal reserves is computed using the units-ofproductionmethod utilizing only proven and probable reservesin the depletion base. Amortization of advance royaltiesis computed using the units-of-production method. Minedevelopment costs are principally amortized over the estimatedlives of the mines using the straight-line method.Depreciation of plant and equipment (excluding life of mineassets) is computed using the straight-line method over theestimated useful lives as follows:YearsBuilding and improvements 10 to 30Machinery and equipment 3 to 30Leasehold improvementsLife of LeaseIn addition, certain plant and equipment assets associatedwith mining are depreciated using the straight-line methodover the estimated life of the mine, which varies from one to33 years.Investments in Joint VenturesThe Company accounts for its investments in less thanmajority owned corporate joint ventures under either the equityor cost method. The Company currently has no investmentsaccounted for under the cost method. The Company applies theequity method to investments in joint ventures when it has theability to exercise significant influence over the operating andfinancial policies of the joint venture. Investments accountedfor under the equity method are initially recorded at cost, andany difference between the cost of the Company’s investmentand the underlying equity in the net assets of the joint ventureat the investment date is amortized over the lives of the relatedassets that gave rise to the difference. The Company’s prorata share of earnings from joint ventures and basis differenceamortization is reported in the consolidated statement ofoperations in “Income from equity affiliates.” The book value ofthe Company’s equity method investments as of December <strong>31</strong>,<strong>2005</strong> and 2004 was $97.2 million and $83.2 million, respectively,and is reported within “Investments and other assets” in theconsolidated balance sheets.Variable Interest EntitiesThe Company evaluates equity investments in jointventures, notes issued, leases or other contractual relationshipswith third parties to determine whether the joint venture orthird party is a variable interest entity, and if so, whether theCompany’s variable interest in the variable interest entitymakes it the primary beneficiary of the entity, which wouldrequire the entity to be included in the Company’s consolidatedfinancial statements. The Company was not the primarybeneficiary related to any variable interest entity and as aresult did not consolidate any entity under the provisions ofFASB Interpretation 46(R): “Consolidation of Variable InterestEntities, an interpretation of ARB No. 51,” for any of the periodspresented in these consolidated financial statements.Generation Development CostsDevelopment costs related to coal-based electricitygeneration, including expenditures for permitting and licensing,are capitalized at cost under the guidelines in SFAS No. 142,“Goodwill and Other Intangible Assets.” Start-up costs, asdefined in Statement of Position (“SOP”) No. 98-5, “Reportingon the Costs of Start-up Activities,” are expensed as incurred.Development costs of $22.4 million and $16.7 million wererecorded as part of “Investments and other assets” in theconsolidated balance sheets as of December <strong>31</strong>, <strong>2005</strong> and2004, respectively.58 <strong>Peabody</strong> <strong>Energy</strong>