PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

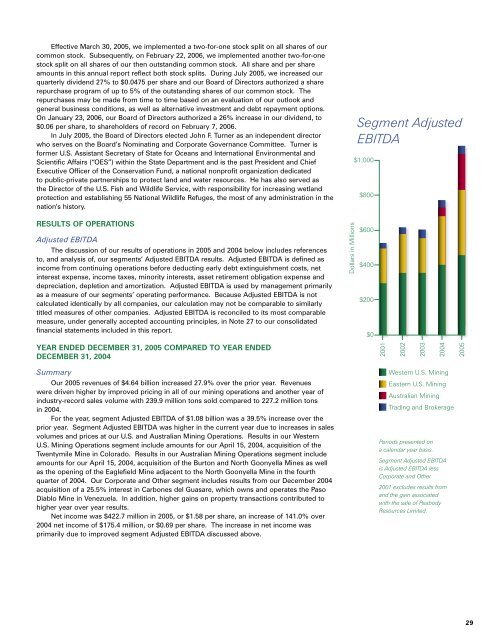

Effective March 30, <strong>2005</strong>, we implemented a two-for-one stock split on all shares of ourcommon stock. Subsequently, on February 22, 2006, we implemented another two-for-onestock split on all shares of our then outstanding common stock. All share and per shareamounts in this annual report reflect both stock splits. During July <strong>2005</strong>, we increased ourquarterly dividend 27% to $0.0475 per share and our Board of Directors authorized a sharerepurchase program of up to 5% of the outstanding shares of our common stock. Therepurchases may be made from time to time based on an evaluation of our outlook andgeneral business conditions, as well as alternative investment and debt repayment options.On January 23, 2006, our Board of Directors authorized a 26% increase in our dividend, to$0.06 per share, to shareholders of record on February 7, 2006.In July <strong>2005</strong>, the Board of Directors elected John F. Turner as an independent directorwho serves on the Board’s Nominating and Corporate Governance Committee. Turner isformer U.S. Assistant Secretary of State for Oceans and International Environmental andScientific Affairs (“OES”) within the State Department and is the past President and ChiefExecutive Officer of the Conservation Fund, a national nonprofit organization dedicatedto public-private partnerships to protect land and water resources. He has also served asthe Director of the U.S. Fish and Wildlife Service, with responsibility for increasing wetlandprotection and establishing 55 National Wildlife Refuges, the most of any administration in thenation’s history.Segment AdjustedEBITDARESULTS OF OPERATIONSAdjusted EBITDAThe discussion of our results of operations in <strong>2005</strong> and 2004 below includes referencesto, and analysis of, our segments’ Adjusted EBITDA results. Adjusted EBITDA is defined asincome from continuing operations before deducting early debt extinguishment costs, netinterest expense, income taxes, minority interests, asset retirement obligation expense anddepreciation, depletion and amortization. Adjusted EBITDA is used by management primarilyas a measure of our segments’ operating performance. Because Adjusted EBITDA is notcalculated identically by all companies, our calculation may not be comparable to similarlytitled measures of other companies. Adjusted EBITDA is reconciled to its most comparablemeasure, under generally accepted accounting principles, in Note 27 to our consolidatedfinancial statements included in this report.YEAR <strong>ENDED</strong> <strong>DECEMBER</strong> <strong>31</strong>, <strong>2005</strong> COMPARED TO YEAR <strong>ENDED</strong><strong>DECEMBER</strong> <strong>31</strong>, 2004SummaryOur <strong>2005</strong> revenues of $4.64 billion increased 27.9% over the prior year. Revenueswere driven higher by improved pricing in all of our mining operations and another year ofindustry-record sales volume with 239.9 million tons sold compared to 227.2 million tonsin 2004.For the year, segment Adjusted EBITDA of $1.08 billion was a 39.5% increase over theprior year. Segment Adjusted EBITDA was higher in the current year due to increases in salesvolumes and prices at our U.S. and Australian Mining Operations. Results in our WesternU.S. Mining Operations segment include amounts for our April 15, 2004, acquisition of theTwentymile Mine in Colorado. Results in our Australian Mining Operations segment includeamounts for our April 15, 2004, acquisition of the Burton and North Goonyella Mines as wellas the opening of the Eaglefield Mine adjacent to the North Goonyella Mine in the fourthquarter of 2004. Our Corporate and Other segment includes results from our December 2004acquisition of a 25.5% interest in Carbones del Guasare, which owns and operates the PasoDiablo Mine in Venezuela. In addition, higher gains on property transactions contributed tohigher year over year results.Net income was $422.7 million in <strong>2005</strong>, or $1.58 per share, an increase of 141.0% over2004 net income of $175.4 million, or $0.69 per share. The increase in net income wasprimarily due to improved segment Adjusted EBITDA discussed above.29