PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

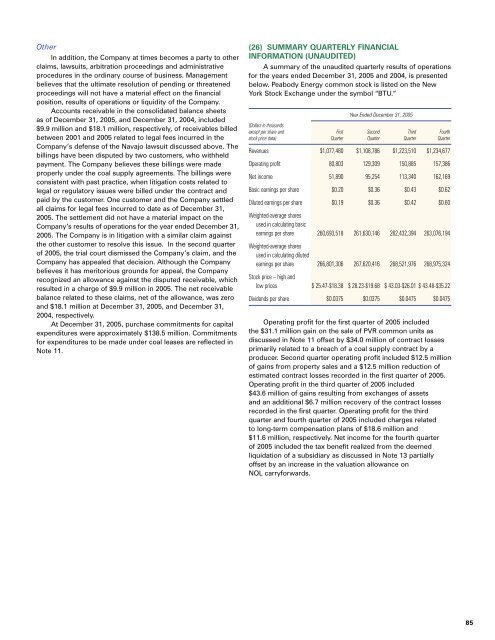

OtherIn addition, the Company at times becomes a party to otherclaims, lawsuits, arbitration proceedings and administrativeprocedures in the ordinary course of business. Managementbelieves that the ultimate resolution of pending or threatenedproceedings will not have a material effect on the financialposition, results of operations or liquidity of the Company.Accounts receivable in the consolidated balance sheetsas of December <strong>31</strong>, <strong>2005</strong>, and December <strong>31</strong>, 2004, included$9.9 million and $18.1 million, respectively, of receivables billedbetween 2001 and <strong>2005</strong> related to legal fees incurred in theCompany’s defense of the Navajo lawsuit discussed above. Thebillings have been disputed by two customers, who withheldpayment. The Company believes these billings were madeproperly under the coal supply agreements. The billings wereconsistent with past practice, when litigation costs related tolegal or regulatory issues were billed under the contract andpaid by the customer. One customer and the Company settledall claims for legal fees incurred to date as of December <strong>31</strong>,<strong>2005</strong>. The settlement did not have a material impact on theCompany’s results of operations for the year ended December <strong>31</strong>,<strong>2005</strong>. The Company is in litigation with a similar claim againstthe other customer to resolve this issue. In the second quarterof <strong>2005</strong>, the trial court dismissed the Company’s claim, and theCompany has appealed that decision. Although the Companybelieves it has meritorious grounds for appeal, the Companyrecognized an allowance against the disputed receivable, whichresulted in a charge of $9.9 million in <strong>2005</strong>. The net receivablebalance related to these claims, net of the allowance, was zeroand $18.1 million at December <strong>31</strong>, <strong>2005</strong>, and December <strong>31</strong>,2004, respectively.At December <strong>31</strong>, <strong>2005</strong>, purchase commitments for capitalexpenditures were approximately $138.5 million. Commitmentsfor expenditures to be made under coal leases are reflected inNote 11.(26) SUMMARY QUARTERLY FINANCIALINFORMATION (UNAUDITED)A summary of the unaudited quarterly results of operationsfor the years ended December <strong>31</strong>, <strong>2005</strong> and 2004, is presentedbelow. <strong>Peabody</strong> <strong>Energy</strong> common stock is listed on the NewYork Stock Exchange under the symbol “BTU.”Year Ended December <strong>31</strong>, <strong>2005</strong>(Dollars in thousandsexcept per share and First Second Third Fourthstock price data) Quarter Quarter Quarter QuarterRevenues $1,077,480 $1,108,786 $1,223,510 $1,234,677Operating profit 80,803 129,309 150,885 157,386Net income 51,890 95,254 113,340 162,169Basic earnings per share $0.20 $0.36 $0.43 $0.62Diluted earnings per share $0.19 $0.36 $0.42 $0.60Weighted-average sharesused in calculating basicearnings per share 260,693,518 261,630,146 262,432,394 263,076,194Weighted-average sharesused in calculating dilutedearnings per share 266,801,306 267,620,416 268,521,976 268,975,324Stock price – high andlow prices $ 25.47-$18.38 $ 28.23-$19.68 $ 43.03-$26.01 $ 43.48-$35.22Dividends per share $0.0375 $0.0375 $0.0475 $0.0475Operating profit for the first quarter of <strong>2005</strong> includedthe $<strong>31</strong>.1 million gain on the sale of PVR common units asdiscussed in Note 11 offset by $34.0 million of contract lossesprimarily related to a breach of a coal supply contract by aproducer. Second quarter operating profit included $12.5 millionof gains from property sales and a $12.5 million reduction ofestimated contract losses recorded in the first quarter of <strong>2005</strong>.Operating profit in the third quarter of <strong>2005</strong> included$43.6 million of gains resulting from exchanges of assetsand an additional $6.7 million recovery of the contract lossesrecorded in the first quarter. Operating profit for the thirdquarter and fourth quarter of <strong>2005</strong> included charges relatedto long-term compensation plans of $18.6 million and$11.6 million, respectively. Net income for the fourth quarterof <strong>2005</strong> included the tax benefit realized from the deemedliquidation of a subsidiary as discussed in Note 13 partiallyoffset by an increase in the valuation allowance onNOL carryforwards.85