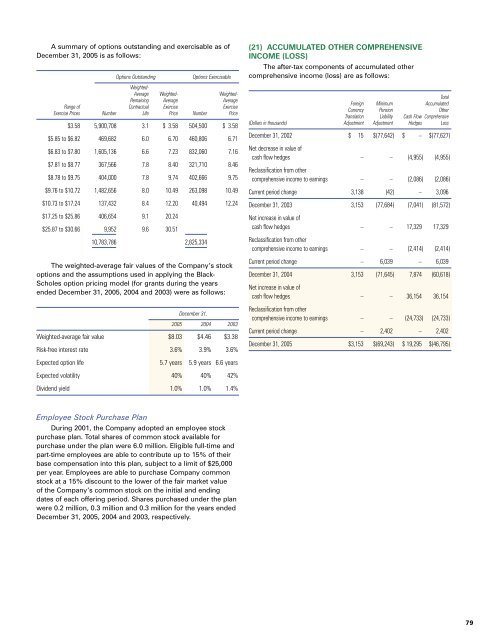

A summary of options outstanding and exercisable as ofDecember <strong>31</strong>, <strong>2005</strong> is as follows:Options OutstandingOptions ExercisableWeighted-Average Weighted- Weighted-Remaining Average AverageRange of Contractual Exercise ExerciseExercise Prices Number Life Price Number Price$3.58 5,900,708 3.1 $ 3.58 504,500 $ 3.58$5.85 to $6.82 469,682 6.0 6.70 460,806 6.71$6.83 to $7.80 1,605,136 6.6 7.23 832,060 7.16$7.81 to $8.77 367,566 7.8 8.40 321,710 8.46$8.78 to $9.75 404,000 7.8 9.74 402,666 9.75$9.76 to $10.72 1,482,656 8.0 10.49 263,098 10.49$10.73 to $17.24 137,432 8.4 12.20 40,494 12.24$17.25 to $25.86 406,654 9.1 20.24$25.87 to $30.66 9,952 9.6 30.5110,783,786 2,825,334The weighted-average fair values of the Company’s stockoptions and the assumptions used in applying the Black-Scholes option pricing model (for grants during the yearsended December <strong>31</strong>, <strong>2005</strong>, 2004 and 2003) were as follows:December <strong>31</strong>,<strong>2005</strong> 2004 2003Weighted-average fair value $8.03 $4.46 $3.38Risk-free interest rate 3.6% 3.9% 3.6%(21) ACCUMULATED OTHER COMPREHENSIVEINCOME (LOSS)The after-tax components of accumulated othercomprehensive income (loss) are as follows:TotalForeign Minimum AccumulatedCurrency Pension OtherTranslation Liability Cash Flow Comprehensive(Dollars in thousands) Adjustment Adjustment Hedges LossDecember <strong>31</strong>, 2002 $ 15 $(77,642) $ – $(77,627)Net decrease in value ofcash flow hedges – – (4,955) (4,955)Reclassification from othercomprehensive income to earnings – – (2,086) (2,086)Current period change 3,138 (42) – 3,096December <strong>31</strong>, 2003 3,153 (77,684) (7,041) (81,572)Net increase in value ofcash flow hedges – – 17,329 17,329Reclassification from othercomprehensive income to earnings – – (2,414) (2,414)Current period change – 6,039 – 6,039December <strong>31</strong>, 2004 3,153 (71,645) 7,874 (60,618)Net increase in value ofcash flow hedges – – 36,154 36,154Reclassification from othercomprehensive income to earnings – – (24,733) (24,733)Current period change – 2,402 – 2,402December <strong>31</strong>, <strong>2005</strong> $3,153 $(69,243) $ 19,295 $(46,795)Expected option life 5.7 years 5.9 years 6.6 yearsExpected volatility 40% 40% 42%Dividend yield 1.0% 1.0% 1.4%Employee Stock Purchase PlanDuring 2001, the Company adopted an employee stockpurchase plan. Total shares of common stock available forpurchase under the plan were 6.0 million. Eligible full-time andpart-time employees are able to contribute up to 15% of theirbase compensation into this plan, subject to a limit of $25,000per year. Employees are able to purchase Company commonstock at a 15% discount to the lower of the fair market valueof the Company’s common stock on the initial and endingdates of each offering period. Shares purchased under the planwere 0.2 million, 0.3 million and 0.3 million for the years endedDecember <strong>31</strong>, <strong>2005</strong>, 2004 and 2003, respectively.79

(22) RELATED PARTY TRANSACTIONSOn March 23, 2004, August 4, 2003, and May 7, 2003,Lehman Brothers Merchant Banking Partners II L.P. and affiliates(“Merchant Banking Fund”), the Company’s largest stockholderas of those dates, sold 41.1 million, 21.6 million and 22.5 millionshares, respectively, of the Company’s common stock. TheCompany did not receive any proceeds from the sales of sharesby Merchant Banking Fund. The March 2004 offering completedMerchant Banking Fund’s planned exit strategy and eliminatedthe remaining portion of their beneficial ownership of the Company.Lehman Brothers Inc. (“Lehman Brothers”) is an affiliate ofthe Merchant Banking Fund. In March 2004, Morgan Stanleyand Lehman Brothers served as joint managers in connectionwith the secondary equity offering discussed above. LehmanBrothers received from third parties customary underwritingdiscounts and commissions from the offering. The Companypaid no fees to Lehman Brothers related to the secondaryequity offerings. In May 2003 and August 2003, LehmanBrothers served as the lead underwriter in connection with thesecondary offerings discussed above and fees for their serviceswere paid by the selling shareholders and not by the Company.The Company paid incidental expenses customarily incurred bya registering company in connection with the secondary offerings.Lehman Brothers served as lead underwriter in connectionwith the Company’s sale of limited partner interests in PVRin March 2004 and December 2003, as discussed in Note 11above. Lehman Brothers received customary fees, plusreimbursement of certain expenses, for those services.As discussed in Note 14 above, in March 2003, theCompany refinanced a substantial portion of its indebtednessby entering into a new Senior Secured Credit Facility andissuing new Senior Notes. Based upon a competitive biddingprocess conducted by members of management and reviewedby members of the Company’s Board of Directors not affiliatedwith Lehman Brothers, the Company appointed WachoviaSecurities, Inc., Fleet Securities, Inc. and Lehman Brothersas lead arrangers for the Senior Secured Credit Facility, andLehman Brothers and Morgan Stanley as joint book runningmanagers for the Senior Notes. Lehman Brothers received totalfees of $7.4 million for their services in connection with therefinancing; such fees were consistent with the fees paid toother parties to the transaction for their respective services.As discussed in Note 14 above, in May 2003, the Companyentered into four $25.0 million fixed-to-floating interest rateswaps as a hedge of the changes in fair value of the 6.875%Senior Notes due 2013. Lehman Brothers was chosen as oneof the swap counterparties as part of a competitive biddingprocess among eight financial institutions.(23) GUARANTEES AND FINANCIAL INSTRUMENTSWITH OFF-BALANCE-SHEET RISKIn the normal course of business, the Company is a partyto guarantees and financial instruments with off-balancesheetrisk, such as bank letters of credit, performance orsurety bonds and other guarantees and indemnities, whichare not reflected in the accompanying consolidated balancesheets. Such financial instruments are valued based on theamount of exposure under the instrument and the likelihood ofperformance being required. In the Company’s past experience,virtually no claims have been made against these financialinstruments. Management does not expect any materiallosses to result from these guarantees or off-balance-sheetinstruments.Letters of Credit and BondingThe Company has letters of credit, surety bonds andcorporate guarantees (such as self bonds) in support of theCompany’s reclamation, lease, workers’ compensation,retiree healthcare and other obligations as follows as ofDecember <strong>31</strong>, <strong>2005</strong>:Workers’ RetireeReclamation Lease Compensation Healthcare(Dollars in thousands) Obligations Obligations Obligations Obligations Other (1) TotalSelf Bonding $ 671,815 $ – $ – $ – $ 2,917 $ 674,732Surety Bonds 335,644 258,769 19,193 – 28,411 642,017Letters of Credit 105 22,652 144,591 120,089 119,745 407,182$1,007,564 $281,421 $163,784 $120,089 $151,073 $1,723,9<strong>31</strong>(1) Other includes the two letters of credit obligations described below and an additional$71.3 million in self-bonding, letters of credit and surety bonds related to collateral forsurety companies, road maintenance, performance guarantees and other operations.The Company owns a 30.0% interest in a partnership thatleases a coal export terminal from the Peninsula Ports Authorityof Virginia under a 30-year lease that permits the partnershipto purchase the terminal at the end of the lease term for anominal amount. The partners have severally (but not jointly)agreed to make payments under various agreements whichin the aggregate provide the partnership with sufficient fundsto pay rents and to cover the principal and interest paymentson the floating-rate industrial revenue bonds issued by thePeninsula Ports Authority, and which are supported by lettersof credit from a commercial bank. The Company’s maximumreimbursement obligation to the commercial bank is in turnsupported by a letter of credit totaling $42.8 million.80 <strong>Peabody</strong> <strong>Energy</strong>