PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

PERIOD ENDED DECEMBER 31, 2005 Annual ... - Peabody Energy

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

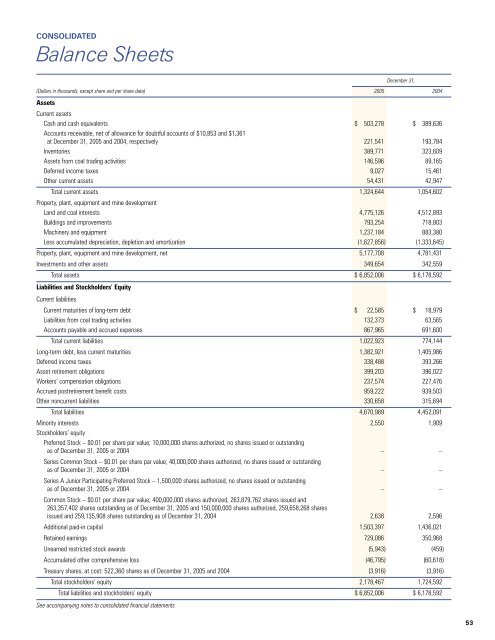

CONSOLIDATEDBalance SheetsDecember <strong>31</strong>,(Dollars in thousands, except share and per share data) <strong>2005</strong> 2004AssetsCurrent assetsCash and cash equivalents $ 503,278 $ 389,636Accounts receivable, net of allowance for doubtful accounts of $10,853 and $1,361at December <strong>31</strong>, <strong>2005</strong> and 2004, respectively 221,541 193,784Inventories 389,771 323,609Assets from coal trading activities 146,596 89,165Deferred income taxes 9,027 15,461Other current assets 54,4<strong>31</strong> 42,947Total current assets 1,324,644 1,054,602Property, plant, equipment and mine developmentLand and coal interests 4,775,126 4,512,893Buildings and improvements 793,254 718,803Machinery and equipment 1,237,184 883,380Less accumulated depreciation, depletion and amortization (1,627,856) (1,333,645)Property, plant, equipment and mine development, net 5,177,708 4,781,4<strong>31</strong>Investments and other assets 349,654 342,559Total assets $ 6,852,006 $ 6,178,592Liabilities and Stockholders’ EquityCurrent liabilitiesCurrent maturities of long-term debt $ 22,585 $ 18,979Liabilities from coal trading activities 132,373 63,565Accounts payable and accrued expenses 867,965 691,600Total current liabilities 1,022,923 774,144Long-term debt, less current maturities 1,382,921 1,405,986Deferred income taxes 338,488 393,266Asset retirement obligations 399,203 396,022Workers’ compensation obligations 237,574 227,476Accrued postretirement benefit costs 959,222 939,503Other noncurrent liabilities 330,658 <strong>31</strong>5,694Total liabilities 4,670,989 4,452,091Minority interests 2,550 1,909Stockholders’ equityPreferred Stock – $0.01 per share par value; 10,000,000 shares authorized, no shares issued or outstandingas of December <strong>31</strong>, <strong>2005</strong> or 2004 – –Series Common Stock – $0.01 per share par value; 40,000,000 shares authorized, no shares issued or outstandingas of December <strong>31</strong>, <strong>2005</strong> or 2004 – –Series A Junior Participating Preferred Stock – 1,500,000 shares authorized, no shares issued or outstandingas of December <strong>31</strong>, <strong>2005</strong> or 2004 – –Common Stock – $0.01 per share par value; 400,000,000 shares authorized, 263,879,762 shares issued and263,357,402 shares outstanding as of December <strong>31</strong>, <strong>2005</strong> and 150,000,000 shares authorized, 259,658,268 sharesissued and 259,135,908 shares outstanding as of December <strong>31</strong>, 2004 2,638 2,596Additional paid-in capital 1,503,397 1,436,021Retained earnings 729,086 350,968Unearned restricted stock awards (5,943) (459)Accumulated other comprehensive loss (46,795) (60,618)Treasury shares, at cost: 522,360 shares as of December <strong>31</strong>, <strong>2005</strong> and 2004 (3,916) (3,916)Total stockholders’ equity 2,178,467 1,724,592Total liabilities and stockholders’ equity $ 6,852,006 $ 6,178,592See accompanying notes to consolidated financial statements53