LIQUIDITY AND CAPITAL RESOURCESOur primary sources of cash include sales of our coal production to customers, cashgenerated from our trading and brokerage activities, sales of non-core assets and financingtransactions, including the sale of our accounts receivable through our securitization program.Our primary uses of cash include our cash costs of coal production, capital expenditures,interest costs and costs related to past mining obligations as well as planned acquisitions. Ourability to pay dividends, service our debt (interest and principal) and acquire new productiveassets or businesses is dependent upon our ability to continue to generate cash from theprimary sources noted above in excess of the primary uses. Future dividends, among otherthings, are subject to limitations imposed by our 6.875% Senior Notes, 5.875% Senior Notesand Senior Secured Credit Facility covenants. We typically fund all of our capital expenditurerequirements with cash generated from operations, and during <strong>2005</strong> and 2004 we had noborrowings outstanding under our $900.0 million revolving line of credit, which we useprimarily for standby letters of credit.Net cash provided by operating activities was $702.8 million in <strong>2005</strong>, an increaseof $419.0 million, or 147.6%, from 2004. The increase was primarily driven by strongeroperational performance in <strong>2005</strong>, as net income increased $247.3 million from the prioryear. Also contributing to the increase was lower funding of pension plans in <strong>2005</strong>, as wevoluntarily pre-funded $50.0 million in the prior year. The remainder of the increase wasprimarily due to higher working capital cash flows of $85.5 million.Net cash used in investing activities was $584.2 million during <strong>2005</strong> compared to$705.0 million used in 2004. Total capital expenditures were $643.9 million in <strong>2005</strong>, anincrease of $377.3 million over prior year. In <strong>2005</strong>, we purchased mining and related assetsof $141.2 million, which included $56.5 million for the acquisition of coal reserves in Illinoisand Indiana along with surface property and equipment and $84.7 million for the acquisitionof mining and transportation infrastructure in the Powder River Basin. Our $118.4 million infederal coal lease expenditures in <strong>2005</strong> were similar to the 2004 expenditures. Other capitalexpenditures of $384.3 million were $232.4 million higher than the prior year. The <strong>2005</strong>other capital expenditures included the longwall equipment and mine development at ourAustralian mines, longwall replacement at our Twentymile mine, the opening of new minesand upgrading of existing mines in the Midwest and Appalachia, and expansion equipment.In <strong>2005</strong>, we were able to make several acquisitions of strategic coal reserves and miningassets due to the strong operating results that we experienced in <strong>2005</strong>. Proceeds from thedisposal of assets increased $36.9 million primarily due to higher proceeds in <strong>2005</strong> from thesale of PVR units and non-strategic property, reserves and equipment. In 2004, we acquiredthe Twentymile mine in Colorado and two mines in Australia for $421.3 million and made a$5.0 million earn-out payment related to our April 2003 acquisition of the remaining minorityinterest in Black Beauty Coal Company. In December 2004, we acquired a 25.5% interest inCarbones del Guasare, which owns and manages the Paso Diablo mine in Venezuela, for a netpurchase price of $32.5 million.Net cash used in financing activities was $4.9 million in <strong>2005</strong> compared to cash providedby financing activities of $693.4 million in the prior year, with the decrease primarily relatedto the 2004 issuance of 35.3 million shares of common stock at $11.25 per share, nettingproceeds of $383.1 million; issuance of $250 million of 5.875% Senior Notes due in 2016;and the payment of debt issuance costs of $12.9 million in connection with the acquisitionof the three mines discussed above. During 2004, we also completed a repricing of ourSenior Secured Credit Facility, consisting of an amended $450.0 million Term Loan and the$900 million Revolving Credit Facility. During <strong>2005</strong> and 2004, we made scheduled paymentson our long-term debt of $20.2 and $36.3 million, respectively. Securitized interest inaccounts receivable increased by $25.0 million in <strong>2005</strong> compared to an increase of$110.0 million in 2004. We paid dividends of $44.5 million and $32.6 million in <strong>2005</strong> and2004, respectively. In <strong>2005</strong>, we issued $11.5 million in notes payable as part of an assetexchange in which we acquired additional Illinois Basin coal reserves.41

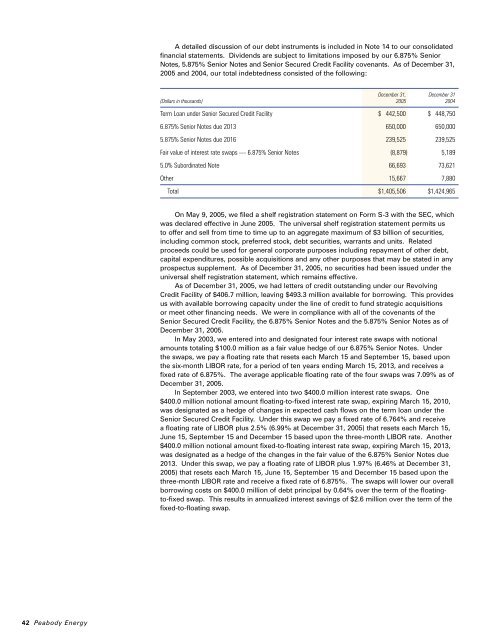

A detailed discussion of our debt instruments is included in Note 14 to our consolidatedfinancial statements. Dividends are subject to limitations imposed by our 6.875% SeniorNotes, 5.875% Senior Notes and Senior Secured Credit Facility covenants. As of December <strong>31</strong>,<strong>2005</strong> and 2004, our total indebtedness consisted of the following:December <strong>31</strong>, December <strong>31</strong>(Dollars in thousands) <strong>2005</strong> 2004Term Loan under Senior Secured Credit Facility $ 442,500 $ 448,7506.875% Senior Notes due 2013 650,000 650,0005.875% Senior Notes due 2016 239,525 239,525Fair value of interest rate swaps — 6.875% Senior Notes (8,879) 5,1895.0% Subordinated Note 66,693 73,621Other 15,667 7,880Total $1,405,506 $1,424,965On May 9, <strong>2005</strong>, we filed a shelf registration statement on Form S-3 with the SEC, whichwas declared effective in June <strong>2005</strong>. The universal shelf registration statement permits usto offer and sell from time to time up to an aggregate maximum of $3 billion of securities,including common stock, preferred stock, debt securities, warrants and units. Relatedproceeds could be used for general corporate purposes including repayment of other debt,capital expenditures, possible acquisitions and any other purposes that may be stated in anyprospectus supplement. As of December <strong>31</strong>, <strong>2005</strong>, no securities had been issued under theuniversal shelf registration statement, which remains effective.As of December <strong>31</strong>, <strong>2005</strong>, we had letters of credit outstanding under our RevolvingCredit Facility of $406.7 million, leaving $493.3 million available for borrowing. This providesus with available borrowing capacity under the line of credit to fund strategic acquisitionsor meet other financing needs. We were in compliance with all of the covenants of theSenior Secured Credit Facility, the 6.875% Senior Notes and the 5.875% Senior Notes as ofDecember <strong>31</strong>, <strong>2005</strong>.In May 2003, we entered into and designated four interest rate swaps with notionalamounts totaling $100.0 million as a fair value hedge of our 6.875% Senior Notes. Underthe swaps, we pay a floating rate that resets each March 15 and September 15, based uponthe six-month LIBOR rate, for a period of ten years ending March 15, 2013, and receives afixed rate of 6.875%. The average applicable floating rate of the four swaps was 7.09% as ofDecember <strong>31</strong>, <strong>2005</strong>.In September 2003, we entered into two $400.0 million interest rate swaps. One$400.0 million notional amount floating-to-fixed interest rate swap, expiring March 15, 2010,was designated as a hedge of changes in expected cash flows on the term loan under theSenior Secured Credit Facility. Under this swap we pay a fixed rate of 6.764% and receivea floating rate of LIBOR plus 2.5% (6.99% at December <strong>31</strong>, <strong>2005</strong>) that resets each March 15,June 15, September 15 and December 15 based upon the three-month LIBOR rate. Another$400.0 million notional amount fixed-to-floating interest rate swap, expiring March 15, 2013,was designated as a hedge of the changes in the fair value of the 6.875% Senior Notes due2013. Under this swap, we pay a floating rate of LIBOR plus 1.97% (6.46% at December <strong>31</strong>,<strong>2005</strong>) that resets each March 15, June 15, September 15 and December 15 based upon thethree-month LIBOR rate and receive a fixed rate of 6.875%. The swaps will lower our overallborrowing costs on $400.0 million of debt principal by 0.64% over the term of the floatingto-fixedswap. This results in annualized interest savings of $2.6 million over the term of thefixed-to-floating swap.42 <strong>Peabody</strong> <strong>Energy</strong>