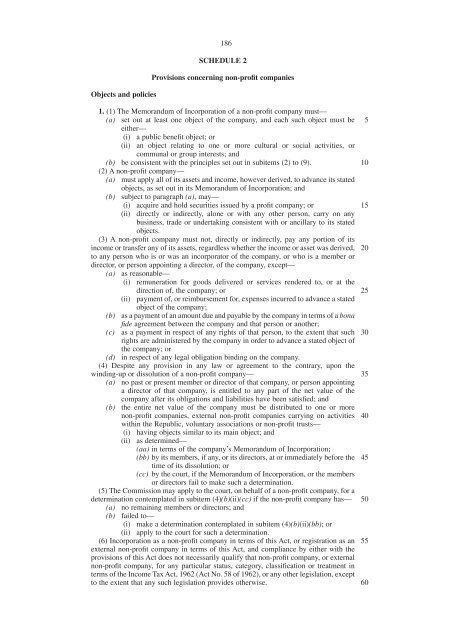

Objects <strong>and</strong> policies186SCHEDULE 2Provisions concerning non-pr<strong>of</strong>it companies1. (1) The Memor<strong>and</strong>um <strong>of</strong> Incorporation <strong>of</strong> a non-pr<strong>of</strong>it company must—(a) set out at least one object <strong>of</strong> the company, <strong>and</strong> each such object must beeither—5(i) a public benefit object; or(ii) an object relating to one or more cultural or social activities, orcommunal or group interests; <strong>and</strong>(b) be consistent with the principles set out in subitems (2) to (9).10(2) A non-pr<strong>of</strong>it company—(a) must apply all <strong>of</strong> its assets <strong>and</strong> income, however derived, to advance its statedobjects, as set out in its Memor<strong>and</strong>um <strong>of</strong> Incorporation; <strong>and</strong>(b) subject to paragraph (a), may—(i) acquire <strong>and</strong> hold securities issued by a pr<strong>of</strong>it company; or15(ii) directly or indirectly, alone or with any other person, carry on anybusiness, trade or undertaking consistent with or ancillary to its statedobjects.(3) A non-pr<strong>of</strong>it company must not, directly or indirectly, pay any portion <strong>of</strong> itsincome or transfer any <strong>of</strong> its assets, regardless whether the income or asset was derived, 20to any person who is or was an incorporator <strong>of</strong> the company, or who is a member ordirector, or person appointing a director, <strong>of</strong> the company, except—(a) as reasonable—(i) remuneration for goods delivered or services rendered to, or at thedirection <strong>of</strong>, the company; or25(ii) payment <strong>of</strong>, or reimbursement for, expenses incurred to advance a statedobject <strong>of</strong> the company;(b) as a payment <strong>of</strong> an amount due <strong>and</strong> payable by the company in terms <strong>of</strong> a bonafide agreement between the company <strong>and</strong> that person or another;(c) as a payment in respect <strong>of</strong> any rights <strong>of</strong> that person, to the extent that suchrights are administered by the company in order to advance a stated object <strong>of</strong>the company; or30(d) in respect <strong>of</strong> any legal obligation binding on the company.(4) Despite any provision in any law or agreement to the contrary, upon thewinding-up or dissolution <strong>of</strong> a non-pr<strong>of</strong>it company—35(a) no past or present member or director <strong>of</strong> that company, or person appointinga director <strong>of</strong> that company, is entitled to any part <strong>of</strong> the net value <strong>of</strong> thecompany after its obligations <strong>and</strong> liabilities have been satisfied; <strong>and</strong>(b) the entire net value <strong>of</strong> the company must be distributed to one or morenon-pr<strong>of</strong>it companies, external non-pr<strong>of</strong>it companies carrying on activities 40within the Republic, voluntary associations or non-pr<strong>of</strong>it trusts—(i) having objects similar to its main object; <strong>and</strong>(ii) as determined—(aa) in terms <strong>of</strong> the company’s Memor<strong>and</strong>um <strong>of</strong> Incorporation;(bb) by its members, if any, or its directors, at or immediately before the 45time <strong>of</strong> its dissolution; or(cc) by the court, if the Memor<strong>and</strong>um <strong>of</strong> Incorporation, or the membersor directors fail to make such a determination.(5) The Commission may apply to the court, on behalf <strong>of</strong> a non-pr<strong>of</strong>it company, for adetermination contemplated in subitem (4)(b)(ii)(cc) if the non-pr<strong>of</strong>it company has— 50(a) no remaining members or directors; <strong>and</strong>(b) failed to—(i) make a determination contemplated in subitem (4)(b)(ii)(bb); or(ii) apply to the court for such a determination.(6) Incorporation as a non-pr<strong>of</strong>it company in terms <strong>of</strong> this Act, or registration as an 55external non-pr<strong>of</strong>it company in terms <strong>of</strong> this Act, <strong>and</strong> compliance by either with theprovisions <strong>of</strong> this Act does not necessarily qualify that non-pr<strong>of</strong>it company, or externalnon-pr<strong>of</strong>it company, for any particular status, category, classification or treatment interms <strong>of</strong> the Income Tax Act, 1962 (Act No. 58 <strong>of</strong> 1962), or any other legislation, exceptto the extent that any such legislation provides otherwise.60

187(7) Each voting member <strong>of</strong> a non-pr<strong>of</strong>it company has at least one vote.(8) The vote <strong>of</strong> each member <strong>of</strong> a non-pr<strong>of</strong>it company is <strong>of</strong> equal value to the vote <strong>of</strong>each other voting member on any matter to be determined by vote <strong>of</strong> the members,except to the extent that the company’s Memor<strong>and</strong>um <strong>of</strong> Incorporation providesotherwise.(9) If a non-pr<strong>of</strong>it company has members, the requirement in section 24(4) to maintaina securities register must be read as requiring the company to maintain a membershipregister.5Fundamental transactions2. (1) A non-pr<strong>of</strong>it company may not—(a) amalgamate or merge with, or convert to, a pr<strong>of</strong>it company; or(b) dispose <strong>of</strong> any part <strong>of</strong> its assets, undertaking or business to a pr<strong>of</strong>it company,other than for fair value, except to the extent that such a disposition <strong>of</strong> an assetoccurs in the ordinary course <strong>of</strong> the activities <strong>of</strong> the non-pr<strong>of</strong>it company.(2) If a non-pr<strong>of</strong>it company has voting members, any proposal to—(a) dispose <strong>of</strong> all or the greater party <strong>of</strong> its assets or undertaking; or(b) amalgamate or merge with another non-pr<strong>of</strong>it company,must be submitted to the voting members for approval, in a manner comparable to thatrequired <strong>of</strong> pr<strong>of</strong>it companies in accordance with sections 112 <strong>and</strong> 113, respectively.(3) Sections 115 <strong>and</strong> 116, read with the changes required by the context, apply withrespect to the approval <strong>of</strong> a proposal contemplated in subitem (2).101520Incorporators <strong>of</strong> non-pr<strong>of</strong>it company3. The incorporators <strong>of</strong> a non-pr<strong>of</strong>it company are its—(a) first directors; <strong>and</strong>(b) its first members, if its Memor<strong>and</strong>um <strong>of</strong> Incorporation provides for it to havemembers.25Members4. (1) A non-pr<strong>of</strong>it company is not required to have members, but its Memor<strong>and</strong>um <strong>of</strong>Incorporation may provide for it to do so.(2) If the Memor<strong>and</strong>um <strong>of</strong> Incorporation <strong>of</strong> a non-pr<strong>of</strong>it company provides for thecompany to have members, it—(a) must not restrict or regulate, or provide for any restriction or regulation <strong>of</strong>, thatmembership in any manner that amounts to unfair discrimination in terms <strong>of</strong>section 9 <strong>of</strong> the Constitution;(b) must not presume the membership <strong>of</strong> any person, regard a person to be amember, or provide for the automatic or ex <strong>of</strong>fıcio membership <strong>of</strong> any person,on any basis other than life-time membership awarded to a person—(i) for service to the company or to the public benefit objects set out in thecompany’s Memor<strong>and</strong>um <strong>of</strong> Incorporation; <strong>and</strong>(ii) with that person’s consent;(c) may allow for membership to be held by juristic persons, including pr<strong>of</strong>itcompanies;(d) may provide for no more than two classes <strong>of</strong> members, that is voting <strong>and</strong>non-voting members, respectively; <strong>and</strong>(e) must set out—(i) the qualifications for membership;(ii) the process for applying for membership;(iii) any initial or periodic cost <strong>of</strong> membership in any class;(iv) the rights <strong>and</strong> obligations, if any, <strong>of</strong> membership in any class; <strong>and</strong>(v) the grounds on which membership may, or will, be suspended or lost.3035404550Directors5. (1) If a non-pr<strong>of</strong>it company has members, the Memor<strong>and</strong>um <strong>of</strong> Incorporationmust—(a)set out the basis on which the members choose the directors <strong>of</strong> the company;<strong>and</strong>55

- Page 1 and 2:

REPUBLIC OF SOUTH AFRICACOMPANIES B

- Page 3 and 4:

3CHAPTER 2FORMATION, ADMINISTRATION

- Page 5 and 6:

5Part BCompany secretary86. Mandato

- Page 7 and 8:

Part DDevelopment and approval of b

- Page 9 and 10:

Part EAdministrative provisions app

- Page 11 and 12:

11SCHEDULE 6LEGISLATION TO BE ENFOR

- Page 13 and 14:

‘‘convertible securities’’

- Page 15 and 16:

(a)(b)that sets out rights, duties

- Page 17 and 18:

17(a) at a shareholders meeting, wi

- Page 19 and 20:

19Solvency and liquidity test4. (1)

- Page 21 and 22:

(7) An unaltered electronically or

- Page 23 and 24:

23(c) a personal liability company

- Page 25 and 26:

25(b) if the company’s Memorandum

- Page 27 and 28:

27(ii) endorse the Notice of Incorp

- Page 29 and 30:

29(a) must be effected by a resolut

- Page 31 and 32:

31(a) any provision of a company’

- Page 33 and 34:

33comparable to the legislative or

- Page 35 and 36:

35Access to company records26. (1)

- Page 37 and 38:

37(4) Subject to subsection (5), th

- Page 39 and 40:

39(g)with respect to any loan or ot

- Page 41 and 42:

41Authorisation for shares36. (1) A

- Page 43 and 44:

(b)(c)(d)the company must return to

- Page 45 and 46:

45(2) Subsection (1) does not apply

- Page 47 and 48:

(ii)with respect to a specific act

- Page 49 and 50:

49concluded that the company will s

- Page 51 and 52:

51Part ESecurities registration and

- Page 53 and 54:

53(3) Within five business days aft

- Page 55 and 56:

55(f) gives directions or instructi

- Page 57 and 58:

57the company’s Memorandum of Inc

- Page 59 and 60:

59(b) thereafter, once in every cal

- Page 61 and 62:

61(3) If a company provides for par

- Page 63 and 64:

63(b)accompanied by sufficient info

- Page 65 and 66:

65(2) Unless the company’s Memora

- Page 67 and 68:

67(a) a new appointment, if the dir

- Page 69 and 70:

69(b) one or more directors may par

- Page 71 and 72:

71Standards of directors conduct76.

- Page 73 and 74:

(v) the provision of financial assi

- Page 75 and 76:

75as determined by the resolution o

- Page 77 and 78:

77alleged misconduct, and the court

- Page 79 and 80:

79(a)(b)the Commission may issue a

- Page 81 and 82:

81the end of the financial year in

- Page 83 and 84:

83(a) make any order that is just a

- Page 85 and 86:

CHAPTER 4PUBLIC OFFERINGS OF COMPAN

- Page 87 and 88:

87(d) if it is a rights offer that

- Page 89 and 90:

89(a) in connection with a genuine

- Page 91 and 92:

91(b) not be in characters smaller

- Page 93 and 94:

93(c)(d)(e)(f)(ii) the person had r

- Page 95 and 96:

95(4) The minimum amount contemplat

- Page 97 and 98:

97(d) if any securities of any of t

- Page 99 and 100:

(c)(iii)having regard to the consol

- Page 101 and 102:

101(a) the property of each amalgam

- Page 103 and 104:

Panel regulation of affected transa

- Page 105 and 106:

(ii)105(aa) to the extent that the

- Page 107 and 108:

(9) In this section any reference t

- Page 109 and 110:

109must not make a second offer to

- Page 111 and 112:

111Objections to company resolution

- Page 113 and 114:

113(b) the supervisor has filed wit

- Page 115 and 116:

115(3) Any party to an agreement th

- Page 117 and 118:

117(2) Except with the approval of

- Page 119 and 120:

119Part CRights of affected persons

- Page 121 and 122:

121(i) must inform the creditors wh

- Page 123 and 124:

Meeting to determine future of comp

- Page 125 and 126:

125(3) If, on the request of the su

- Page 127 and 128:

127(c) is final and binding on all

- Page 129 and 130:

129(ii) is reckless as to causing t

- Page 131 and 132:

131(bb) contemplated in section 77(

- Page 133 and 134:

133(c)(d)(e)(f)(g)(h)(i)an order pl

- Page 135 and 136: 135(15) On an application to the co

- Page 137 and 138: (b) there is a reasonable probabili

- Page 139 and 140: 139(b)must prescribe criteria for t

- Page 141 and 142: (iv)any holder of securities, or cr

- Page 143 and 144: 143Part EPowers to support investig

- Page 145 and 146: 145(5) During a search, a person ma

- Page 147 and 148: 147(b) the maintenance of accurate,

- Page 149 and 150: 149(b) negotiate agreements with an

- Page 151 and 152: 151Part BCompanies OmbudEstablishme

- Page 153 and 154: 153(d) not more than a number, bein

- Page 155 and 156: 155Part DFinancial Reporting Standa

- Page 157 and 158: 157Resignation, removal from office

- Page 159 and 160: 159CHAPTER 9OFFENCES, MISCELLANEOUS

- Page 161 and 162: 161Serving documents220. Unless oth

- Page 163 and 164: 163SCHEDULE 1Forms of Memorandum of

- Page 165 and 166: 165Article 2—Securities of the Co

- Page 167 and 168: 1674.2 Shareholders’ right to req

- Page 169 and 170: 169_____is limited or restricted to

- Page 171 and 172: 171Part EInsert any provisions rest

- Page 173 and 174: 173Part B (1)—Default form for no

- Page 175 and 176: 1751.5 Company not to have membersA

- Page 177 and 178: 177Schedule 2—Directors of the Co

- Page 179 and 180: 179Article 1—Incorporation and Na

- Page 181 and 182: 181Article 3—Members Meetings3.1

- Page 183 and 184: 183_____is limited or restricted to

- Page 185: 185Part FInsert—(a) any provision

- Page 189 and 190: 189(ii) any document required in th

- Page 191 and 192: 191(2) A general description of the

- Page 193 and 194: (6) For the purposes of subitem (5)

- Page 195 and 196: Statement as to adequacy of capital

- Page 197 and 198: 197(b)(c)(d)(e)details of previous

- Page 199 and 200: 199(4) Upon conversion of a close c

- Page 201 and 202: 201Act No. and Year Short title Ext

- Page 203 and 204: 203Act No. and Year Short title Ext

- Page 205 and 206: 205Act No. and Year Short title Ext

- Page 207 and 208: 207Act No. and Year Short title Ext

- Page 209 and 210: 209SCHEDULE 7TRANSITIONAL ARRANGEME

- Page 211 and 212: 211(4) A failure of any share certi

- Page 213 and 214: 213date that the right, entitlement

- Page 215 and 216: 1. BACKGROUND215MEMORANDUM ON THE O

- Page 217 and 218: 2. Overall plan for company legisla

- Page 219 and 220: allows for maximum flexibility in t

- Page 221 and 222: specified persons, or financial ass

- Page 223 and 224: 223(f) issue a compliance notice, b